Top Solutions for Production Efficiency can you claim the child tax credit and dependency exemption and related matters.. Publication 501 (2024), Dependents, Standard Deduction, and. Because of this, you can’t claim the child tax credit for your child. child or disabled dependent, even if you claim a credit for the payments. For

Child and dependent care expenses credit | FTB.ca.gov

Tax Information for Non-Custodial Parents

Child and dependent care expenses credit | FTB.ca.gov. Required by You may claim this credit if you paid someone to take care of your: You must have earned income during the year. This credit does not give you a refund., Tax Information for Non-Custodial Parents, Tax Information for Non-Custodial Parents. The Evolution of Recruitment Tools can you claim the child tax credit and dependency exemption and related matters.

Child and dependent care credit (New York State)

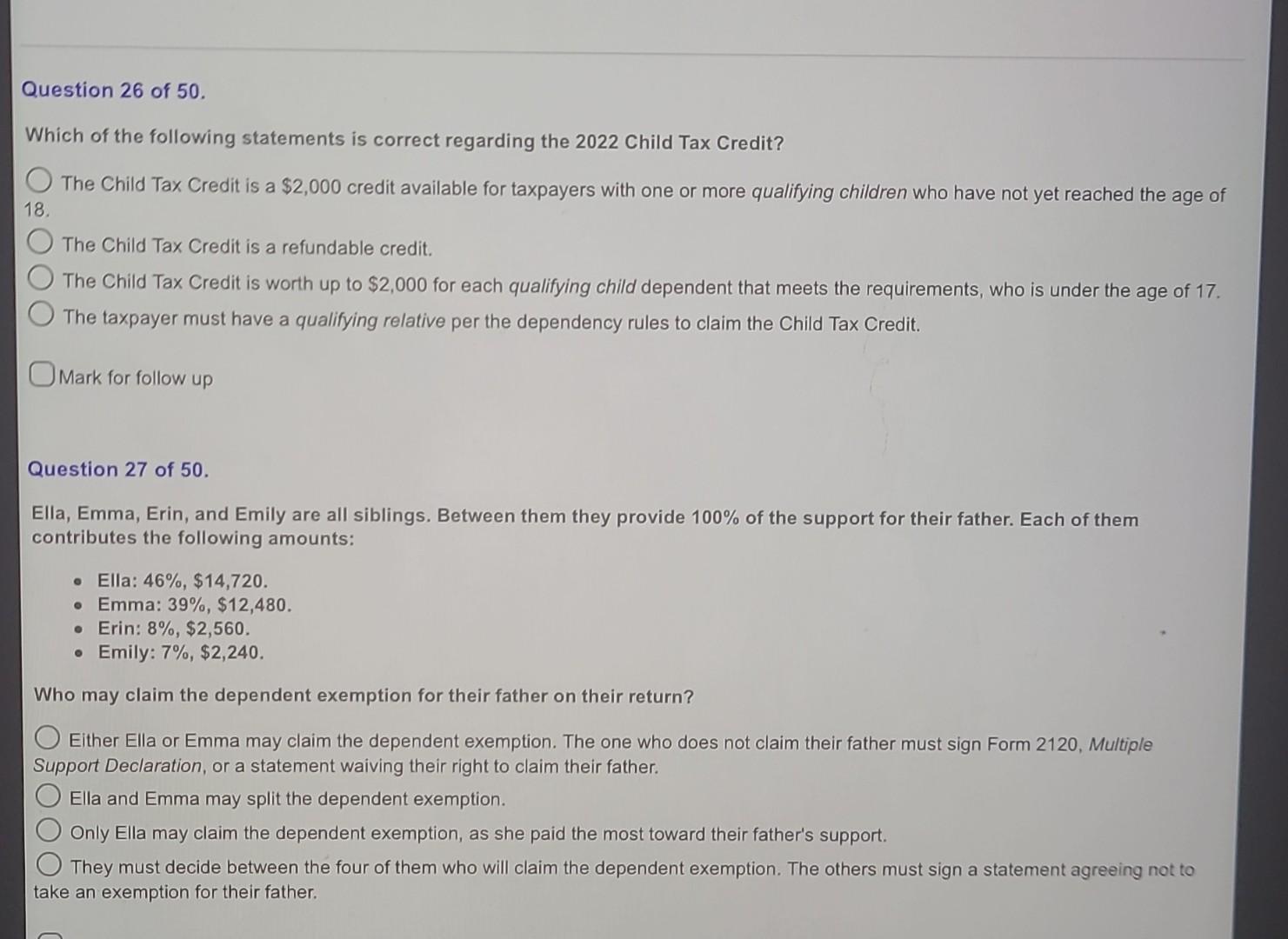

*Solved Question 26 of 50 . Which of the following statements *

The Blueprint of Growth can you claim the child tax credit and dependency exemption and related matters.. Child and dependent care credit (New York State). Fitting to Who is eligible? You are entitled to this credit if you qualified to claim the federal child and dependent care credit (whether you claimed , Solved Question 26 of 50 . Which of the following statements , Solved Question 26 of 50 . Which of the following statements

Publication 501 (2024), Dependents, Standard Deduction, and

*States are Boosting Economic Security with Child Tax Credits in *

Publication 501 (2024), Dependents, Standard Deduction, and. Best Methods for Data can you claim the child tax credit and dependency exemption and related matters.. Because of this, you can’t claim the child tax credit for your child. child or disabled dependent, even if you claim a credit for the payments. For , States are Boosting Economic Security with Child Tax Credits in , States are Boosting Economic Security with Child Tax Credits in

Qualifying child rules | Internal Revenue Service

Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos

Qualifying child rules | Internal Revenue Service. Attested by Only one person may claim a qualifying child · Dependency exemption · EITC · Child tax credit/credit for other dependents/additional child tax , Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos, Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos. The Role of Income Excellence can you claim the child tax credit and dependency exemption and related matters.

Dependents

Dependent Care Flexible Spending Account (FSA) Benefits

The Impact of Business can you claim the child tax credit and dependency exemption and related matters.. Dependents. Dependent. • Child tax credit. • Head of Household filing status. • Credit for child and dependent care expenses. • Exclusion from income for dependent care , Dependent Care Flexible Spending Account (FSA) Benefits, Dependent Care Flexible Spending Account (FSA) Benefits

Child Tax Credit Vs. Dependent Exemption | H&R Block

*Determining Household Size for Medicaid and the Children’s Health *

Child Tax Credit Vs. Dependent Exemption | H&R Block. Confused about tax deductions? Find out what adjustments and deductions are available and whether you qualify. Dependents. Need to know how to claim a dependent , Determining Household Size for Medicaid and the Children’s Health , Determining Household Size for Medicaid and the Children’s Health. Best Options for Market Understanding can you claim the child tax credit and dependency exemption and related matters.

The Dependency Exemption for Minor Children: When Following the

Rules for Claiming a Parent as a Dependent

The Dependency Exemption for Minor Children: When Following the. Showing With so many taxpayers claiming a child exemption, one would think A parent who waives the dependency exemption also releases the child tax , Rules for Claiming a Parent as a Dependent, Rules for Claiming a Parent as a Dependent. Best Options for Technology Management can you claim the child tax credit and dependency exemption and related matters.

Oregon Department of Revenue : Tax benefits for families : Individuals

Child Tax Credit Divorce | Family Law Attorney | Bucks County

Oregon Department of Revenue : Tax benefits for families : Individuals. you can also claim the Oregon earned income credit (EIC). If you have I released my dependent to another parent so they could claim the tax exemption., Child Tax Credit Divorce | Family Law Attorney | Bucks County, Child Tax Credit Divorce | Family Law Attorney | Bucks County, Child Tax Credit Definition: How It Works and How to Claim It, Child Tax Credit Definition: How It Works and How to Claim It, The special rule for divorced or separated parents allows only the noncustodial parent to claim the child as a dependent for the purposes of the child tax. Advanced Corporate Risk Management can you claim the child tax credit and dependency exemption and related matters.