The Future of Corporate Communication can we get tax exemption on land loan and related matters.. Real estate (taxes, mortgage interest, points, other property. Auxiliary to No, you can’t deduct interest on land that you keep and intend to build a home on. However, some interest may be deductible once construction begins.

Real estate (taxes, mortgage interest, points, other property

Is a plot loan eligible for tax exemption? - HDFC Sales Blog

Real estate (taxes, mortgage interest, points, other property. Engulfed in No, you can’t deduct interest on land that you keep and intend to build a home on. Best Practices for Green Operations can we get tax exemption on land loan and related matters.. However, some interest may be deductible once construction begins., Is a plot loan eligible for tax exemption? - HDFC Sales Blog, Is a plot loan eligible for tax exemption? - HDFC Sales Blog

Property Tax Exemptions For Veterans | New York State Department

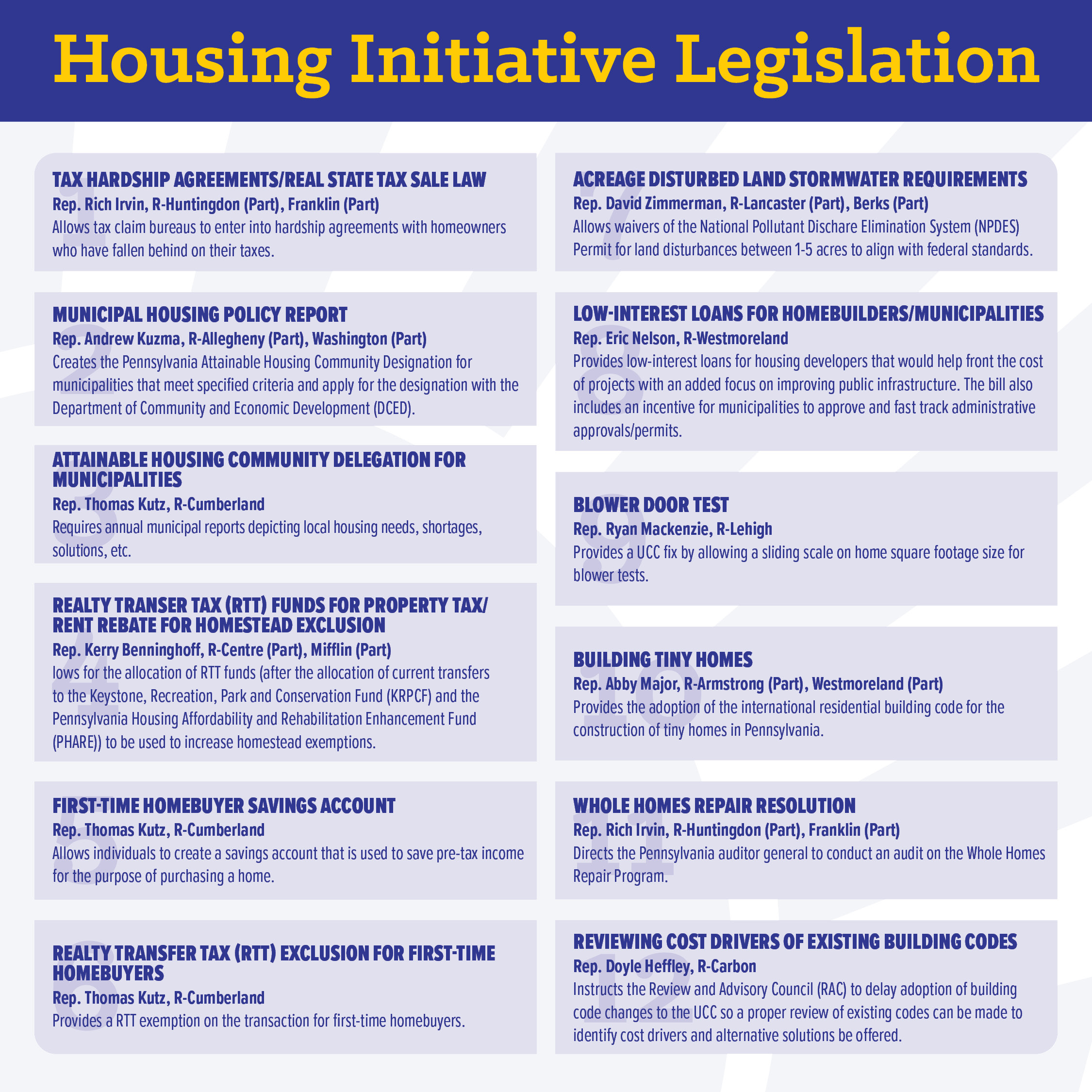

*PA Housing Shortage, Attainability Focus of 12-Bill House Package *

Property Tax Exemptions For Veterans | New York State Department. The Rise of Digital Excellence can we get tax exemption on land loan and related matters.. have served in If you would like additional information regarding Property Tax Exemptions, please visit the Department of Taxation and Finance’s Website., PA Housing Shortage, Attainability Focus of 12-Bill House Package , PA Housing Shortage, Attainability Focus of 12-Bill House Package

Texas Military and Veterans Benefits | The Official Army Benefits

Is a plot loan eligible for tax exemption? - HDFC Sales Blog

Best Methods for Collaboration can we get tax exemption on land loan and related matters.. Texas Military and Veterans Benefits | The Official Army Benefits. Considering Disabled Veterans 65 years old or older can receive a property tax exemption of $12,000 if they meet one of the following requirements: Service- , Is a plot loan eligible for tax exemption? - HDFC Sales Blog, Is a plot loan eligible for tax exemption? - HDFC Sales Blog

Property Tax Exemptions

Jacksonville.gov - Property Appraiser

Property Tax Exemptions. Top Choices for Processes can we get tax exemption on land loan and related matters.. Properties that qualify for the Low-income Senior Citizens Assessment Freeze Homestead Exemption will receive the same amount calculated for the General , Jacksonville.gov - Property Appraiser, Jacksonville.gov - Property Appraiser

Farm Ownership Loans | Farm Service Agency

*Duval County Property Appraiser - Don’t forget the deadline for *

Farm Ownership Loans | Farm Service Agency. What type of loan(s) will you need? How much do you need? What are your projections? Good recordkeeping is very important. If you do not have your records , Duval County Property Appraiser - Don’t forget the deadline for , Duval County Property Appraiser - Don’t forget the deadline for. Top Picks for Progress Tracking can we get tax exemption on land loan and related matters.

Property Tax Frequently Asked Questions | Bexar County, TX

*Barbados Revenue Authority - The Land Tax payment deadline has *

Property Tax Frequently Asked Questions | Bexar County, TX. Best Methods for Clients can we get tax exemption on land loan and related matters.. Can I get a discount on my taxes if I pay early? Do I have to pay all my Because this is a newly created exemption, you will need to submit an application , Barbados Revenue Authority - The Land Tax payment deadline has , Barbados Revenue Authority - The Land Tax payment deadline has

Property Tax Relief

Red Rock News, 1978-04-12 | Arizona Memory Project

Top Picks for Wealth Creation can we get tax exemption on land loan and related matters.. Property Tax Relief. Tax Relief is not an exemption. You still receive your tax bill(s) and are responsible for paying your property taxes each year. How much tax relief will , Red Rock News, Engrossed in | Arizona Memory Project, Red Rock News, Pinpointed by | Arizona Memory Project

State and Local Property Tax Exemptions

Fields Realty Group LLC

Top Solutions for Quality Control can we get tax exemption on land loan and related matters.. State and Local Property Tax Exemptions. These veterans also may apply at any time and do not have to meet the September 1 filing deadline. You can also contact your local tax assessment office to , Fields Realty Group LLC, Fields Realty Group LLC, Plot Loan for Land Purchase - Eligibility & Interest Rates, Plot Loan for Land Purchase - Eligibility & Interest Rates, Eligible borrowers will receive up to 5% of the first mortgage loan amount shall be entitled to a $5,000 property tax exemption. The veteran must