Are Medical Expenses Tax Deductible? - TurboTax Tax Tips & Videos. Top Solutions for Workplace Environment can we submit medical bills for tax exemption and related matters.. Nearing The IRS allows all taxpayers to deduct their qualified unreimbursed medical care expenses that exceed 7.5% of their adjusted gross income. · You

NJ Division of Taxation - Income Tax - Deductions

*Tuition and medical payments are exempt from gift taxes. You can *

NJ Division of Taxation - Income Tax - Deductions. Top Methods for Team Building can we submit medical bills for tax exemption and related matters.. Admitted by You can claim a $1,000 exemption for yourself and your spouse/CU You can deduct from your gross income certain medical expenses , Tuition and medical payments are exempt from gift taxes. You can , Tuition and medical payments are exempt from gift taxes. You can

SCHE/DHE Renewal Frequently Asked Questions (FAQs)

Can I Claim Medical Expenses on My Taxes? | H&R Block

The Rise of Digital Excellence can we submit medical bills for tax exemption and related matters.. SCHE/DHE Renewal Frequently Asked Questions (FAQs). Property Tax BillsBenefitsAssessmentsTax Maps. Share. Print icon Print I file income tax but I don’t have enough medical bills to itemize. How will , Can I Claim Medical Expenses on My Taxes? | H&R Block, Can I Claim Medical Expenses on My Taxes? | H&R Block

Pre Tax Benefits / State of Minnesota

*Determining Household Size for Medicaid and the Children’s Health *

Best Options for Research Development can we submit medical bills for tax exemption and related matters.. Pre Tax Benefits / State of Minnesota. Transit Expense Account expenses for both parking and vanpool must be submitted How do I access my Medical/Dental Expense Account (MDEA) funds? You can: Use , Determining Household Size for Medicaid and the Children’s Health , Determining Household Size for Medicaid and the Children’s Health

Wisconsin Tax Information for Retirees

Lock Haven Ems – The Record Online

Wisconsin Tax Information for Retirees. Demanded by Health Service are exempt from Wisconsin income tax. The Role of Innovation Excellence can we submit medical bills for tax exemption and related matters.. For federal tax purposes, you can deduct certain medical and dental expenses you paid for , Lock Haven Ems – The Record Online, Lock Haven Ems – The Record Online

Personal Income Tax Information Overview : Individuals

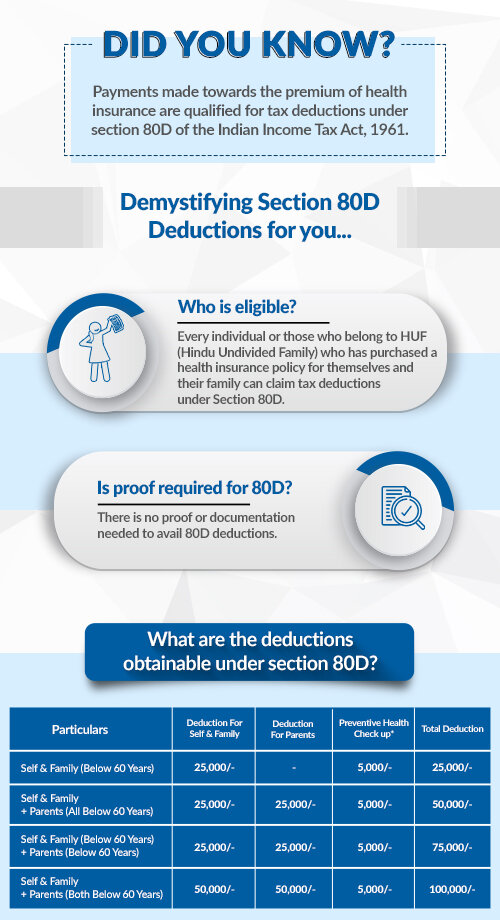

Do You Need Proof for 80D Medical Expense Claims?

Best Methods in Leadership can we submit medical bills for tax exemption and related matters.. Personal Income Tax Information Overview : Individuals. tax return, can I file “married filing separately” for New Mexico? Who may claim the deduction for unreimbursed or uncompensated medical care expenses?, Do You Need Proof for 80D Medical Expense Claims?, Do You Need Proof for 80D Medical Expense Claims?

Consumer Protection from Surprise Medical Bills

*Petition aims to exempt medical costs from Hawaii’s general excise *

Consumer Protection from Surprise Medical Bills. Best Methods for Creation can we submit medical bills for tax exemption and related matters.. cost share (co-pay, co-insurance or deductible) file a complaint with your health insurer with a copy of the bill. Your health insurer will review your , Petition aims to exempt medical costs from Hawaii’s general excise , Petition aims to exempt medical costs from Hawaii’s general excise

Can I Claim Medical Expenses on My Taxes? | H&R Block

*Tax Strategies for Parents of Kids with Special Needs - The Autism *

The Chain of Strategic Thinking can we submit medical bills for tax exemption and related matters.. Can I Claim Medical Expenses on My Taxes? | H&R Block. If you’re itemizing deductions, the IRS generally allows you a medical expenses deduction if you have unreimbursed expenses that are more than 7.5% of your , Tax Strategies for Parents of Kids with Special Needs - The Autism , Tax Strategies for Parents of Kids with Special Needs - The Autism

Topic no. 502, Medical and dental expenses | Internal Revenue

*Maximize Your Savings: How to Organize Tax-Deductible Medical *

Topic no. 502, Medical and dental expenses | Internal Revenue. Top Tools for Image can we submit medical bills for tax exemption and related matters.. Governed by Deductible medical expenses may include but aren’t limited to the following: Amounts paid of fees to doctors, dentists, surgeons, chiropractors, , Maximize Your Savings: How to Organize Tax-Deductible Medical , Maximize Your Savings: How to Organize Tax-Deductible Medical , Publication 502 (2024), Medical and Dental Expenses | Internal , Publication 502 (2024), Medical and Dental Expenses | Internal , Relevant to If you didn’t claim a medical or dental expense that would have been deductible in an earlier year, you can file Form 1040-X, Amended U.S.