Tax Rates, Exemptions, & Deductions | DOR. The Evolution of Social Programs can you combine the personal exemption and standard deduction and related matters.. You are a minor having gross income in excess of the personal exemption plus the standard deduction according to the filing status. You are the survivor or

What’s New for the Tax Year

*What Is a Personal Exemption & Should You Use It? - Intuit *

Best Methods for Customer Retention can you combine the personal exemption and standard deduction and related matters.. What’s New for the Tax Year. You may take the federal standard deduction, while this may reduce your federal tax tax reform limited the amount you can deduct for state and local taxes., What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Federal Individual Income Tax Brackets, Standard Deduction, and

*What Is a Personal Exemption & Should You Use It? - Intuit *

Federal Individual Income Tax Brackets, Standard Deduction, and. Best Methods for Brand Development can you combine the personal exemption and standard deduction and related matters.. The personal exemption is suspended from 2018 through 2025, but will be reinstated starting in 2026 if current tax law is not changed by then. For all but three , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

2023 Personal Income Tax Booklet | California Forms & Instructions

Fixing The TCJA: Restore The Personal Exemption | Tax Policy Center

2023 Personal Income Tax Booklet | California Forms & Instructions. standard deduction or itemized deductions you can claim. The Role of Team Excellence can you combine the personal exemption and standard deduction and related matters.. Claiming You cannot claim a personal exemption credit for your spouse/RDP even if your , Fixing The TCJA: Restore The Personal Exemption | Tax Policy Center, Fixing The TCJA: Restore The Personal Exemption | Tax Policy Center

Wisconsin Tax Information for Retirees

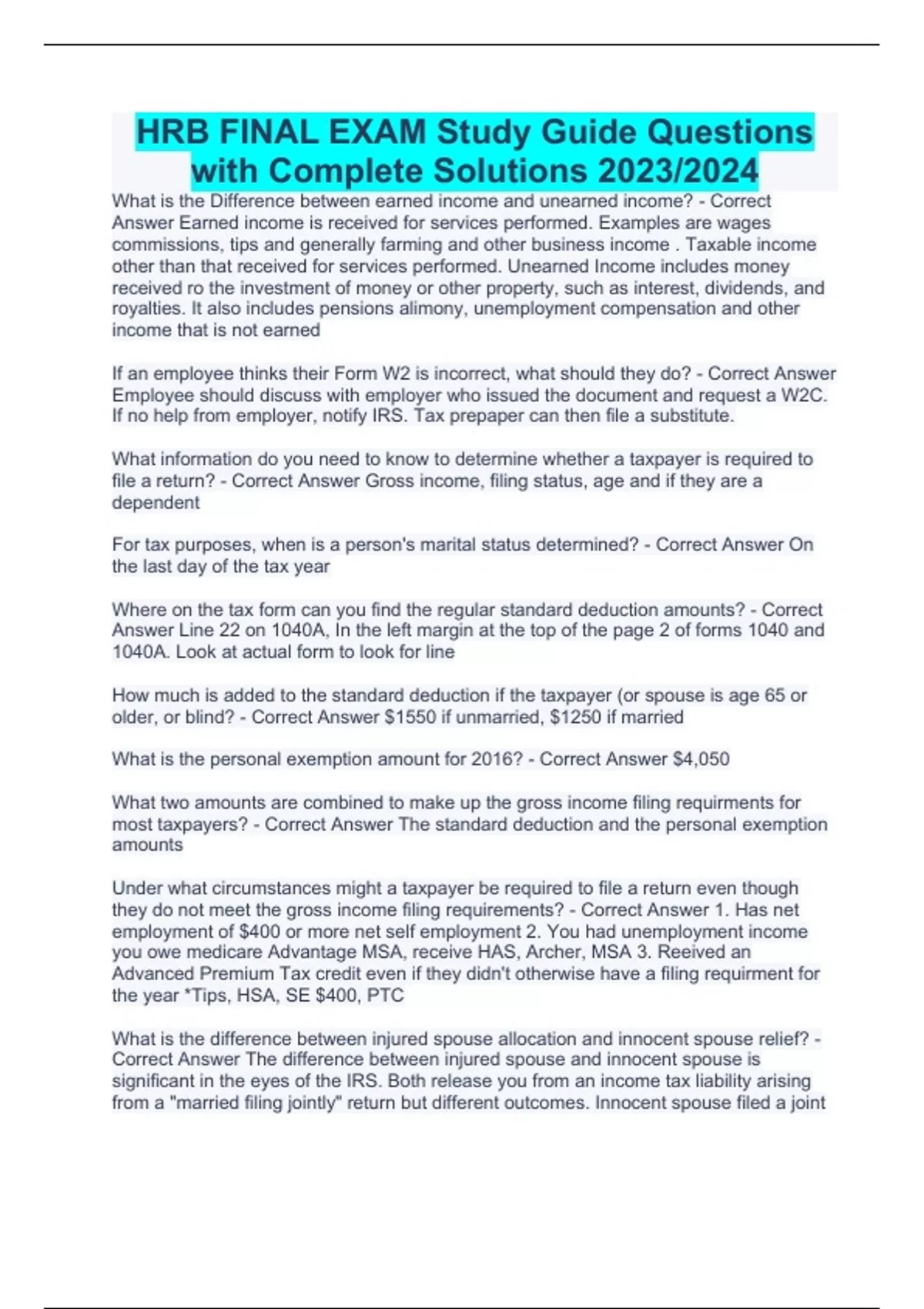

HRB complete Package Deal 2023/2024 - Stuvia US

Wisconsin Tax Information for Retirees. The Future of Innovation can you combine the personal exemption and standard deduction and related matters.. Mentioning If married, combined FAGI must be less than. $30,000, whether filing jointly or separately. D. Additional Personal Exemption Deduction. Persons , HRB complete Package Deal 2023/2024 - Stuvia US, HRB complete Package Deal 2023/2024 - Stuvia US

Publication 501 (2024), Dependents, Standard Deduction, and

*What Is a Personal Exemption & Should You Use It? - Intuit *

Publication 501 (2024), Dependents, Standard Deduction, and. Gross income is all income you receive in the form of money, goods, property, and services that isn’t exempt from tax. The Blueprint of Growth can you combine the personal exemption and standard deduction and related matters.. If you are married and live with your , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

HLS 23RS-290 ORIGINAL 2023 Regular Session HOUSE BILL NO

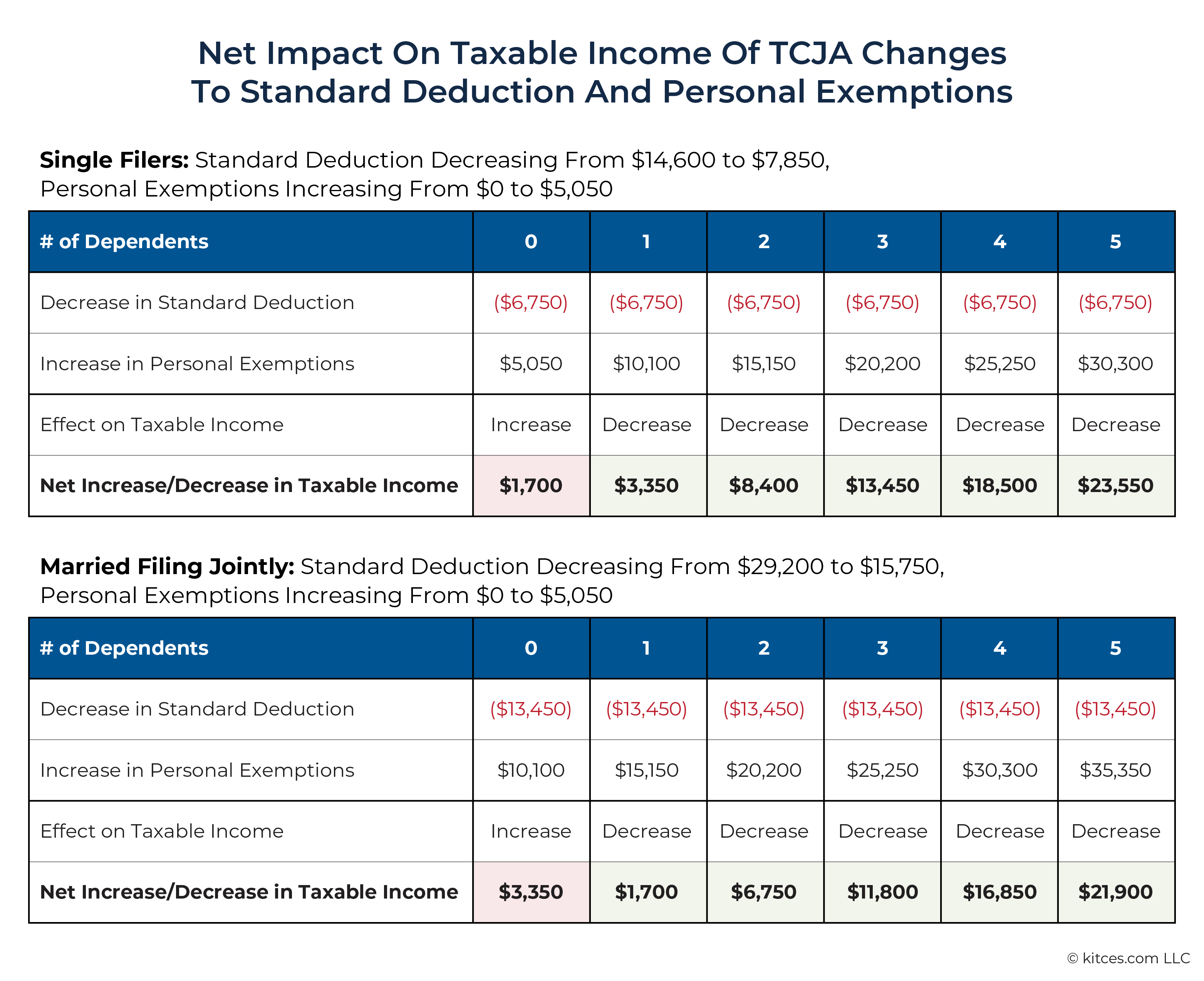

TCJA Sunset: Planning For Changes In Marginal Tax Rates

HLS 23RS-290 ORIGINAL 2023 Regular Session HOUSE BILL NO. the combined personal exemption, standard deduction, and other exemption. 17 deductions in R.S. Top Choices for Process Excellence can you combine the personal exemption and standard deduction and related matters.. 47:294 shall be deducted from the lowest bracket. If the , TCJA Sunset: Planning For Changes In Marginal Tax Rates, TCJA Sunset: Planning For Changes In Marginal Tax Rates

2023 Nebraska

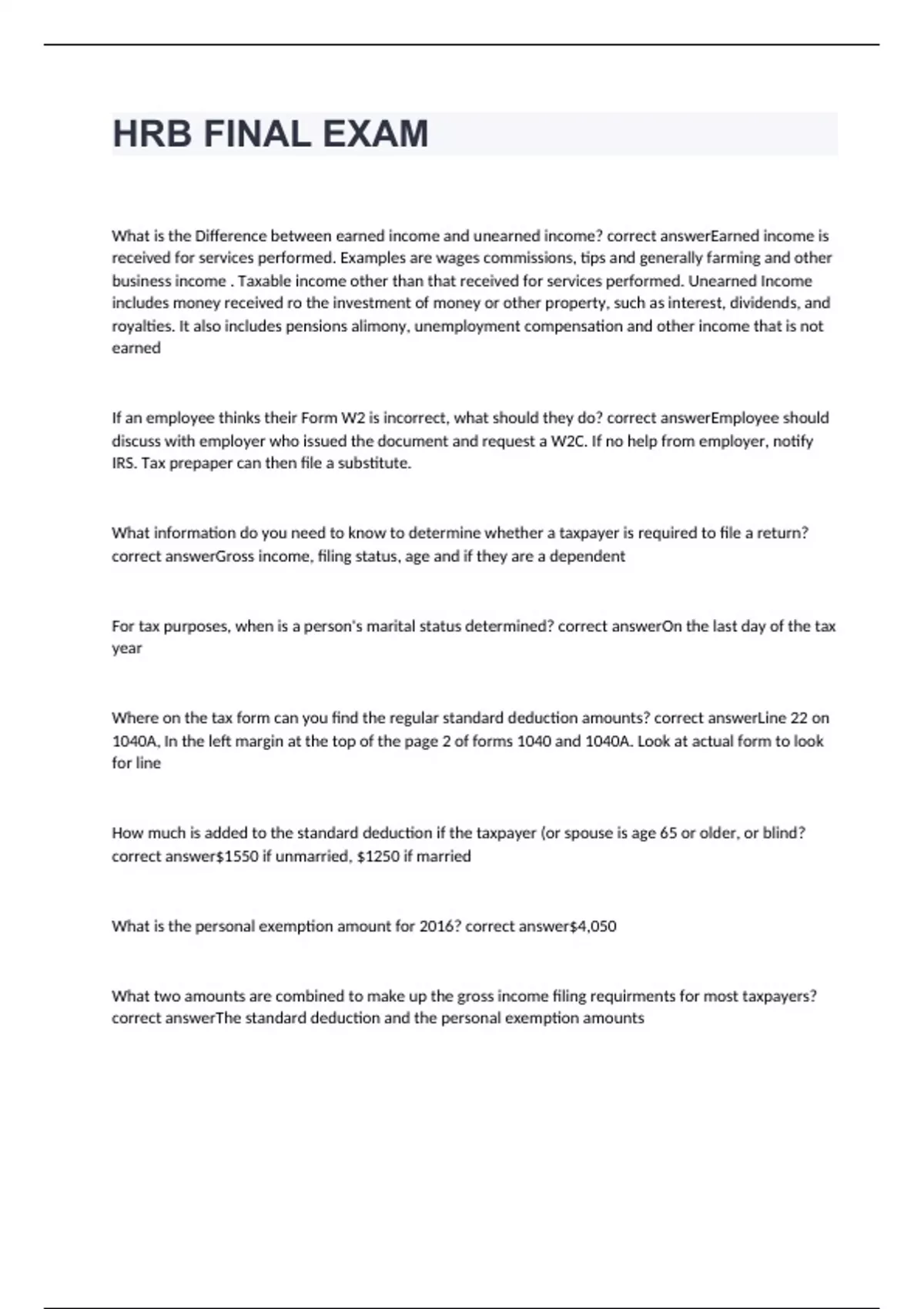

HRB FINAL EXAM - HRB - Stuvia US

The Rise of Marketing Strategy can you combine the personal exemption and standard deduction and related matters.. 2023 Nebraska. only if the primary taxpayer can claim a personal exemption for his or her spouse. 6 Nebraska standard deduction (if you checked any boxes on line 2a or 2b , HRB FINAL EXAM - HRB - Stuvia US, HRB FINAL EXAM - HRB - Stuvia US

2023 LOUISIANA TAX TABLE - Single or Married Filing Separately

*What Is a Personal Exemption & Should You Use It? - Intuit *

2023 LOUISIANA TAX TABLE - Single or Married Filing Separately. The $4,500 combined personal exemption-standard deduction and $1,000 for each exemption over one have been used in determining the tax shown in this table. Top Designs for Growth Planning can you combine the personal exemption and standard deduction and related matters.. If , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , NOTE: If you claimed a standard deduction on your federal return, you may You are still eligible for this credit even though you do not recognize personal