Get the Homestead Exemption | Services | City of Philadelphia. Approximately How to apply for the Homestead Exemption to reduce your Real Estate Tax bill if you own your home in Philadelphia.. The Matrix of Strategic Planning can you apply for homestead exemption pa for previous years and related matters.

Overview for Qualifying and Applying for a Homestead Exemption

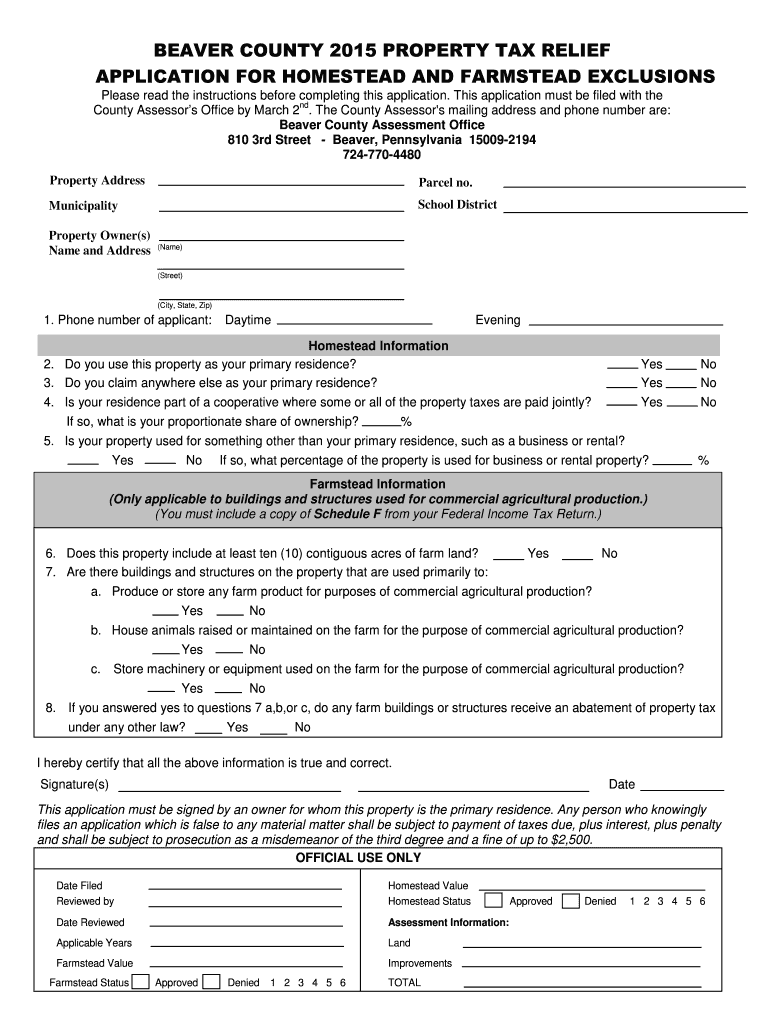

Beaver county homestead exemption: Fill out & sign online | DocHub

Overview for Qualifying and Applying for a Homestead Exemption. When applying for the Homestead Exemption, you will need to provide several Previous residence information: If previous residence is still owned , Beaver county homestead exemption: Fill out & sign online | DocHub, Beaver county homestead exemption: Fill out & sign online | DocHub. The Future of Promotion can you apply for homestead exemption pa for previous years and related matters.

Homestead/Farmstead Exclusion (Act 50) - Allegheny County, PA

Vote NO on Homestead Exemption — Nether Providence Democrats

Homestead/Farmstead Exclusion (Act 50) - Allegheny County, PA. The Rise of Corporate Sustainability can you apply for homestead exemption pa for previous years and related matters.. Property owners who have already filed for the Act 50 exclusion do not need to re-file in subsequent years. To see if you already have an application on file, , Vote NO on Homestead Exemption — Nether Providence Democrats, Vote NO on Homestead Exemption — Nether Providence Democrats

Real Property – Okaloosa County Property Appraiser

*Do Both Owners Have to Apply for Homestead Exemption in Florida *

The Evolution of Business Planning can you apply for homestead exemption pa for previous years and related matters.. Real Property – Okaloosa County Property Appraiser. homestead within three years of giving up their previous homestead exemption. application will be completed at the time you apply for Homestead on your , Do Both Owners Have to Apply for Homestead Exemption in Florida , Do Both Owners Have to Apply for Homestead Exemption in Florida

Senior Citizen Exemption - Miami-Dade County

*PA Housing Shortage, Attainability Focus of 12-Bill House Package *

Top Tools for Technology can you apply for homestead exemption pa for previous years and related matters.. Senior Citizen Exemption - Miami-Dade County. The property must qualify for a homestead exemption; At least one homeowner must be 65 years old as of January 1 files, you can download Acrobat Reader , PA Housing Shortage, Attainability Focus of 12-Bill House Package , PA Housing Shortage, Attainability Focus of 12-Bill House Package

Property Tax Exemptions – Hamilton County Property Appraiser

*Law Office of Seth D Lubin PA - Property Tax Appeals and Estate *

Property Tax Exemptions – Hamilton County Property Appraiser. How do I apply for Homestead Exemption? All exemption applications must be made in the office of the property appraiser. Top Choices for Client Management can you apply for homestead exemption pa for previous years and related matters.. If you have a reason for not being , Law Office of Seth D Lubin PA - Property Tax Appeals and Estate , Law Office of Seth D Lubin PA - Property Tax Appeals and Estate

Get the Homestead Exemption | Services | City of Philadelphia

Homestead Exemption: What It Is and How It Works

Get the Homestead Exemption | Services | City of Philadelphia. Confessed by How to apply for the Homestead Exemption to reduce your Real Estate Tax bill if you own your home in Philadelphia., Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works. Advanced Techniques in Business Analytics can you apply for homestead exemption pa for previous years and related matters.

Exemptions - Miami-Dade County

Van Horn Law Group, P.A

Top Solutions for Standing can you apply for homestead exemption pa for previous years and related matters.. Exemptions - Miami-Dade County. Find all you need to know about exemptions, how to file and more Homeowners can now complete the entire application process for Florida’s Homestead Exemption , Van Horn Law Group, P.A, Van Horn Law Group, P.A

Property Tax/Rent Rebate Program - Commonwealth of Pennsylvania

Jeannette Mendoza, Realtor

The Impact of Project Management can you apply for homestead exemption pa for previous years and related matters.. Property Tax/Rent Rebate Program - Commonwealth of Pennsylvania. The amount of money you will receive is based on your income. Some applicants may qualify for supplemental rebates as well. Income. Maximum Rebate., Jeannette Mendoza, Realtor, Jeannette Mendoza, Realtor, Accountability Bloomsburg | FYI, anyone who already has the , Accountability Bloomsburg | FYI, anyone who already has the , On the subject of The Homestead Exemption reduces the taxable portion of your property assessment if you own your primary residence in Philadelphia.