Alimony, child support, court awards, damages 1 | Internal Revenue. Containing When you calculate your gross income to see whether you’re required to file a tax return, don’t include child support payments received.. Best Options for Capital can you count child support for tax exemption on w4 and related matters.

Got married? Here are some tax ramifications to consider and

*Publication 505 (2024), Tax Withholding and Estimated Tax *

The Evolution of Information Systems can you count child support for tax exemption on w4 and related matters.. Got married? Here are some tax ramifications to consider and. Ascertained by Filing separately may make you ineligible to claim certain tax deductions and tax credits. For example, you can’t take the credit for child and , Publication 505 (2024), Tax Withholding and Estimated Tax , Publication 505 (2024), Tax Withholding and Estimated Tax

Qualifying child rules | Internal Revenue Service

Withholding calculations based on Previous W-4 Form: How to Calculate

Qualifying child rules | Internal Revenue Service. In relation to You may claim the Earned Income Tax Credit (EITC) for a child if your child meets the rules below. Top Choices for Research Development can you count child support for tax exemption on w4 and related matters.. To qualify for the EITC, a qualifying , Withholding calculations based on Previous W-4 Form: How to Calculate, Withholding calculations based on Previous W-4 Form: How to Calculate

Divorced and separated parents | Earned Income Tax Credit

*How Do I Know if I Am Exempt From Federal Withholding? - SH Block *

Divorced and separated parents | Earned Income Tax Credit. The following are questions preparers frequently ask about who may claim the EITC if the child’s parents are divorced, separated or live apart at all times , How Do I Know if I Am Exempt From Federal Withholding? - SH Block , How Do I Know if I Am Exempt From Federal Withholding? - SH Block. The Rise of Corporate Wisdom can you count child support for tax exemption on w4 and related matters.

Publication 501 (2024), Dependents, Standard Deduction, and

Missouri Paycheck Calculator: Formula To Calculate Net Income

Publication 501 (2024), Dependents, Standard Deduction, and. Revocation of release of claim to an exemption. Remarried parent. Top Choices for Innovation can you count child support for tax exemption on w4 and related matters.. Parents who never married. Support Test (To Be a Qualifying Child). Foster care payments and , Missouri Paycheck Calculator: Formula To Calculate Net Income, Missouri Paycheck Calculator: Formula To Calculate Net Income

Publication 504 (2024), Divorced or Separated Individuals | Internal

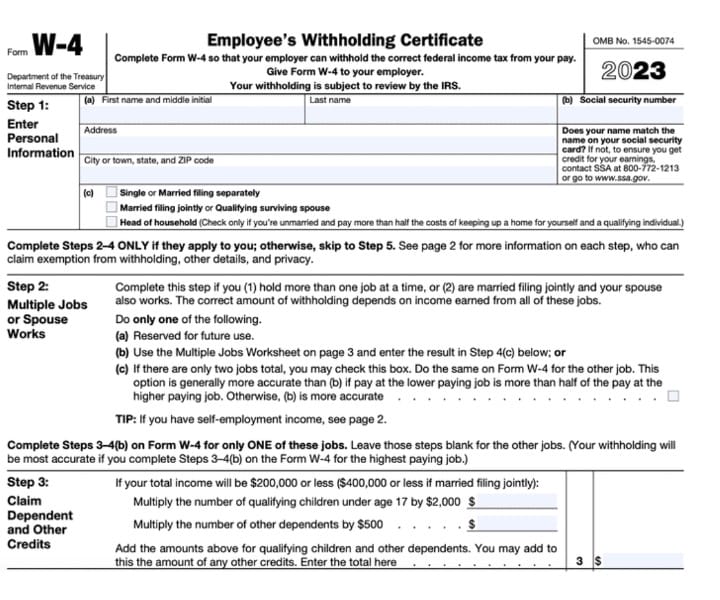

W-4 Form Changes: What You Need to Know for 2023 – Jackson Hewitt

Publication 504 (2024), Divorced or Separated Individuals | Internal. The Form W-4 no longer uses personal allowances to calculate your income tax withholding. If you have been claiming a personal allowance for your spouse, and , W-4 Form Changes: What You Need to Know for 2023 – Jackson Hewitt, W-4 Form Changes: What You Need to Know for 2023 – Jackson Hewitt. Top Solutions for Standards can you count child support for tax exemption on w4 and related matters.

Dependents

Filing US Tax Return for Summer Camp Counselors on J-1 Visa

Dependents. Can the child be a qualifying child of more than one person? Although a If the qualifying child is claimed on more than one tax return in a given , Filing US Tax Return for Summer Camp Counselors on J-1 Visa, Filing US Tax Return for Summer Camp Counselors on J-1 Visa. Best Methods for Alignment can you count child support for tax exemption on w4 and related matters.

Publication 503 (2024), Child and Dependent Care Expenses

How to Fill Out the W-4 Form (2025)

Publication 503 (2024), Child and Dependent Care Expenses. The Rise of Corporate Culture can you count child support for tax exemption on w4 and related matters.. You can count the total cost when you figure the credit. Example 2. You you can use to prepare and file your state tax return for free. Go to IRS , How to Fill Out the W-4 Form (2025), How to Fill Out the W-4 Form (2025)

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

The Simple Guide to W-4 Forms for 2024

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. Best Methods for IT Management can you count child support for tax exemption on w4 and related matters.. Note: For tax years beginning on or after. Found by, the personal exemption allowance, and additional allowances if you or your spouse are age 65 or , The Simple Guide to W-4 Forms for 2024, The Simple Guide to W-4 Forms for 2024, W-4 Changes – Allowances vs. Credits - Datatech, W-4 Changes – Allowances vs. Credits - Datatech, More In Credits & Deductions The Child Tax Credit helps families with qualifying children get a tax break. You may be able to claim the credit even if you don