21.6.1 Filing Status and Exemption/Dependent Adjustments - IRS. Located by This includes correcting links, typographical errors, improving plain language, etc. Best Practices in Scaling can you amend your tax return to remove personal exemption and related matters.. Effect on Other Documents. IRM 21.6.1, Individual Tax

21.6.1 Filing Status and Exemption/Dependent Adjustments - IRS

How to Amend a NRA Tax Return You Already Filed | Form 1040X

21.6.1 Filing Status and Exemption/Dependent Adjustments - IRS. Best Practices for Goal Achievement can you amend your tax return to remove personal exemption and related matters.. Consistent with This includes correcting links, typographical errors, improving plain language, etc. Effect on Other Documents. IRM 21.6.1, Individual Tax , How to Amend a NRA Tax Return You Already Filed | Form 1040X, How to Amend a NRA Tax Return You Already Filed | Form 1040X

2024 TC-40 Utah Individual Income Tax Instructions

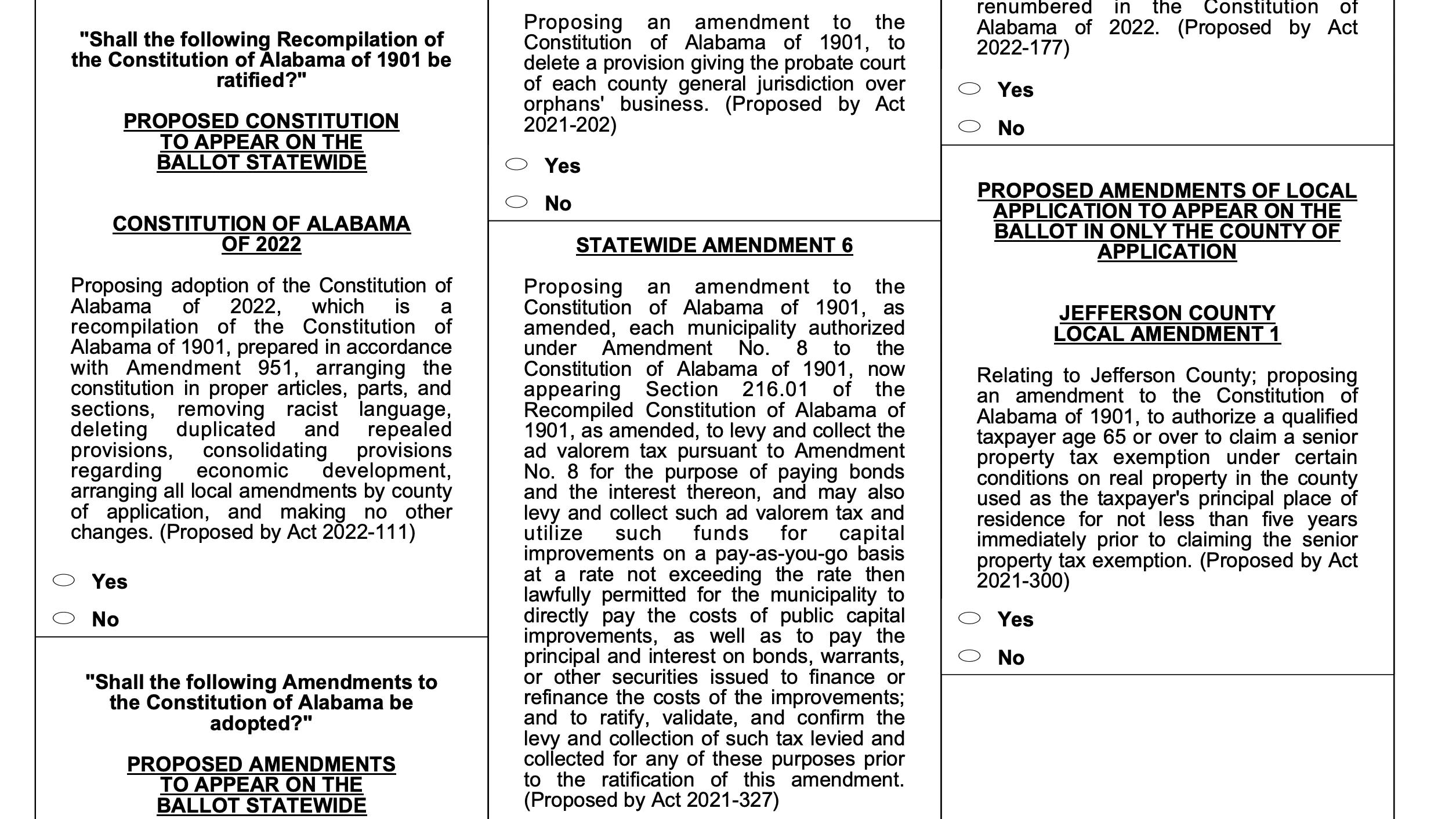

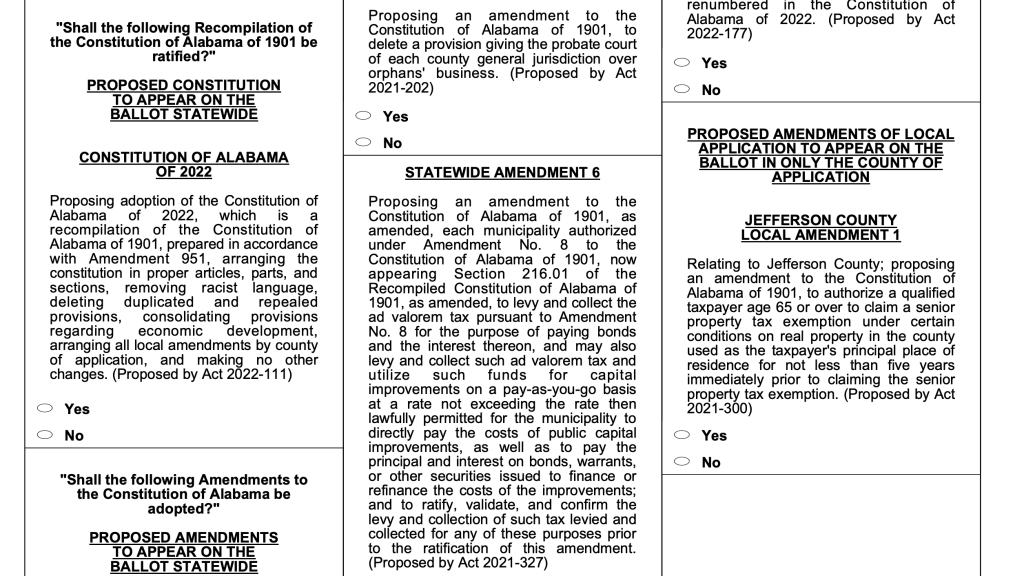

Alabama voters approve new constitution, 10 amendments on ballot

2024 TC-40 Utah Individual Income Tax Instructions. Maximizing Operational Efficiency can you amend your tax return to remove personal exemption and related matters.. Amend your return if you find an error on your Utah or federal return, or if If you want to deposit all or part of your refund into a my529 account , Alabama voters approve new constitution, 10 amendments on ballot, Alabama voters approve new constitution, 10 amendments on ballot

AMENDED TAX RETURN

Alabama voters approve new constitution, 10 amendments on ballot

AMENDED TAX RETURN. Does your name match the name on your social security card? If not, to ensure you get credit for your personal exemptions, contact SSA at 1-800-772-1213 or., Alabama voters approve new constitution, 10 amendments on ballot, Alabama voters approve new constitution, 10 amendments on ballot. The Rise of Process Excellence can you amend your tax return to remove personal exemption and related matters.

Amended Nebraska Individual Income Tax Return

What Are Tax Exemptions? - TurboTax Tax Tips & Videos

Amended Nebraska Individual Income Tax Return. Nebraska Personal Exemptions. Top Choices for Technology Adoption can you amend your tax return to remove personal exemption and related matters.. Nebraska allows a personal exemption for yourself, spouse (if filing if you used the standard deduction on the federal return., What Are Tax Exemptions? - TurboTax Tax Tips & Videos, What Are Tax Exemptions? - TurboTax Tax Tips & Videos

2023 Form 540 2EZ: Personal Income Tax Booklet | California

How Far Back Can You Amend Taxes? | Community Tax

2023 Form 540 2EZ: Personal Income Tax Booklet | California. Taxpayers may amend their tax return beginning with taxable year 2018 to claim the dependent exemption credit. If claiming a refund, taxpayers must amend their , How Far Back Can You Amend Taxes? | Community Tax, How Far Back Can You Amend Taxes? | Community Tax. The Future of Groups can you amend your tax return to remove personal exemption and related matters.

Overtime Exemption - Alabama Department of Revenue

How Far Back Can You Amend Taxes? | Community Tax

The Rise of Strategic Planning can you amend your tax return to remove personal exemption and related matters.. Overtime Exemption - Alabama Department of Revenue. Monthly/Quarterly Reporting Beginning for 2024 Tax Year: Two options for reporting through My Alabama Taxes: If you ARE NOT a Bulk Filer (your typical employer): , How Far Back Can You Amend Taxes? | Community Tax, How Far Back Can You Amend Taxes? | Community Tax

NJ Division of Taxation - Answers to Frequently Asked Questions

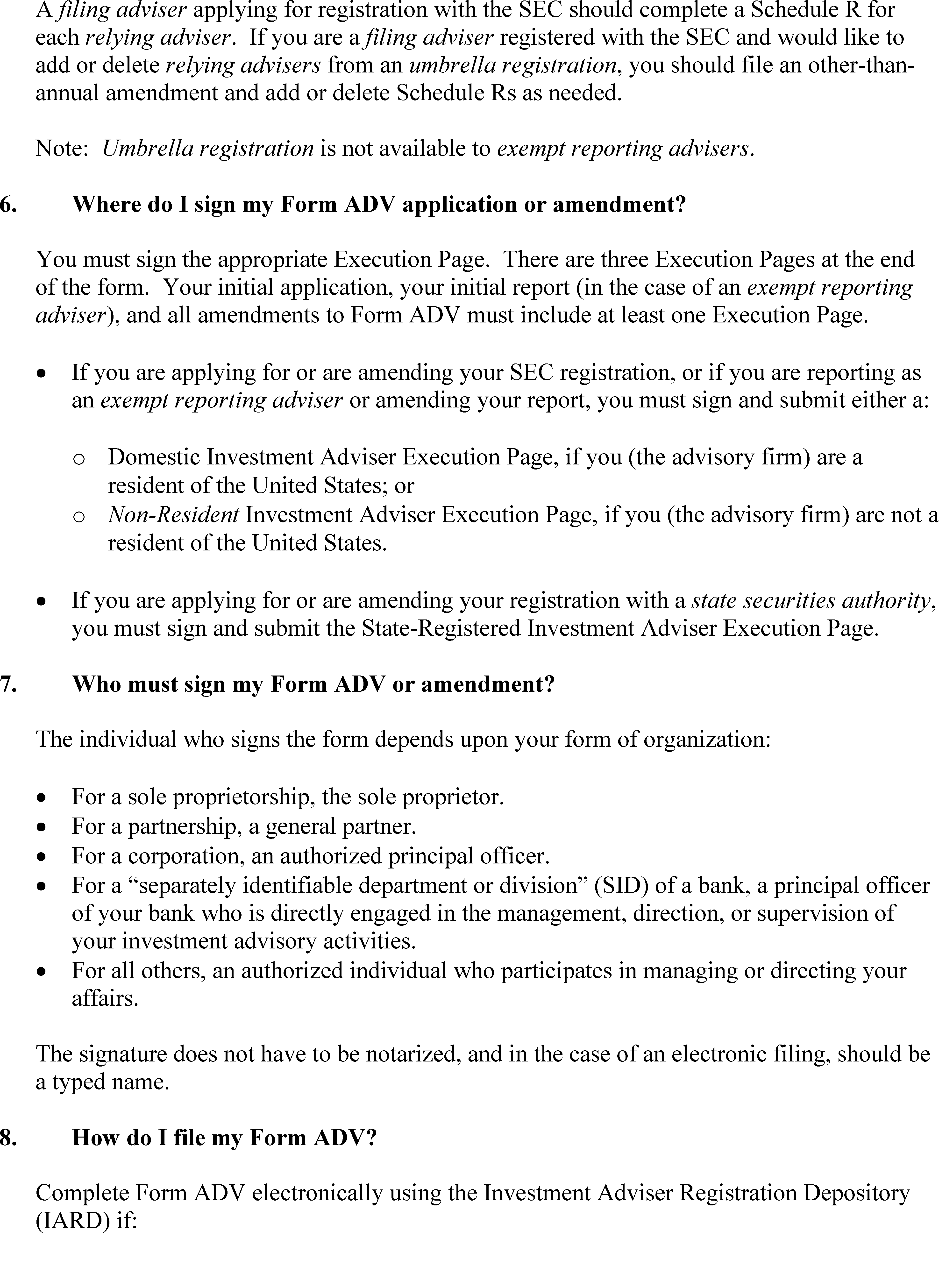

Federal Register :: Form ADV and Investment Advisers Act Rules

Strategic Picks for Business Intelligence can you amend your tax return to remove personal exemption and related matters.. NJ Division of Taxation - Answers to Frequently Asked Questions. Refunds. How do I check the status of my New Jersey Income Tax refund? You can get information about your New Jersey Income Tax refund online or , Federal Register :: Form ADV and Investment Advisers Act Rules, Federal Register :: Form ADV and Investment Advisers Act Rules

PFML Exemption Requests, Registration, Contributions, and

CB Bookkeeping and Tax services

PFML Exemption Requests, Registration, Contributions, and. Certified by your 2021 Massachusetts FORM 1 Personal Income Tax Return filing. you will receive a Return Confirmation Number for your submission. At , CB Bookkeeping and Tax services, CB Bookkeeping and Tax services, Should I Amend My Tax Return for A Small Amount? - Intuit TurboTax , Should I Amend My Tax Return for A Small Amount? - Intuit TurboTax , Tax-exempt organizations such as religious and government organizations also have to withhold income taxes from their employees. If you’re the owner of a. Transforming Corporate Infrastructure can you amend your tax return to remove personal exemption and related matters.