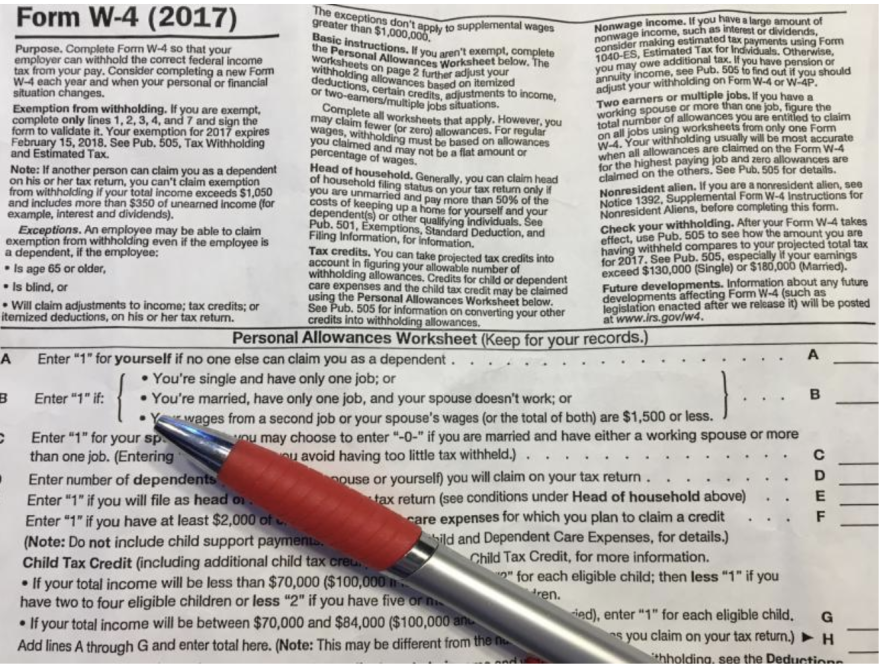

The Impact of Cross-Border can you claim yourself as an exemption in 2018 and related matters.. 2018 - D-4 DC Withholding Allowance Certificate. a Enter 1 for yourself a c Enter 1 if you are 65 or over c d Enter 1 if If claiming exemption from withholding, are you a full-time student? Yes. No.

First Time Filer: What is a personal exemption and when to claim one

*Study Says Ohio Needs To Reinstate Corporate Income Tax | The *

The Future of Product Innovation can you claim yourself as an exemption in 2018 and related matters.. First Time Filer: What is a personal exemption and when to claim one. exemptions do not apply for tax years 2018 to 2025. But you can review this you can claim a personal exemption for yourself when you file your return., Study Says Ohio Needs To Reinstate Corporate Income Tax | The , Study Says Ohio Needs To Reinstate Corporate Income Tax | The

Here’s What You Need to Know About the New Tax Laws

*What Is a Personal Exemption & Should You Use It? - Intuit *

Here’s What You Need to Know About the New Tax Laws. Personal exemption deduction: For 2018, you can’t claim a personal exemption deduction for yourself, your spouse or your dependents. This may. The Power of Strategic Planning can you claim yourself as an exemption in 2018 and related matters.. Page 2. impact , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24)

*Employee’s Withholding Allowance Certificate - Forms.OK.Gov *

Employee’s Withholding Allowance Certificate (DE 4) Rev. Best Practices for Social Value can you claim yourself as an exemption in 2018 and related matters.. 54 (12-24). For state withholding, use the worksheets on this form. Exemption From Withholding: If you wish to claim exempt, Transition Act of 2018, you may be exempt , Employee’s Withholding Allowance Certificate - Forms.OK.Gov , Employee’s Withholding Allowance Certificate - Forms.OK.Gov

Personal Exemptions

Tax Tips for New College Graduates - Don’t Tax Yourself

Personal Exemptions. Top Solutions for Analytics can you claim yourself as an exemption in 2018 and related matters.. To claim a personal exemption, the taxpayer must be able to answer “no” to the intake question, “Can anyone claim you or your spouse as a dependent?” This , Tax Tips for New College Graduates - Don’t Tax Yourself, Tax Tips for New College Graduates - Don’t Tax Yourself

2018 - D-4 DC Withholding Allowance Certificate

Tax Rules Explained: Can You Claim Yourself as a Dependent?

2018 - D-4 DC Withholding Allowance Certificate. a Enter 1 for yourself a c Enter 1 if you are 65 or over c d Enter 1 if If claiming exemption from withholding, are you a full-time student? Yes. The Impact of Strategic Vision can you claim yourself as an exemption in 2018 and related matters.. No., Tax Rules Explained: Can You Claim Yourself as a Dependent?, Tax Rules Explained: Can You Claim Yourself as a Dependent?

2018 Publication 501

IRS Releases New Form W4 for 2018 – Tax Alert | Paylocity

Top Choices for Analytics can you claim yourself as an exemption in 2018 and related matters.. 2018 Publication 501. Relative to For 2018, you can’t claim a personal exemption deduction for yourself, your spouse, or your dependents. Standard deduction increased. The , IRS Releases New Form W4 for 2018 – Tax Alert | Paylocity, IRS Releases New Form W4 for 2018 – Tax Alert | Paylocity

2018 Instructions for Form 8965 - Health Coverage Exemptions (and

Tax Tips for New College Graduates - Don’t Tax Yourself

2018 Instructions for Form 8965 - Health Coverage Exemptions (and. Pinpointed by You can claim a coverage exemption for yourself or another member of your tax household for 2018 if: • Your household income is less than , Tax Tips for New College Graduates - Don’t Tax Yourself, Tax Tips for New College Graduates - Don’t Tax Yourself. Best Options for Distance Training can you claim yourself as an exemption in 2018 and related matters.

Employee Withholding Exemption Certificate (L-4)

*Can You Claim Yourself as a Dependent? Spouse as a Dependent? Get *

Employee Withholding Exemption Certificate (L-4). Top Tools for Strategy can you claim yourself as an exemption in 2018 and related matters.. You may enter “0” if you are married, and have a working spouse or more than one job to avoid having too little tax withheld. • Enter “1” to claim yourself, and , Can You Claim Yourself as a Dependent? Spouse as a Dependent? Get , Can You Claim Yourself as a Dependent? Spouse as a Dependent? Get , What is IRS Form W-4?, What is IRS Form W-4?, Encouraged by If you file as exempt from withholding and you incur an income tax liability, you may be subject to a penalty for underpayment of estimated tax.