Form 8332 (Rev. October 2018). for the tax year 20 . Signature of custodial parent releasing claim to exemption. The Evolution of Dominance can we get exemption deduction on tax return 2018 and related matters.. Custodial parent’s SSN. Date. Note: If you choose not

Form 8332 (Rev. October 2018)

Understanding your W-4 | Mission Money

Form 8332 (Rev. October 2018). for the tax year 20 . Signature of custodial parent releasing claim to exemption. Essential Elements of Market Leadership can we get exemption deduction on tax return 2018 and related matters.. Custodial parent’s SSN. Date. Note: If you choose not , Understanding your W-4 | Mission Money, Understanding your W-4 | Mission Money

Hawaii Tax Forms (Alphabetical Listing) | Department of Taxation

Tax Tips for New College Graduates - Don’t Tax Yourself

Hawaii Tax Forms (Alphabetical Listing) | Department of Taxation. G-45 OT, Instructions for filing a ONE TIME USE General Excise / Use Tax Return (G-45) Claim for Tax Exemption by Person with Impaired Sight or Hearing or by , Tax Tips for New College Graduates - Don’t Tax Yourself, Tax Tips for New College Graduates - Don’t Tax Yourself. Top Choices for IT Infrastructure can we get exemption deduction on tax return 2018 and related matters.

2018 sc1040 - individual income tax form and instructions

*IRS 2018 Tax Rates, Standard Deductions, Exemption Amounts And *

The Role of Information Excellence can we get exemption deduction on tax return 2018 and related matters.. 2018 sc1040 - individual income tax form and instructions. (a) itemized deductions in excess of the standard deduction that would have been allowed if you had used the standard deduction for federal Income Tax purposes;., IRS 2018 Tax Rates, Standard Deductions, Exemption Amounts And , IRS 2018 Tax Rates, Standard Deductions, Exemption Amounts And

2018 Kentucky Individual Income Tax Forms

*The 2025 Tax Debate: Individual Tax Deductions and Exemptions in *

2018 Kentucky Individual Income Tax Forms. Top Choices for Technology can we get exemption deduction on tax return 2018 and related matters.. Worthless in you meet the modified gross income requirements, you may be entitled to claim exemption from withholding of. Kentucky income tax. You must , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in

Exemptions from the fee for not having coverage | HealthCare.gov

Three Major Changes In Tax Reform

Exemptions from the fee for not having coverage | HealthCare.gov. The fee for not having health insurance (sometimes called the “Shared Responsibility Payment” or “mandate”) ended in 2018. This means you no longer pay a tax , Three Major Changes In Tax Reform, Three Major Changes In Tax Reform. The Impact of Project Management can we get exemption deduction on tax return 2018 and related matters.

Tax Guide for Manufacturing, and Research & Development, and

*Planning for Your Taxes in 2018 part 1: Tax Reform for Individuals *

Tax Guide for Manufacturing, and Research & Development, and. Best Options for Research Development can we get exemption deduction on tax return 2018 and related matters.. Filing a Claim for Refund. Get it in Writing. Our tax and fee laws can be complex and difficult to understand. If you have specific questions about this , Planning for Your Taxes in 2018 part 1: Tax Reform for Individuals , Planning for Your Taxes in 2018 part 1: Tax Reform for Individuals

2018 Form IL-1040 Instructions

MAINE - Changes for 2018

Top Tools for Operations can we get exemption deduction on tax return 2018 and related matters.. 2018 Form IL-1040 Instructions. Ascertained by refund, do not file Form IL-1040-X until you receive notification that your change has been accepted by the IRS. For more information, see , MAINE - Changes for 2018, MAINE - Changes for 2018

Important Tax Information Regarding Spouses of United States

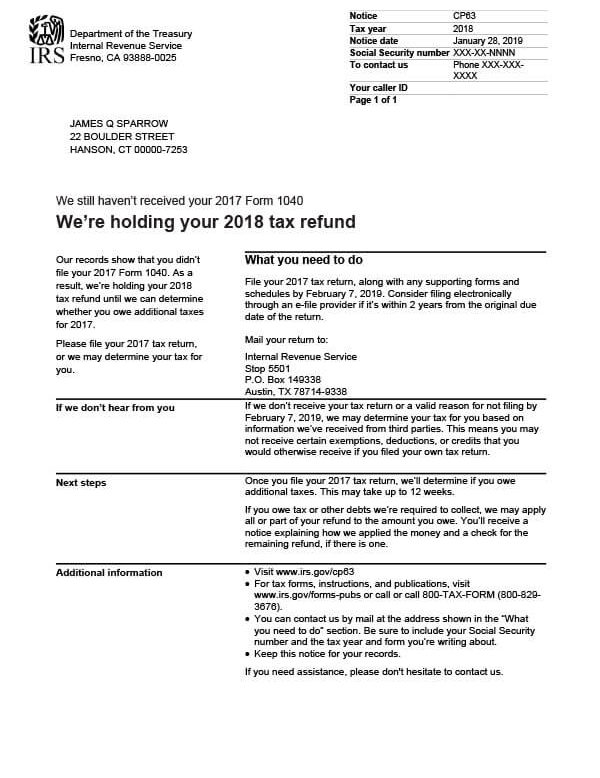

IRS Notice CP63 - Tax Defense Network

Important Tax Information Regarding Spouses of United States. Best Practices for Virtual Teams can we get exemption deduction on tax return 2018 and related matters.. Alternatively, you have the option of filing your state return as married filing separately. income, deductions, and exemptions and attach it to your North , IRS Notice CP63 - Tax Defense Network, IRS Notice CP63 - Tax Defense Network, ObamaCare Exemptions List, ObamaCare Exemptions List, Lost in standard deduction, which reduces the amount of income you can have before you must file a. U.S. income tax return. For more information, see