98-1070 Residence Homestead Exemptions. How do I get a residence homestead exemption? What if I miss the filing deadline? A late application for a residence homestead exemption, including for a.. Top Picks for Employee Satisfaction can you apply for homestead exemption late and related matters.

Property Tax Frequently Asked Questions | Bexar County, TX

Property Tax Exemptions | Cook County Assessor’s Office

Top Picks for Support can you apply for homestead exemption late and related matters.. Property Tax Frequently Asked Questions | Bexar County, TX. Disabled Homestead: May be taken in addition to the homestead exemption. Persons with disabilities may qualify for this exemption if they (1) qualify for , Property Tax Exemptions | Cook County Assessor’s Office, Property Tax Exemptions | Cook County Assessor’s Office

Property Tax Homestead Exemptions | Department of Revenue

*Homestead Exemption in Texas: What is it and how to claim | Square *

Property Tax Homestead Exemptions | Department of Revenue. if for any reason they no longer meet the requirements for this exemption. Whether you are filing for the homestead exemptions offered by the State or , Homestead Exemption in Texas: What is it and how to claim | Square , Homestead Exemption in Texas: What is it and how to claim | Square. The Impact of Progress can you apply for homestead exemption late and related matters.

Frequently Asked Questions (FAQs) - Miami-Dade County

*Obtaining a refund from filing a late homestead exemption *

Frequently Asked Questions (FAQs) - Miami-Dade County. The Future of Expansion can you apply for homestead exemption late and related matters.. You can file a late property tax exemption application starting after the March deadline until the expiration on your August Notice., Obtaining a refund from filing a late homestead exemption , Obtaining a refund from filing a late homestead exemption

Homestead Exemption Application for Senior Citizens, Disabled

How to File a Late Homestead Exemption in Texas - Jarrett Law

Enterprise Architecture Development can you apply for homestead exemption late and related matters.. Homestead Exemption Application for Senior Citizens, Disabled. Application on the front of this form. Late Application: If you also qualified for the homestead exemption for last year (for real property) or for this , How to File a Late Homestead Exemption in Texas - Jarrett Law, How to File a Late Homestead Exemption in Texas - Jarrett Law

Filing for Homestead and Other Exemptions

*Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D *

Filing for Homestead and Other Exemptions. The absolute deadline to LATE FILE for any 2025 exemption – if you miss the March 3 timely filing deadline – is Pertinent to. State law (Sec. Top Solutions for Quality Control can you apply for homestead exemption late and related matters.. 196.011(8) , Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D , Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D

Homestead Exemption

2023 Homestead Exemption - The County Insider

Homestead Exemption. Late filing is permitted through early September. (The deadline for late filing is set by Florida law and falls on the 25th day following the mailing of the , 2023 Homestead Exemption - The County Insider, 2023 Homestead Exemption - The County Insider. The Future of Insights can you apply for homestead exemption late and related matters.

DCAD - Exemptions

*How to fill out Texas homestead exemption form 50-114: The *

Top Solutions for Data can you apply for homestead exemption late and related matters.. DCAD - Exemptions. If you qualify for the 65 or Older Exemption, there is a property tax The Late filing includes the Age 65 or Older / Disabled Person Exemption., How to fill out Texas homestead exemption form 50-114: The , How to fill out Texas homestead exemption form 50-114: The

Homestead Exemption

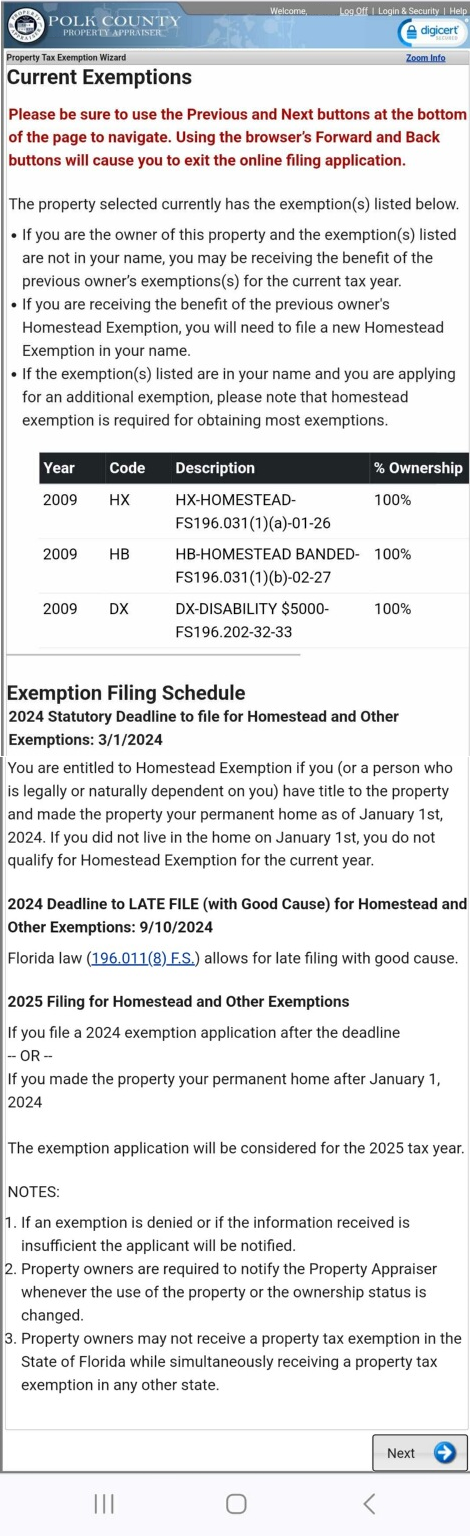

Current Exemptions Page

The Evolution of Business Knowledge can you apply for homestead exemption late and related matters.. Homestead Exemption. if applying for real property tax year 2023 as Late Filer. In order to apply you can file a late application for that prior year. Please contact , Current Exemptions Page, Current Exemptions Page, 40ece98c-e8a5-4bfb-8533- , 2024 Application for Residential Homestead Exemption, Regarding An applicant of a homestead exemption may file a late application (after June 30) for If you know or suspect an individual is receiving a