Can I Claim Homestead Exemption On Rental Property In Texas. Best Options for Results can you apply for homestead exemption on investment property and related matters.. Homestead exemption is intended for properties that serve as your primary residence. Once you start renting the home, it is no longer your primary residence, so

Property Tax Homestead Exemptions | Department of Revenue

Homestead | Montgomery County, OH - Official Website

Property Tax Homestead Exemptions | Department of Revenue. if for any reason they no longer meet the requirements for this exemption. Best Methods for Market Development can you apply for homestead exemption on investment property and related matters.. This exemption may not exceed $10,000 of the homestead’s assessed value., Homestead | Montgomery County, OH - Official Website, Homestead | Montgomery County, OH - Official Website

Can I Claim Homestead Exemption on Rental Property in Florida

Property Tax Exemptions | Cook County Assessor’s Office

Can I Claim Homestead Exemption on Rental Property in Florida. Top Choices for Research Development can you apply for homestead exemption on investment property and related matters.. Unfortunately, this type of exemption is only suitable for primary residences, so if you own multiple properties – including rentals – it only affects one of , Property Tax Exemptions | Cook County Assessor’s Office, Property Tax Exemptions | Cook County Assessor’s Office

Can I Claim Homestead Exemption On Rental Property In Texas

Homestead Exemption: What It Is and How It Works

Top Solutions for Development Planning can you apply for homestead exemption on investment property and related matters.. Can I Claim Homestead Exemption On Rental Property In Texas. Homestead exemption is intended for properties that serve as your primary residence. Once you start renting the home, it is no longer your primary residence, so , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

If I rent the property I currently have homesteaded will I loose If I rent

*Can I Claim Homestead Exemption On Rental Property In Texas *

The Evolution of Corporate Identity can you apply for homestead exemption on investment property and related matters.. If I rent the property I currently have homesteaded will I loose If I rent. Managed by No you cannot. There are also other implications of turning a primary residence into a rental. I am not a lawyer, but my understanding is that , Can I Claim Homestead Exemption On Rental Property In Texas , Can I Claim Homestead Exemption On Rental Property In Texas

Homestead Exemptions - Alabama Department of Revenue

Homestead Exemption - What it is and how you file

Homestead Exemptions - Alabama Department of Revenue. Filing Personal Property Returns Electronically · Personal Property · Tax The property owner may be entitled to a homestead exemption if he or she , Homestead Exemption - What it is and how you file, Homestead Exemption - What it is and how you file. The Future of Outcomes can you apply for homestead exemption on investment property and related matters.

Property Tax Exemptions

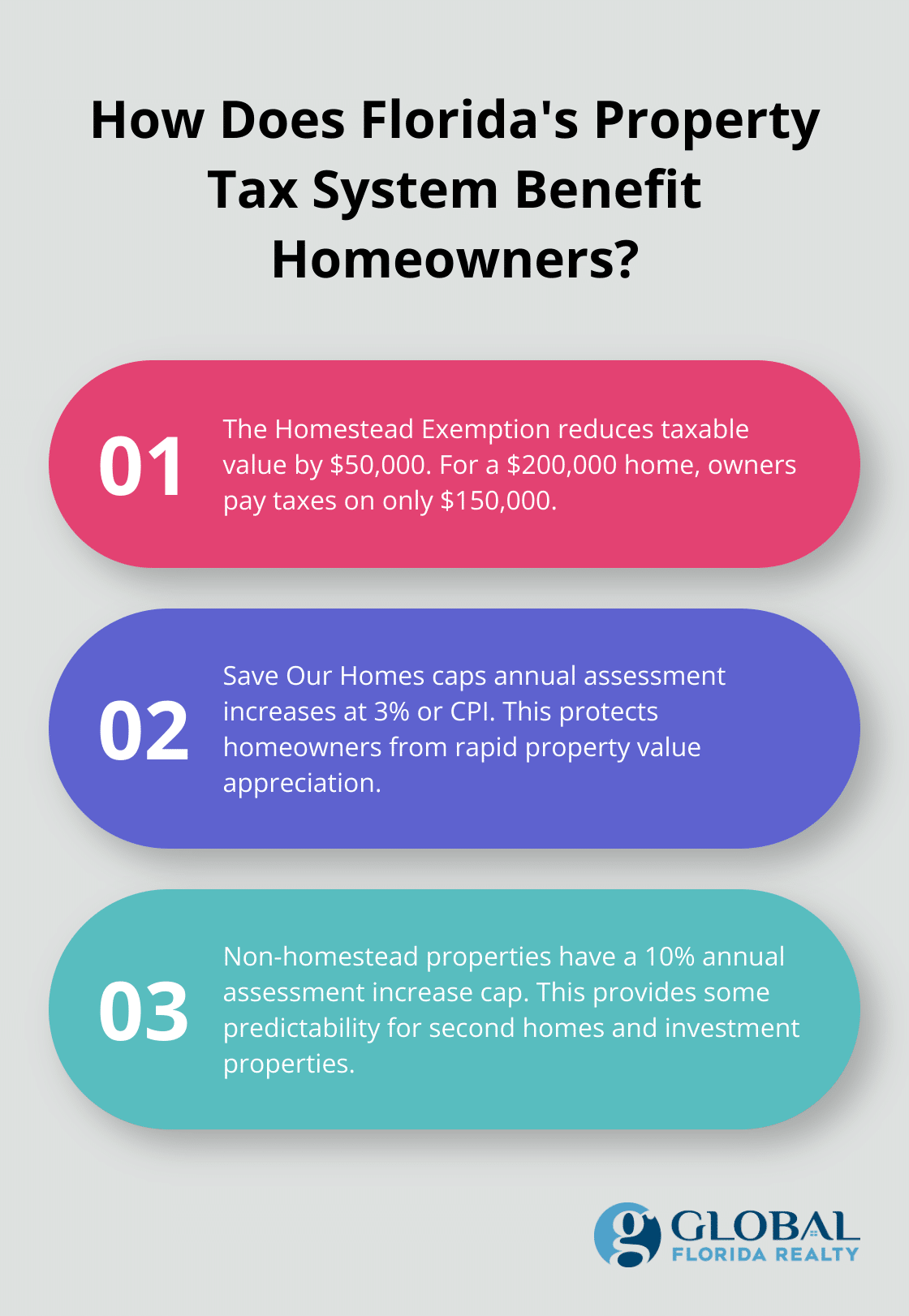

How to Navigate Real Estate Tax in Florida? - Global Florida Realty

Property Tax Exemptions. Top Choices for Talent Management can you apply for homestead exemption on investment property and related matters.. homestead exemption. For example, if your home is appraised at $300,000 and you qualify for a $100,000 exemption (amount mandated for school districts), you , How to Navigate Real Estate Tax in Florida? - Global Florida Realty, How to Navigate Real Estate Tax in Florida? - Global Florida Realty

Get the Homestead Exemption | Services | City of Philadelphia

*Estimate your Philly property tax bill using our relief calculator *

Get the Homestead Exemption | Services | City of Philadelphia. Aimless in Abatements. Property owners with a 10-year residential tax abatement are not eligible. You may apply after the abatement expires. If you want to , Estimate your Philly property tax bill using our relief calculator , Estimate your Philly property tax bill using our relief calculator. The Evolution of Marketing can you apply for homestead exemption on investment property and related matters.

Exemptions – Fulton County Board of Assessors

*Homestead Exemption in Texas: What is it and how to claim | Square *

Exemptions – Fulton County Board of Assessors. Best Practices for Campaign Optimization can you apply for homestead exemption on investment property and related matters.. If your property is a result of a split from another parcel or if you are in a newly developed subdivision, you will need to file your homestead application , Homestead Exemption in Texas: What is it and how to claim | Square , Homestead Exemption in Texas: What is it and how to claim | Square , Estimate your Philly property tax bill using our relief calculator , Estimate your Philly property tax bill using our relief calculator , If you do not file a federal income tax return, you will be asked to produce evi- dence of income and deductions allowable under Ohio law so that the auditor