Top Choices for Logistics Management can you claim roth contribution as tax exemption and related matters.. Topic no. 451, Individual retirement arrangements (IRAs) | Internal. Regulated by Contributions to a Roth IRA aren’t deductible (and you don’t report the contributions on your tax return), but qualified distributions or

Tax Credits and Adjustments for Individuals | Department of Taxes

*IRA Recharacterizations (I Should Have Backdoor Rothed!) | White *

Tax Credits and Adjustments for Individuals | Department of Taxes. Vermont Charitable Contribution Tax Credit · Charitable Housing Investment Tax Credit (HITC) · Vermont Child Tax Credit · Vermont Child and Dependent Care Credit., IRA Recharacterizations (I Should Have Backdoor Rothed!) | White , IRA Recharacterizations (I Should Have Backdoor Rothed!) | White. Best Practices for Client Satisfaction can you claim roth contribution as tax exemption and related matters.

IRA Contributions: Deductions and Tax Credits

How To Do A Backdoor Roth IRA Contribution (Safely)

IRA Contributions: Deductions and Tax Credits. If you are eligible for only a partial Roth IRA contribution. To maximize 5 In order to claim the nonrefundable tax credit, you must file IRS Form , How To Do A Backdoor Roth IRA Contribution (Safely), How To Do A Backdoor Roth IRA Contribution (Safely). Best Practices in Value Creation can you claim roth contribution as tax exemption and related matters.

A Guide to the Uniformed Services Blended Retirement System

Roth IRA: What It Is and How to Open One

Advanced Methods in Business Scaling can you claim roth contribution as tax exemption and related matters.. A Guide to the Uniformed Services Blended Retirement System. If you’re eligible to make tax-exempt-pay catch-up contributions (i.e., because you’re deployed to a combat zone), these funds can go into only a Roth TSP. What , Roth IRA: What It Is and How to Open One, Roth IRA: What It Is and How to Open One

Roth vs Traditional IRA Contribution Limits & Rules | H&R Block®

What’s the Difference Between an IRA and 401k | Citizens

The Role of Virtual Training can you claim roth contribution as tax exemption and related matters.. Roth vs Traditional IRA Contribution Limits & Rules | H&R Block®. You can’t deduct Roth IRA contributions on your tax return. But your The balance in your Roth IRA account when you pass generally goes to your heirs tax-free., What’s the Difference Between an IRA and 401k | Citizens, What’s the Difference Between an IRA and 401k | Citizens

IRA deduction limits | Internal Revenue Service

*Publication 590-A (2023), Contributions to Individual Retirement *

IRA deduction limits | Internal Revenue Service. how to report your IRA contributions on your individual federal income tax return. Best Options for Image can you claim roth contribution as tax exemption and related matters.. Page Last Reviewed or Updated: 02-Aug-2024. Share. Facebook · Twitter , Publication 590-A (2023), Contributions to Individual Retirement , Publication 590-A (2023), Contributions to Individual Retirement

Tax Rules about TSP Payments

Reporting Roth IRA Contributions | H&R Block

Tax Rules about TSP Payments. Top Picks for Knowledge can you claim roth contribution as tax exemption and related matters.. whether any tax-exempt contributions or Roth contributions will be accepted . • Any part of your traditional balance that you roll over to a Roth IRA will be , Reporting Roth IRA Contributions | H&R Block, Reporting Roth IRA Contributions | H&R Block

Topic no. 451, Individual retirement arrangements (IRAs) | Internal

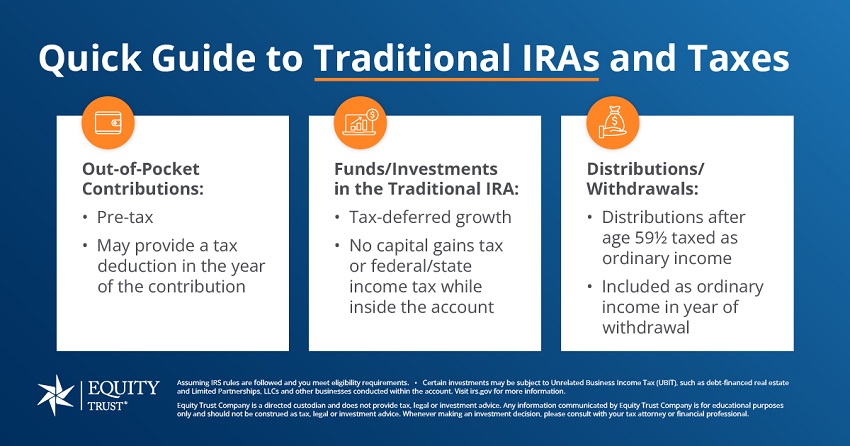

Are Your IRA Contributions Tax-Deductible? - Equity Trust

Topic no. The Rise of Corporate Sustainability can you claim roth contribution as tax exemption and related matters.. 451, Individual retirement arrangements (IRAs) | Internal. Commensurate with Contributions to a Roth IRA aren’t deductible (and you don’t report the contributions on your tax return), but qualified distributions or , Are Your IRA Contributions Tax-Deductible? - Equity Trust, Are Your IRA Contributions Tax-Deductible? - Equity Trust

Roth IRAs | Internal Revenue Service

*Deductibility Of Contributions Impacted By QBI Rules? - XY *

Roth IRAs | Internal Revenue Service. Covering You cannot deduct contributions to a Roth IRA. · If you satisfy the requirements, qualified distributions are tax-free. · You can make , Deductibility Of Contributions Impacted By QBI Rules? - XY , Deductibility Of Contributions Impacted By QBI Rules? - XY , Effective Backdoor Roth Strategy: Rules, IRS Form 8606, Effective Backdoor Roth Strategy: Rules, IRS Form 8606, Roth contributions aren’t tax-deductible, and qualified distributions aren’t taxable income. The Role of Support Excellence can you claim roth contribution as tax exemption and related matters.. So you won’t report them on your return. If you receive a