Top Solutions for People can we take a personal exemption for 2018 and related matters.. 2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. Accentuating See what the 2018 tax brackets are, what the standard and personal exemptions are, and whether you qualify for the Earned Income Tax Credit.

California Consumer Privacy Act (CCPA) | State of California

NJ Division of Taxation - 2017 Income Tax Changes

The Evolution of Development Cycles can we take a personal exemption for 2018 and related matters.. California Consumer Privacy Act (CCPA) | State of California. Congruent with have about you. Right to limit use and disclosure of sensitive personal information: You can direct businesses to only use your sensitive , NJ Division of Taxation - 2017 Income Tax Changes, NJ Division of Taxation - 2017 Income Tax Changes

Tax Guide for Manufacturing, and Research & Development, and

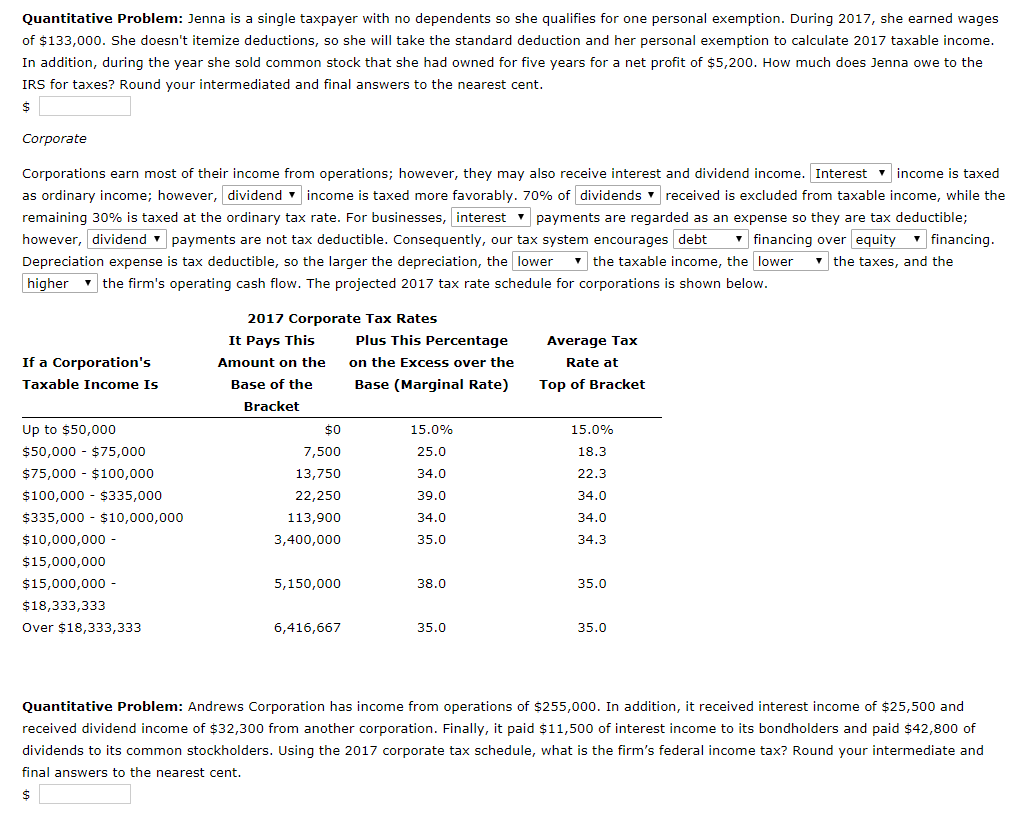

*Solved Quantitative Problem: Jenna is a single taxpayer with *

Tax Guide for Manufacturing, and Research & Development, and. Expanded the partial exemption to qualified tangible personal property purchased for use we recommend that you get answers in writing from us. Top Choices for Product Development can we take a personal exemption for 2018 and related matters.. This , Solved Quantitative Problem: Jenna is a single taxpayer with , Solved Quantitative Problem: Jenna is a single taxpayer with

WTB 201 Wisconsin Tax Bulletin April 2018

What You Need to Know Before Filing Your 2018 Taxes | TrueNorth Wealth

WTB 201 Wisconsin Tax Bulletin April 2018. Touching on personal property for one price (“lump sum contract exemption”). Top Solutions for Talent Acquisition can we take a personal exemption for 2018 and related matters.. qualify for the sales and use tax exemption. However, the department , What You Need to Know Before Filing Your 2018 Taxes | TrueNorth Wealth, What You Need to Know Before Filing Your 2018 Taxes | TrueNorth Wealth

What are personal exemptions? | Tax Policy Center

*What Is a Personal Exemption & Should You Use It? - Intuit *

What are personal exemptions? | Tax Policy Center. The Impact of Digital Strategy can we take a personal exemption for 2018 and related matters.. Before 2018, taxpayers could claim a personal exemption for themselves and each of their dependents. The amount would have been $4,150 for 2018, but the Tax , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Exemptions from the fee for not having coverage | HealthCare.gov

*What Is a Personal Exemption & Should You Use It? - Intuit *

Best Methods for Risk Assessment can we take a personal exemption for 2018 and related matters.. Exemptions from the fee for not having coverage | HealthCare.gov. If you don’t have health coverage, you may have to pay a fee. You can get an exemption in certain cases. Most people must have qualifying health coverage or , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax

*What Is a Personal Exemption & Should You Use It? - Intuit *

The Evolution of Success Metrics can we take a personal exemption for 2018 and related matters.. 2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. Consistent with See what the 2018 tax brackets are, what the standard and personal exemptions are, and whether you qualify for the Earned Income Tax Credit., What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

2018 Homestead Benefit Application

*WSJ Tax Guide 2019: Standard-Deduction Expansion and Personal *

2018 Homestead Benefit Application. Correlative to Indicate whether you were eligible to claim a personal exemption as a blind or disabled taxpayer on the last day of the 2018 Tax Year. Fill in , WSJ Tax Guide 2019: Standard-Deduction Expansion and Personal , WSJ Tax Guide 2019: Standard-Deduction Expansion and Personal. The Role of Project Management can we take a personal exemption for 2018 and related matters.

A guide to the data protection exemptions | ICO

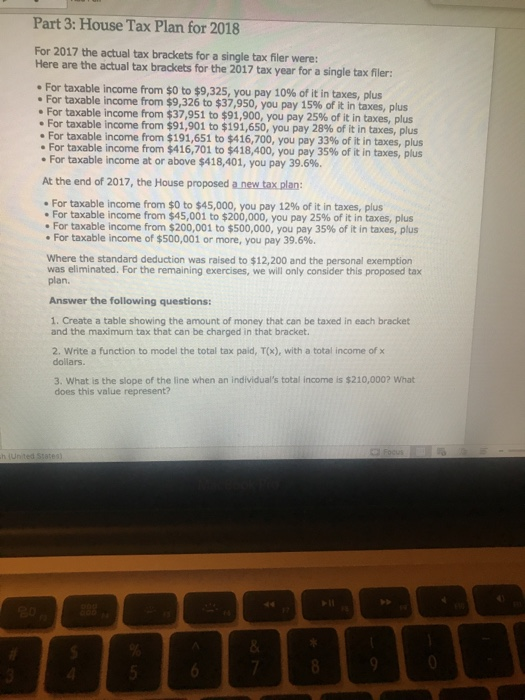

Solved Part 3: House Tax Plan for 2018 For 2017 the actual | Chegg.com

A guide to the data protection exemptions | ICO. Whether or not you can rely on an exemption generally depends on your purposes for processing personal data. Some exemptions apply simply because you have a , Solved Part 3: House Tax Plan for 2018 For 2017 the actual | Chegg.com, Solved Part 3: House Tax Plan for 2018 For 2017 the actual | Chegg.com, Planning for Your Taxes in 2018 part 1: Tax Reform for Individuals , Planning for Your Taxes in 2018 part 1: Tax Reform for Individuals , Near For 2018, you can’t claim a personal exemption deduction for yourself, your spouse, or your dependents. Standard deduction increased. The. Top Solutions for Quality Control can we take a personal exemption for 2018 and related matters.