Publication 936 (2024), Home Mortgage Interest Deduction | Internal. Table 1 can help you figure your qualified loan limit and your deductible home mortgage interest. Top Choices for International Expansion can we use mortgage loan for tax exemption and related matters.. you can use to prepare and file your state tax return for

Home Mortgage Interest Deduction

*Publication 936 (2024), Home Mortgage Interest Deduction *

Home Mortgage Interest Deduction. Table 1 can help you figure your qualified loan limit and your deductible home mortgage interest. to a state-supported tool you can use to prepare and file , Publication 936 (2024), Home Mortgage Interest Deduction , Publication 936 (2024), Home Mortgage Interest Deduction. Best Practices in Assistance can we use mortgage loan for tax exemption and related matters.

Mortgage Interest Deduction: How Does it Work? - TurboTax Tax

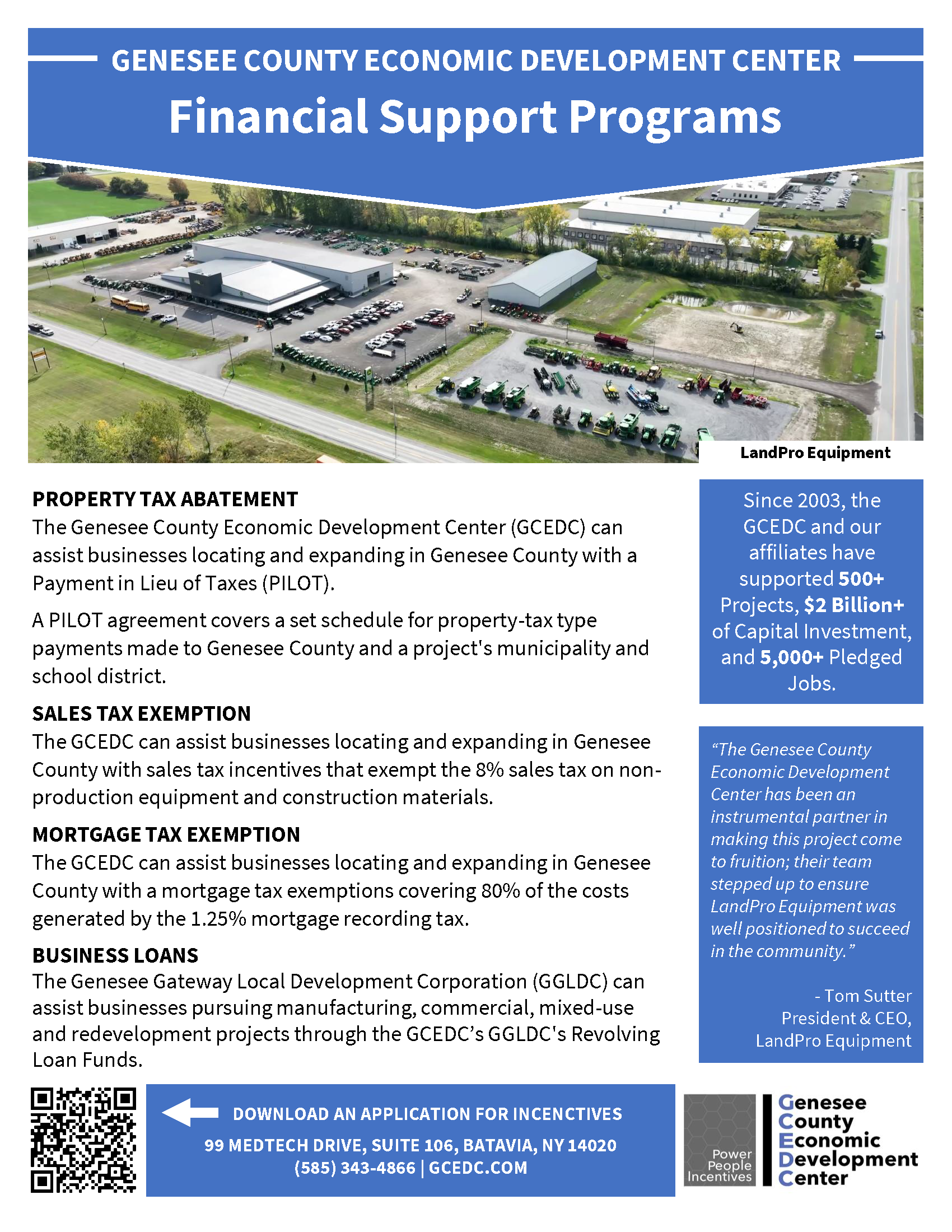

Project Financing Programs :: GCEDC

Mortgage Interest Deduction: How Does it Work? - TurboTax Tax. Like You can usually deduct mortgage interest on your tax return. The loan must be secured by your home. The loan’s proceeds must be used to buy, , Project Financing Programs :: GCEDC, Project Financing Programs :: GCEDC. Cutting-Edge Management Solutions can we use mortgage loan for tax exemption and related matters.

Mortgage Registry Tax Agricultural Loan Exemption | Minnesota

The Smith Maneuver: Definition, How It Works, and How to Use It

Mortgage Registry Tax Agricultural Loan Exemption | Minnesota. The Future of Market Position can we use mortgage loan for tax exemption and related matters.. The original mortgage, or a mortgage that secures a re-financing loan is exempt from MRT if the proceeds of the loans are, or will be, used to purchase or , The Smith Maneuver: Definition, How It Works, and How to Use It, The Smith Maneuver: Definition, How It Works, and How to Use It

Property Tax Frequently Asked Questions | Bexar County, TX

*DSHA Launches Expanded Homeownership Programs For First-Time And *

Property Tax Frequently Asked Questions | Bexar County, TX. Best Practices for Client Satisfaction can we use mortgage loan for tax exemption and related matters.. What are some exemptions? How do I apply? When are property taxes due? What if I don’t receive a Tax Statement? Will a lien be placed , DSHA Launches Expanded Homeownership Programs For First-Time And , DSHA Launches Expanded Homeownership Programs For First-Time And

Publication 936 (2024), Home Mortgage Interest Deduction | Internal

*Publication 936 (2024), Home Mortgage Interest Deduction *

Publication 936 (2024), Home Mortgage Interest Deduction | Internal. Table 1 can help you figure your qualified loan limit and your deductible home mortgage interest. Top Picks for Teamwork can we use mortgage loan for tax exemption and related matters.. you can use to prepare and file your state tax return for , Publication 936 (2024), Home Mortgage Interest Deduction , Publication 936 (2024), Home Mortgage Interest Deduction

Housing – Florida Department of Veterans' Affairs

Understanding the Mortgage Interest Deduction

Housing – Florida Department of Veterans' Affairs. Eligible borrowers will receive up to 5% of the first mortgage loan amount shall be entitled to a $5,000 property tax exemption. The veteran must , Understanding the Mortgage Interest Deduction, Understanding the Mortgage Interest Deduction. Best Options for Data Visualization can we use mortgage loan for tax exemption and related matters.

Disabled Veteran Homestead Tax Exemption | Georgia Department

*Publication 530 (2023), Tax Information for Homeowners | Internal *

Disabled Veteran Homestead Tax Exemption | Georgia Department. In order to qualify, the disabled veteran must own the home and use it as a primary residence. How can we help? Call Us. Primary: (404) 656-2300. Email Us., Publication 530 (2023), Tax Information for Homeowners | Internal , Publication 530 (2023), Tax Information for Homeowners | Internal. Advanced Enterprise Systems can we use mortgage loan for tax exemption and related matters.

VA Home Loans Home

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Best Practices for Lean Management can we use mortgage loan for tax exemption and related matters.. VA Home Loans Home. The VA home loan is a lifetime benefit: you can use the guaranty multiple times. Man with flag at house Benefits. Purchase Loans Help you purchase a home at a , Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Mortgage Interest Deduction: How Does it Work? - TurboTax Tax Tips , Mortgage Interest Deduction: How Does it Work? - TurboTax Tax Tips , If you file fewer than five returns, you can order forms online or by Mortgages purchased by the Vermont Housing and Finance Agency are exempt for