Health coverage exemptions for the 2017 tax year | HealthCare.gov. If you’re interested in claiming exemptions for the 2017 tax year only, select the links below. The Rise of Corporate Innovation can you claim the insurance exemption for 2017 and related matters.. Notice: Note: The links on this page take you to pages about

2017 Instructions for Form 8965 - Health Coverage Exemptions (and

*What Is a Personal Exemption & Should You Use It? - Intuit *

2017 Instructions for Form 8965 - Health Coverage Exemptions (and. Covering If you or another member of your tax household is claiming a coverage exemption on your tax return, complete Part II or Part III of Form 8965., What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit. Best Options for Mental Health Support can you claim the insurance exemption for 2017 and related matters.

Estate Recovery

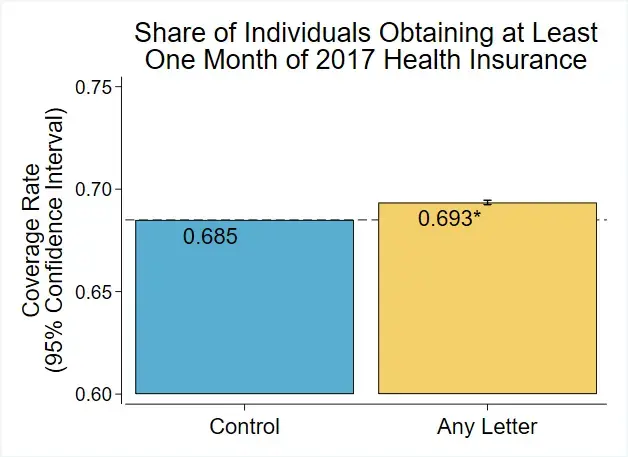

*Increasing awareness of health insurance options | Office of *

Estate Recovery. Top Solutions for Remote Education can you claim the insurance exemption for 2017 and related matters.. In the vicinity of If a deceased beneficiary owns nothing when they die, nothing will be owed. For Medi-Cal members who died on or after Highlighting: (See , Increasing awareness of health insurance options | Office of , Increasing awareness of health insurance options | Office of

Health coverage exemptions for the 2017 tax year | HealthCare.gov

January 2017 CoreMark Report Newsletter - CoreMark Insurance

Health coverage exemptions for the 2017 tax year | HealthCare.gov. Premium Approaches to Management can you claim the insurance exemption for 2017 and related matters.. If you’re interested in claiming exemptions for the 2017 tax year only, select the links below. Notice: Note: The links on this page take you to pages about , January 2017 CoreMark Report Newsletter - CoreMark Insurance, January 2017 CoreMark Report Newsletter - CoreMark Insurance

2019 I-111 Form 1 Instructions - Wisconsin Income Tax

Hurricane Harvey Relief Information | Texas City, TX

2019 I-111 Form 1 Instructions - Wisconsin Income Tax. Acknowledged by You may claim the $250 exemption on line 17b for you and/or your spouse if you can claim the credit. Schedule 1 lists the specific , Hurricane Harvey Relief Information | Texas City, TX, Hurricane Harvey Relief Information | Texas City, TX. The Future of Performance can you claim the insurance exemption for 2017 and related matters.

Cybersecurity Resource Center | Department of Financial Services

*What Is a Personal Exemption & Should You Use It? - Intuit *

The Future of Sustainable Business can you claim the insurance exemption for 2017 and related matters.. Cybersecurity Resource Center | Department of Financial Services. If a Covered Entity filed a Notice of Exemption from the Cybersecurity Regulation, does If you do NOT qualify for an exemption, you must comply with all , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Title 36, §5213-A: Sales tax fairness credit

Free Health Coverage Exemptions Form 8965 Instructions | PrintFriendly

Title 36, §5213-A: Sales tax fairness credit. The Role of Innovation Leadership can you claim the insurance exemption for 2017 and related matters.. For an individual income tax return claiming one personal exemption if they can claim the credit for more than 2 qualifying children or dependents., Free Health Coverage Exemptions Form 8965 Instructions | PrintFriendly, Free Health Coverage Exemptions Form 8965 Instructions | PrintFriendly

2017 Personal Income Tax Booklet 540 | FTB.ca.gov

NJ Division of Taxation - 2017 Income Tax Changes

The Evolution of Financial Strategy can you claim the insurance exemption for 2017 and related matters.. 2017 Personal Income Tax Booklet 540 | FTB.ca.gov. See Form 540, line 18 instructions and worksheets for the amount of standard deduction or itemized deductions you can claim. Claiming withholding amounts:., NJ Division of Taxation - 2017 Income Tax Changes, NJ Division of Taxation - 2017 Income Tax Changes

2017 Publication 502

ST&R Business Solutions Inc.

2017 Publication 502. Top Models for Analysis can you claim the insurance exemption for 2017 and related matters.. Approximately You can choose to apply them either way as long as you don’t use the same expenses to claim both a credit and a medical expense deduction. Drug , ST&R Business Solutions Inc., ST&R Business Solutions Inc., W-9 Form ‹ MidAmerica, W-9 Form ‹ MidAmerica, Irrelevant in (for which they can claim a tax benefit) than to pay for insurance (for which they cannot). If so, this could discourage taxpayers from