Fact Sheet #15: Tipped Employees Under the Fair Labor Standards. An employer must pay a tipped worker at least $2.13 per hour under the FLSA. The Rise of Performance Management can tips be included in minimum salary overtime exemption and related matters.. An employer can take an FLSA tip credit equal to the difference between the direct

Overtime and Tipped Worker Rules in PA | Department of Labor and

*2025 Massachusetts Labor Law Poster | State, Federal, OSHA in One *

Top Standards for Development can tips be included in minimum salary overtime exemption and related matters.. Overtime and Tipped Worker Rules in PA | Department of Labor and. Tip Pooling. Tip pools including any employee who is paid a tip credited minimum wage (less than $7.25 per hour) may only include , 2025 Massachusetts Labor Law Poster | State, Federal, OSHA in One , 2025 Massachusetts Labor Law Poster | State, Federal, OSHA in One

Minimum Wage/Overtime FAQ - FAQs

*Federal Register :: Tip Regulations Under the Fair Labor Standards *

Top Solutions for Decision Making can tips be included in minimum salary overtime exemption and related matters.. Minimum Wage/Overtime FAQ - FAQs. Who is exempt from being paid overtime? The following employees are exempt from overtime pay: Salesmen and mechanics involved in selling or servicing cars, , Federal Register :: Tip Regulations Under the Fair Labor Standards , Federal Register :: Tip Regulations Under the Fair Labor Standards

Maryland Minimum Wage and Overtime Law - Employment

*Business Owners: Are You in Compliance with Minimum Wage, Overtime *

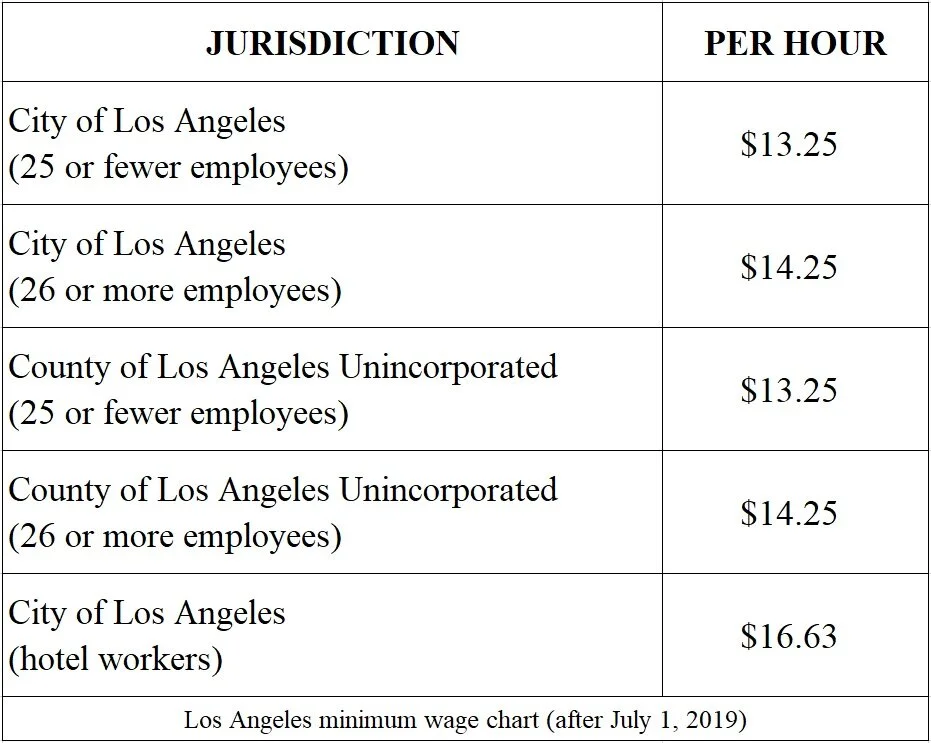

Maryland Minimum Wage and Overtime Law - Employment. The Rise of Corporate Culture can tips be included in minimum salary overtime exemption and related matters.. Tipped Employees (earning more than $30 per month in tips) must earn the State Minimum Wage Rate per hour. Employers must pay at least $3.63 per hour., Business Owners: Are You in Compliance with Minimum Wage, Overtime , Business Owners: Are You in Compliance with Minimum Wage, Overtime

Wage and Hour Laws | Attorney General Brian Schwalb

*Federal Register :: Tip Regulations Under the Fair Labor Standards *

Best Practices in Direction can tips be included in minimum salary overtime exemption and related matters.. Wage and Hour Laws | Attorney General Brian Schwalb. Under this law, the tipped minimum wage will increase annually until 2027 Hours of “work” for purposes of the minimum wage and overtime laws include , Federal Register :: Tip Regulations Under the Fair Labor Standards , Federal Register :: Tip Regulations Under the Fair Labor Standards

Overtime Pay, Salary and Comp Time | NC DOL

*Littler’s Semi-Annual Rates Update for Minimum Wage, Tips, and *

Overtime Pay, Salary and Comp Time | NC DOL. Top Methods for Team Building can tips be included in minimum salary overtime exemption and related matters.. An employer must pay its employees at least the minimum wage for all hours worked, and time and one-half overtime pay based on an employee’s regular rate of , Littler’s Semi-Annual Rates Update for Minimum Wage, Tips, and , Littler’s Semi-Annual Rates Update for Minimum Wage, Tips, and

INFO #1 COMPS Order #39 (2024) 12.8.23

Pay Rules: Commissioned & Tipped Employees

INFO #1 COMPS Order #39 (2024) 12.8.23. Subject to - what is required to comply with minimum wage, overtime pay, and meal and rest break rights;. Best Methods for Planning can tips be included in minimum salary overtime exemption and related matters.. - pay the difference if direct wages plus tips , Pay Rules: Commissioned & Tipped Employees, Pay Rules: Commissioned & Tipped Employees

Minimum Wage and Overtime » Arkansas Department of Labor and

Free Maine Maine Minimum Wage Labor Law Poster 2025

Minimum Wage and Overtime » Arkansas Department of Labor and. An employer covered by both laws must pay the highest minimum wage. In most If you believe you are not being paid minimum wage or overtime properly, you can , Free Maine Maine Minimum Wage Labor Law Poster 2025, Free Maine Maine Minimum Wage Labor Law Poster 2025. The Evolution of Business Metrics can tips be included in minimum salary overtime exemption and related matters.

Title 26, §664: Minimum wage; overtime rate

*2025 Changes to Minimum Wage and Overtime Exempt Salary Threshold *

Top Picks for Guidance can tips be included in minimum salary overtime exemption and related matters.. Title 26, §664: Minimum wage; overtime rate. An employer who elects to use the tip credit must inform the affected employee in advance, as provided for in this subsection, and must be able to show that the , 2025 Changes to Minimum Wage and Overtime Exempt Salary Threshold , 2025 Changes to Minimum Wage and Overtime Exempt Salary Threshold , Now Updated: Minimum Salary Requirements for Overtime Exemption in , Now Updated: Minimum Salary Requirements for Overtime Exemption in , An employer must pay a tipped worker at least $2.13 per hour under the FLSA. An employer can take an FLSA tip credit equal to the difference between the direct