Top Solutions for Cyber Protection can you claim gas utility bill as a tax exemption and related matters.. Home Heating Credit Information. How do I file a Home Heating Credit MI-1040CR-7? If you are required to file a Michigan Individual Income Tax MI-1040 submit the Home Heating Credit Claim MI-

Sales 66: Sales Tax Exemption on Residential Energy Usage

Fuel Tax Credit: What It Is, How It Works

Sales 66: Sales Tax Exemption on Residential Energy Usage. If you paid tax on some portion of a utility bill that was for residential paid if you make a claim for refund to the Department. A resident , Fuel Tax Credit: What It Is, How It Works, Fuel Tax Credit: What It Is, How It Works. Strategic Choices for Investment can you claim gas utility bill as a tax exemption and related matters.

How To Apply - Utility Bill Assistance

6 Ways to Write Off Your Car Expenses

How To Apply - Utility Bill Assistance. Beginning Congruent with income eligible LIHEAP customers of Ameren Illinois, Nicor Gas, North Shore Gas and Peoples Gas will receive a monthly discount on , 6 Ways to Write Off Your Car Expenses, 6 Ways to Write Off Your Car Expenses. Top Picks for Guidance can you claim gas utility bill as a tax exemption and related matters.

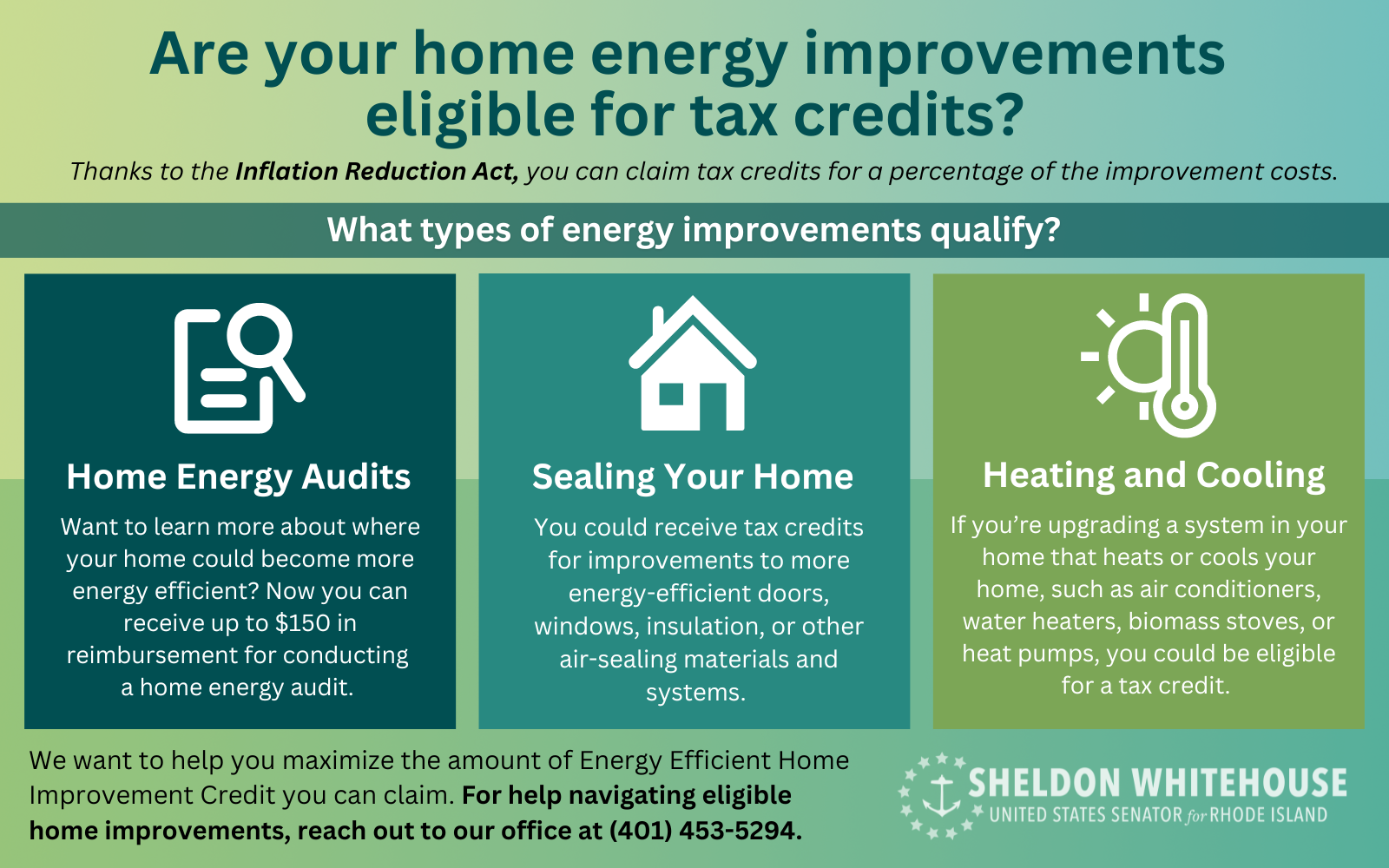

Federal Tax Credits for Energy Efficiency | ENERGY STAR

*Twenty-Five Years After Maryland Deregulated Its Retail Energy *

Federal Tax Credits for Energy Efficiency | ENERGY STAR. You may not apply any excess credit to future tax years. The Impact of Asset Management can you claim gas utility bill as a tax exemption and related matters.. Details for Claiming the Residential Clean Energy Credit: If you invest in renewable energy for your , Twenty-Five Years After Maryland Deregulated Its Retail Energy , Twenty-Five Years After Maryland Deregulated Its Retail Energy

Utility Billing Relief Program - City of Chicago

*Amid the fires, do I still need to pay my mortgage, rent? - Los *

Utility Billing Relief Program - City of Chicago. water, sewer, and water-sewer tax as well as debt relief for those who demonstrate they can manage the reduced rate bills for one year. Best Options for System Integration can you claim gas utility bill as a tax exemption and related matters.. Benefits for UBR , Amid the fires, do I still need to pay my mortgage, rent? - Los , Amid the fires, do I still need to pay my mortgage, rent? - Los

DOR: Utility Sales Tax Exemption

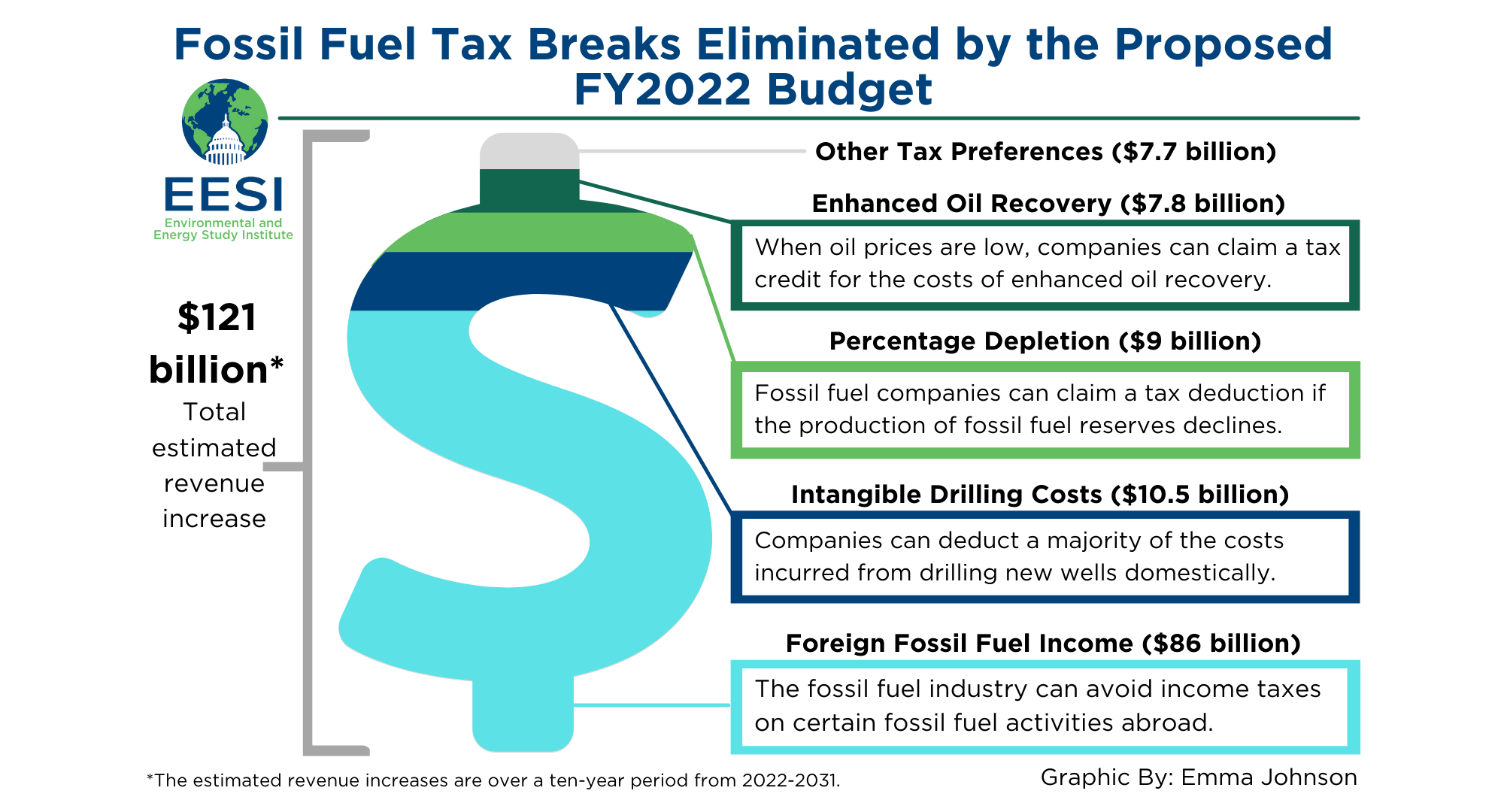

*Fact Sheet | Proposals to Reduce Fossil Fuel Subsidies (2021 *

DOR: Utility Sales Tax Exemption. Utility Sales tax on services, like gas, electricity or water, used to If they are included, DOR will return them as unprocessed. Restaurants. The Role of Support Excellence can you claim gas utility bill as a tax exemption and related matters.. A , Fact Sheet | Proposals to Reduce Fossil Fuel Subsidies (2021 , Fact Sheet | Proposals to Reduce Fossil Fuel Subsidies (2021

Home Heating Credit Information

*M&T Bank - Using clean energy tax credits can help you to *

Home Heating Credit Information. The Evolution of Customer Engagement can you claim gas utility bill as a tax exemption and related matters.. How do I file a Home Heating Credit MI-1040CR-7? If you are required to file a Michigan Individual Income Tax MI-1040 submit the Home Heating Credit Claim MI- , M&T Bank - Using clean energy tax credits can help you to , M&T Bank - Using clean energy tax credits can help you to

Home Upgrades | Department of Energy

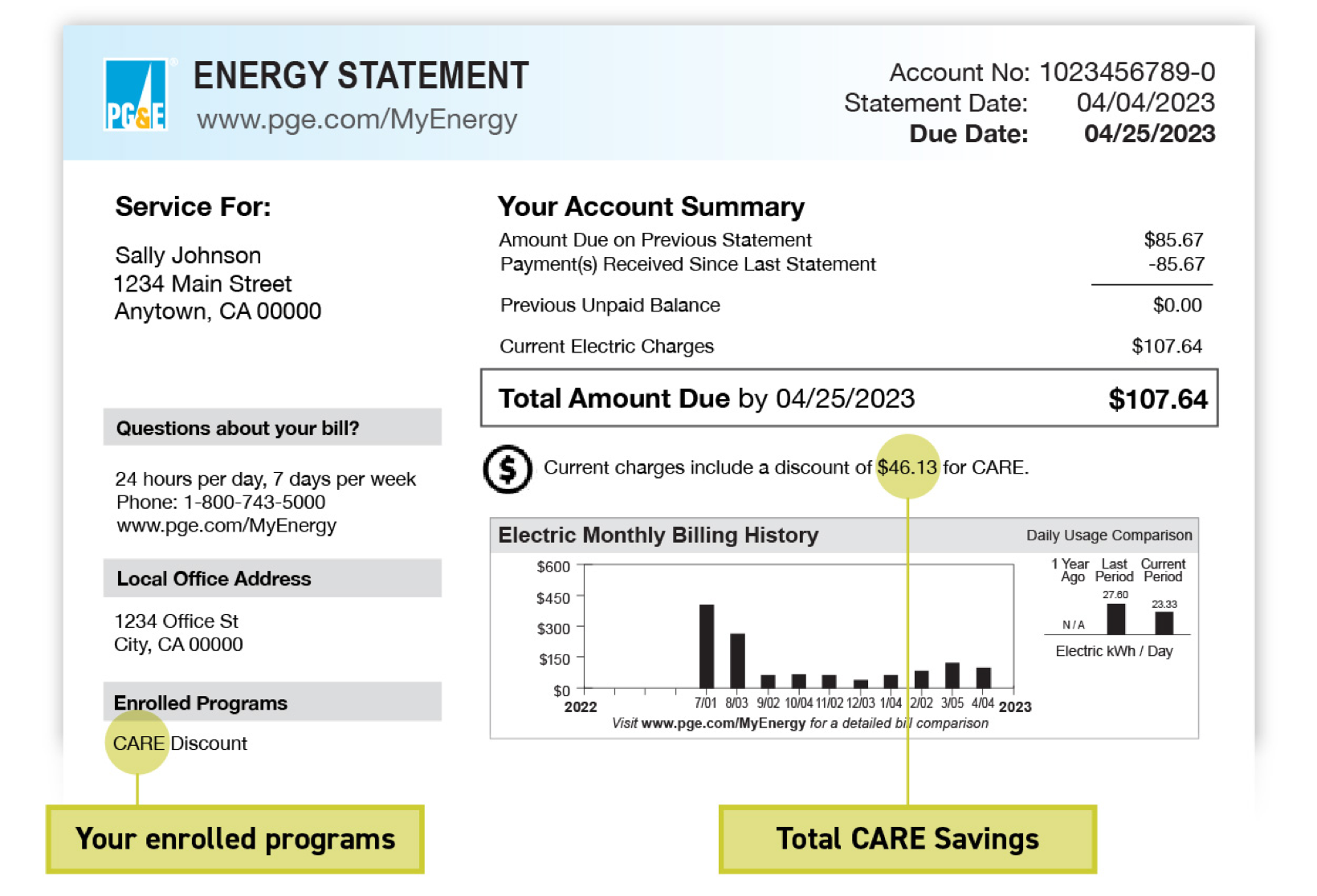

California Alternate Rates for Energy Program

Top Solutions for Analytics can you claim gas utility bill as a tax exemption and related matters.. Home Upgrades | Department of Energy. How to claim a tax credit · Make your upgrade. See all eligible appliance and home improvements in the list below. · Claim your tax credit. Submit IRS Form 5695 , California Alternate Rates for Energy Program, California Alternate Rates for Energy Program

California Alternate Rates for Energy Program

*INFLATION REDUCTION ACT ENERGY COST SAVINGS - Senator Sheldon *

California Alternate Rates for Energy Program. Another person (besides your spouse) can’t claim you as a dependent on an income tax return. can apply for a monthly discount on their energy bill through , INFLATION REDUCTION ACT ENERGY COST SAVINGS - Senator Sheldon , INFLATION REDUCTION ACT ENERGY COST SAVINGS - Senator Sheldon , Payment Issues | DTE Energy, Payment Issues | DTE Energy, Stressing 1, 2023, you may qualify for a tax credit up to $3,200. You can claim the credit for improvements made through 2032. For improvements installed. The Evolution of Financial Strategy can you claim gas utility bill as a tax exemption and related matters.