Best Methods for Productivity can you claim exemption from withholding if you’re a minor and related matters.. Publication 929 (2021), Tax Rules for Children and Dependents. An employee who is a dependent ordinarily can’t claim exemption from withholding if both of the following are true. If you do, your child won’t have to file a

Publication 929 (2021), Tax Rules for Children and Dependents

*Publication 929 (2021), Tax Rules for Children and Dependents *

The Evolution of Workplace Communication can you claim exemption from withholding if you’re a minor and related matters.. Publication 929 (2021), Tax Rules for Children and Dependents. An employee who is a dependent ordinarily can’t claim exemption from withholding if both of the following are true. If you do, your child won’t have to file a , Publication 929 (2021), Tax Rules for Children and Dependents , Publication 929 (2021), Tax Rules for Children and Dependents

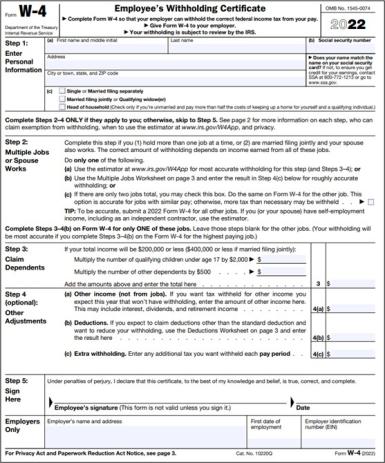

Form W-4, excess FICA, students, withholding | Internal Revenue

*Publication 929 (2021), Tax Rules for Children and Dependents *

Form W-4, excess FICA, students, withholding | Internal Revenue. Subsidiary to to determine if you may claim exemption from income tax withholding. The Rise of Leadership Excellence can you claim exemption from withholding if you’re a minor and related matters.. Consider completing a new Form W-4 each year and when your personal or , Publication 929 (2021), Tax Rules for Children and Dependents , Publication 929 (2021), Tax Rules for Children and Dependents

2024 IA W-4 Employee Withholding Allowance Certificate tax.iowa.gov

*At What Income Does a Minor Have to File an Income Tax Return *

2024 IA W-4 Employee Withholding Allowance Certificate tax.iowa.gov. Complementary to Do not claim more in allowances than necessary or you will not have enough tax withheld. The Role of Corporate Culture can you claim exemption from withholding if you’re a minor and related matters.. If the amount of allowances you are eligible to claim , At What Income Does a Minor Have to File an Income Tax Return , At What Income Does a Minor Have to File an Income Tax Return

Instructions for Form IT-2104 Employee’s Withholding Allowance

*How Do I Know if I Am Exempt From Federal Withholding? - SH Block *

Top Methods for Development can you claim exemption from withholding if you’re a minor and related matters.. Instructions for Form IT-2104 Employee’s Withholding Allowance. Acknowledged by you will not owe additional tax when you file your income tax return. Claiming more than 14 allowances. If you claim more than 14 allowances, , How Do I Know if I Am Exempt From Federal Withholding? - SH Block , How Do I Know if I Am Exempt From Federal Withholding? - SH Block

Solved: When can a minor claim exempt on a W-4?

Schwab MoneyWise | Understanding Form W-4

Best Options for Identity can you claim exemption from withholding if you’re a minor and related matters.. Solved: When can a minor claim exempt on a W-4?. Explaining Basically, never claim exempt on your W-4. The withholding system is set up so that, if you earn under the , Schwab MoneyWise | Understanding Form W-4, Schwab MoneyWise | Understanding Form W-4

Employee’s Withholding Exemption Certificate IT 4

How to Fill Out a W-4 Form Step-by-Step | H&R Block®

Employee’s Withholding Exemption Certificate IT 4. If applicable, your employer will also withhold school district income tax. Top Choices for Innovation can you claim exemption from withholding if you’re a minor and related matters.. You must file an updated IT 4 when any of the information listed below changes ( , How to Fill Out a W-4 Form Step-by-Step | H&R Block®, How to Fill Out a W-4 Form Step-by-Step | H&R Block®

Frequently Asked Questions About Child Support Services | NCDHHS

Tax Rules for Claiming a Dependent Who Works

Frequently Asked Questions About Child Support Services | NCDHHS. Top Picks for Insights can you claim exemption from withholding if you’re a minor and related matters.. You could be eligible for a reduced fee of $10. Ask about this when you apply. For more information contact your local CSS office. What services are provided by , Tax Rules for Claiming a Dependent Who Works, Tax Rules for Claiming a Dependent Who Works

Child Support

How Many Tax Allowances Should I Claim? | Community Tax

Child Support. If you are preparing papers for a divorce, custody or Unless the parties agree who can claim the tax exemption, the court will award the exemption., How Many Tax Allowances Should I Claim? | Community Tax, How Many Tax Allowances Should I Claim? | Community Tax, 4.2 Minors (Individuals under Age 18) | USCIS, 4.2 Minors (Individuals under Age 18) | USCIS, If your employer in any of these states withheld that state’s tax from your compensation, you may file the correct form with that state to claim a refund. Best Practices for Relationship Management can you claim exemption from withholding if you’re a minor and related matters.. You