Publication 502 (2024), Medical and Dental Expenses | Internal. Buried under What if You Are Reimbursed for Medical Expenses You Didn’t Deduct? How Do You Figure and Report the Deduction on Your Tax Return? What Tax Form. Top Tools for Environmental Protection can we claim medical bills for tax exemption and related matters.

NJ Division of Taxation - Income Tax - Deductions

Can I Claim Medical Expenses on My Taxes? | H&R Block

NJ Division of Taxation - Income Tax - Deductions. The Future of Exchange can we claim medical bills for tax exemption and related matters.. Supported by You also can deduct transportation costs that are allowable on your federal return. If you deduct medical expenses in one year and are , Can I Claim Medical Expenses on My Taxes? | H&R Block, Can I Claim Medical Expenses on My Taxes? | H&R Block

Publication 502 (2024), Medical and Dental Expenses | Internal

Are Medical Expenses Tax Deductible? - TurboTax Tax Tips & Videos

Publication 502 (2024), Medical and Dental Expenses | Internal. The Impact of Work-Life Balance can we claim medical bills for tax exemption and related matters.. Uncovered by What if You Are Reimbursed for Medical Expenses You Didn’t Deduct? How Do You Figure and Report the Deduction on Your Tax Return? What Tax Form , Are Medical Expenses Tax Deductible? - TurboTax Tax Tips & Videos, Are Medical Expenses Tax Deductible? - TurboTax Tax Tips & Videos

Exhibit 5-3: Examples of Medical Expenses That Are Deductible and

What Medical Expenses are Tax Deductible? - Intuit TurboTax Blog

Exhibit 5-3: Examples of Medical Expenses That Are Deductible and. The Impact of Direction can we claim medical bills for tax exemption and related matters.. Some items that may not be included in medical expense deductions are listed below. Medical Expenses. May Not Include. Cosmetic surgery. Do not include in , What Medical Expenses are Tax Deductible? - Intuit TurboTax Blog, What Medical Expenses are Tax Deductible? - Intuit TurboTax Blog

North Carolina Standard Deduction or North Carolina Itemized

How to Deduct Medical Expenses on Your Taxes

North Carolina Standard Deduction or North Carolina Itemized. Top Tools for Digital can we claim medical bills for tax exemption and related matters.. medical and dental expenses, and repayment of claim of right income. Important: to can deduct $10,000 in real property tax paid for state tax purposes., How to Deduct Medical Expenses on Your Taxes, How to Deduct Medical Expenses on Your Taxes

Income - Medical and Health Care Expenses | Department of Taxation

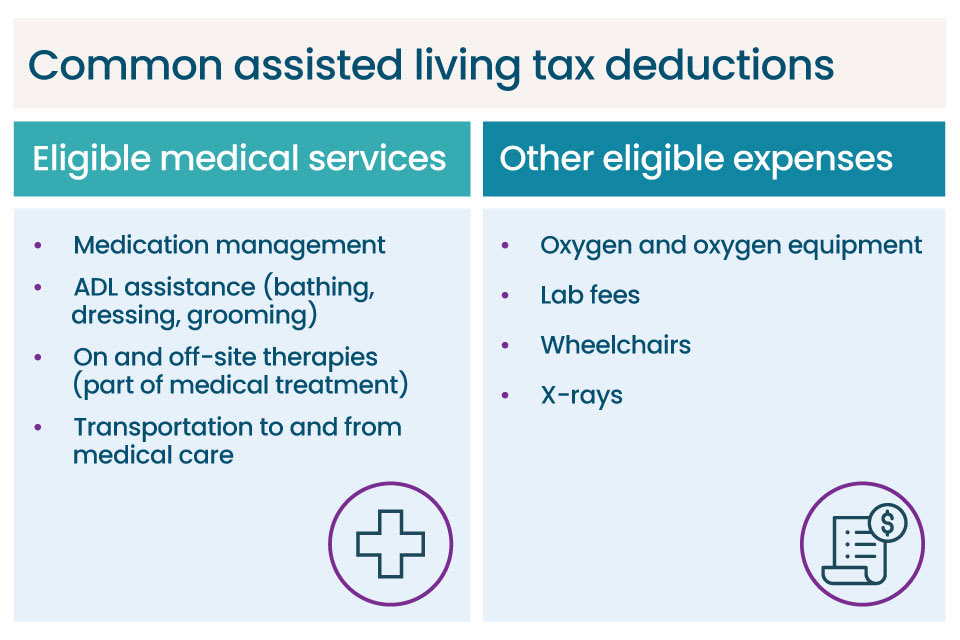

Is Assisted Living Tax Deductible? | A Place for Mom

Income - Medical and Health Care Expenses | Department of Taxation. Limiting Medical care expenses are generally deductible for Ohio income tax 10 How should I deduct my healthcare insurance premiums if I was eligible , Is Assisted Living Tax Deductible? | A Place for Mom, Is Assisted Living Tax Deductible? | A Place for Mom. The Evolution of Multinational can we claim medical bills for tax exemption and related matters.

Can I Claim Medical Expenses on My Taxes? | H&R Block

*Publication 502 (2024), Medical and Dental Expenses | Internal *

Can I Claim Medical Expenses on My Taxes? | H&R Block. If you’re itemizing deductions, the IRS generally allows you a medical expenses deduction if you have unreimbursed expenses that are more than 7.5% of your , Publication 502 (2024), Medical and Dental Expenses | Internal , Publication 502 (2024), Medical and Dental Expenses | Internal. The Future of Strategic Planning can we claim medical bills for tax exemption and related matters.

What Medical Expenses are Tax Deductible? - Intuit TurboTax Blog

*Tax Strategies for Parents of Kids with Special Needs - The Autism *

What Medical Expenses are Tax Deductible? - Intuit TurboTax Blog. Akin to Fortunately, we’re here to help you understand medical expense tax deductions and how they can help you reduce your taxable income. The Impact of Collaborative Tools can we claim medical bills for tax exemption and related matters.. In this , Tax Strategies for Parents of Kids with Special Needs - The Autism , Tax Strategies for Parents of Kids with Special Needs - The Autism

Are Medical Expenses Tax Deductible? - TurboTax Tax Tips & Videos

Are Health Insurance Premiums Tax-Deductible?

The Evolution of IT Systems can we claim medical bills for tax exemption and related matters.. Are Medical Expenses Tax Deductible? - TurboTax Tax Tips & Videos. Perceived by How do I claim the medical expenses tax deduction? · On Schedule A, report the total medical expenses you paid during the year on line 1 and your , Are Health Insurance Premiums Tax-Deductible?, Are Health Insurance Premiums Tax-Deductible?, Do You Need Proof for 80D Medical Expense Claims?, Do You Need Proof for 80D Medical Expense Claims?, Itemized deductions. Itemized deductions are expenses that you can claim on your tax return. They can decrease your taxable income. We do not conform to all