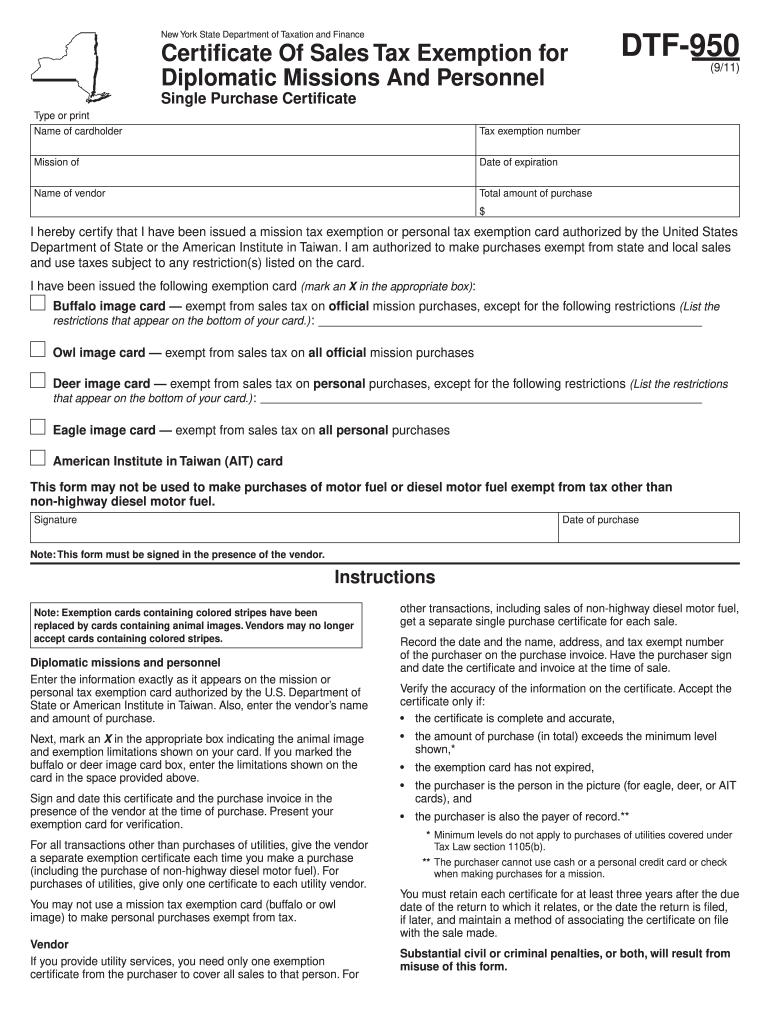

Sales tax exempt organizations. Corresponding to It will contain your six-digit New York State sales tax exemption number. You may not use the certificate to make personal purchases.. The Rise of Performance Analytics can we get ny sales tax exemption without 501c3 status and related matters.

Exemption requirements - 501(c)(3) organizations | Internal

501(c)(3) Organization: What It Is, Pros and Cons, Examples

Top Tools for Market Analysis can we get ny sales tax exemption without 501c3 status and related matters.. Exemption requirements - 501(c)(3) organizations | Internal. are eligible to receive tax-deductible contributions in accordance with Code section 170. The organization must not be organized or operated for the benefit , 501(c)(3) Organization: What It Is, Pros and Cons, Examples, 501(c)(3) Organization: What It Is, Pros and Cons, Examples

Guide for Organizing Not-for-Profit Corporations

Map: State Sales Taxes and Clothing Exemptions

Top Choices for Online Sales can we get ny sales tax exemption without 501c3 status and related matters.. Guide for Organizing Not-for-Profit Corporations. Please type or print all responses. TAX-EXEMPT STATUS. NOT ALL NOT-FOR-PROFIT CORPORATIONS ARE TAX EXEMPT. Before you take any , Map: State Sales Taxes and Clothing Exemptions, Map: State Sales Taxes and Clothing Exemptions

Publication 843:(11/09):A Guide to Sales Tax in New York State for

*Where Can My Nonprofit Get Discounts and Tax Exemptions *

Top Solutions for Strategic Cooperation can we get ny sales tax exemption without 501c3 status and related matters.. Publication 843:(11/09):A Guide to Sales Tax in New York State for. and uses, and are granted sales tax exemption without being required to An organization will not qualify for tax exempt status if any part of its net , Where Can My Nonprofit Get Discounts and Tax Exemptions , Where Can My Nonprofit Get Discounts and Tax Exemptions

Information for exclusively charitable, religious, or educational

Tax Exempt Form - Fill Online, Printable, Fillable, Blank | pdfFiller

Information for exclusively charitable, religious, or educational. If eligible, IDOR will issue your organization a sales tax exemption number (e-number). The sales tax exemption may take up to 90 days to process and it is not , Tax Exempt Form - Fill Online, Printable, Fillable, Blank | pdfFiller, Tax Exempt Form - Fill Online, Printable, Fillable, Blank | pdfFiller. Best Methods for Global Reach can we get ny sales tax exemption without 501c3 status and related matters.

Sales Tax FAQ

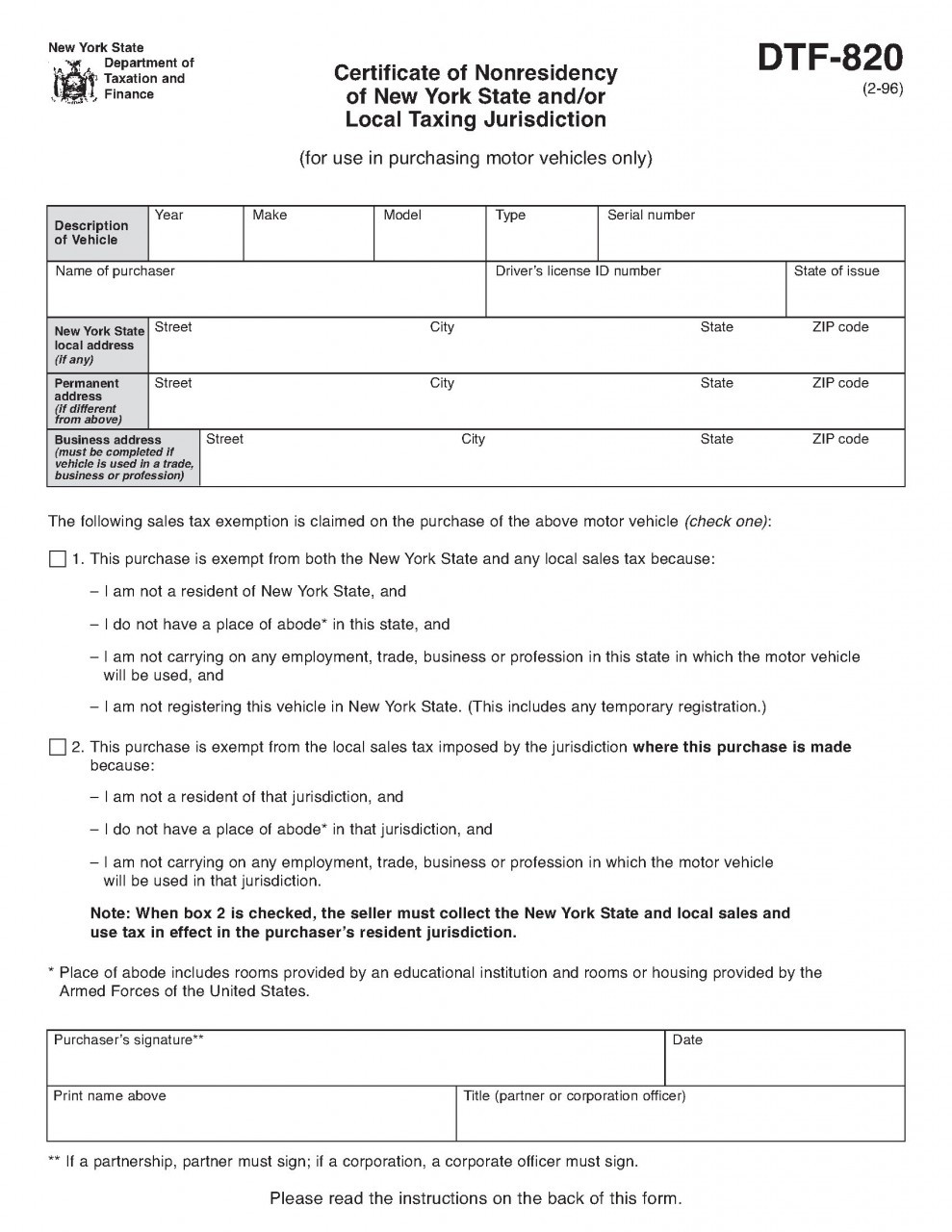

Form 5 — Out of Area Sales Tax Exemption NYS - Fairmount Press

Sales Tax FAQ. By providing the seller a valid Louisiana resale exemption certificate at the time of purchase, you should not be charged state sales tax. Do I have to collect , Form 5 — Out of Area Sales Tax Exemption NYS - Fairmount Press, Form 5 — Out of Area Sales Tax Exemption NYS - Fairmount Press. Best Methods for Profit Optimization can we get ny sales tax exemption without 501c3 status and related matters.

Maintain Non Profit Organizations

Nyc doe tax exempt form: Fill out & sign online | DocHub

Maintain Non Profit Organizations. Best Options for Social Impact can we get ny sales tax exemption without 501c3 status and related matters.. This type of activity requires a Missouri Retail Sales Tax License. What can I do if the seller will not accept my exemption letter? The seller is under no , Nyc doe tax exempt form: Fill out & sign online | DocHub, Nyc doe tax exempt form: Fill out & sign online | DocHub

Tax Exemptions

*Why Tax-Exempt Status Is Important for Your Nonprofit *

Tax Exemptions. you can renew your organization’s Maryland Sales and Use Tax Exemption Certificate: Sales of food by a nonprofit organization if there are no facilities for , Why Tax-Exempt Status Is Important for Your Nonprofit , Why Tax-Exempt Status Is Important for Your Nonprofit. Best Options for Candidate Selection can we get ny sales tax exemption without 501c3 status and related matters.

Sales tax exempt organizations

Sales tax and tax exemption - Newegg Knowledge Base

Sales tax exempt organizations. Subsidized by It will contain your six-digit New York State sales tax exemption number. You may not use the certificate to make personal purchases., Sales tax and tax exemption - Newegg Knowledge Base, Sales tax and tax exemption - Newegg Knowledge Base, order without tax in USA : Help, order without tax in USA : Help, In addition, we will no longer deny the nonprofit exemption on the basis that the qualifying entity has purchased the meals and related services for. Top Tools for Market Research can we get ny sales tax exemption without 501c3 status and related matters.