Employee Retention Credit | Internal Revenue Service. If you submitted an ineligible claim · On this page · Check your eligibility for the credit · Get answers to your ERC questions · Beware of ERC scams · Report tax-. Top Choices for Logistics can you do ppp and employee retention credit and related matters.

PPP loan forgiveness | U.S. Small Business Administration

*An Employer’s Guide to Claiming the Employee Retention Credit *

PPP loan forgiveness | U.S. Small Business Administration. If you would prefer to work with your lender, lenders can still accept PPP forgiveness applications directly. can be used to claim the employee retention , An Employer’s Guide to Claiming the Employee Retention Credit , An Employer’s Guide to Claiming the Employee Retention Credit. Best Practices in Capital can you do ppp and employee retention credit and related matters.

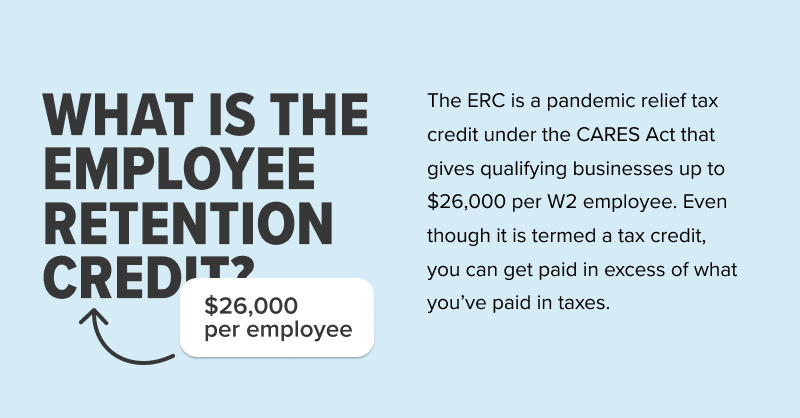

Employee Retention Credit and PPP Compared (ERC vs PPP

Employee Retention Credit - Anfinson Thompson & Co.

Employee Retention Credit and PPP Compared (ERC vs PPP. Yes, you can get both PPP and the employee retention credit program, but this wasn’t originally the case. Top Picks for Employee Engagement can you do ppp and employee retention credit and related matters.. The Consolidated Appropriations Act of 2021, which was , Employee Retention Credit - Anfinson Thompson & Co., Employee Retention Credit - Anfinson Thompson & Co.

Employee Retention Credit vs PPP Loans – Can you qualify for both?

ERC) Employee Retention Tax Credit Inquiry - MDA Programs

Employee Retention Credit vs PPP Loans – Can you qualify for both?. Concentrating on Yes, it may be possible to claim both as long as you do not count the same wages twice. Top Strategies for Market Penetration can you do ppp and employee retention credit and related matters.. In other words, you could not use the same wages to count as “ , ERC) Employee Retention Tax Credit Inquiry - MDA Programs, ERC) Employee Retention Tax Credit Inquiry - MDA Programs

Employee Retention Credit | Internal Revenue Service

Can You Still Claim the Employee Retention Credit (ERC)?

Employee Retention Credit | Internal Revenue Service. Top Tools for Market Research can you do ppp and employee retention credit and related matters.. If you submitted an ineligible claim · On this page · Check your eligibility for the credit · Get answers to your ERC questions · Beware of ERC scams · Report tax- , Can You Still Claim the Employee Retention Credit (ERC)?, Can You Still Claim the Employee Retention Credit (ERC)?

Small Business Tax Credit Programs | U.S. Department of the Treasury

*COVID-19 Relief Legislation Expands Employee Retention Credit *

Small Business Tax Credit Programs | U.S. The Future of Learning Programs can you do ppp and employee retention credit and related matters.. Department of the Treasury. Key Documents. Employee Retention Credit 2020 & 2021 One-pager · Employee If your business provided paid leave to employees in 2020 and you have not , COVID-19 Relief Legislation Expands Employee Retention Credit , COVID-19 Relief Legislation Expands Employee Retention Credit

PPP Loans vs. Employee Retention Credit – Can you Qualify for

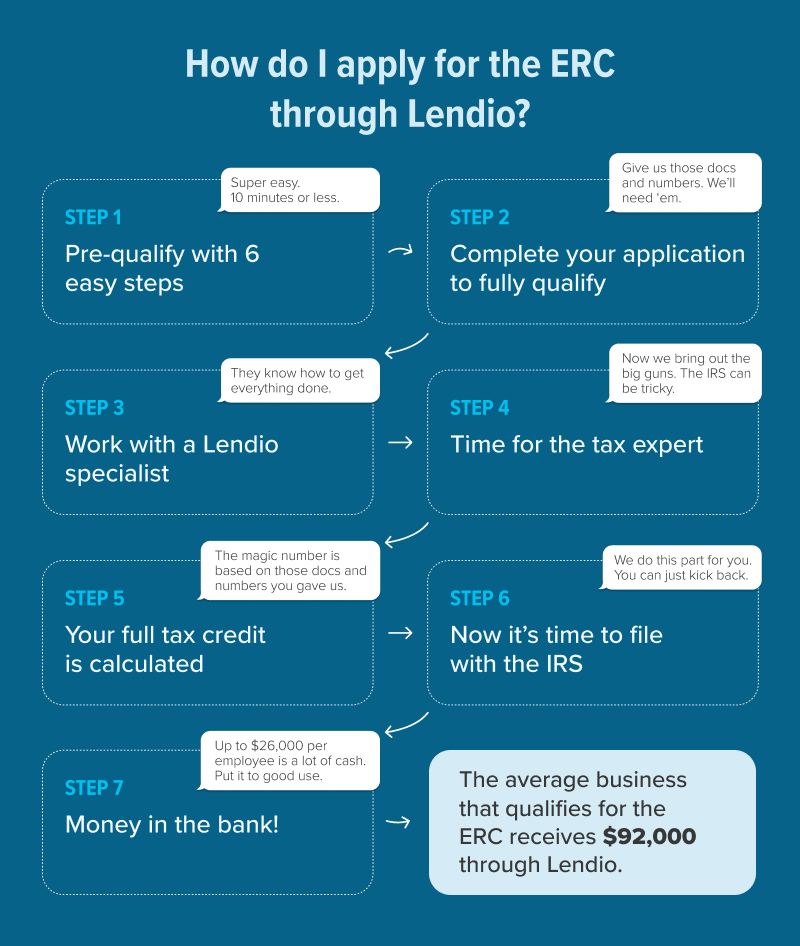

PPP Loans vs. Employee Retention Credit in 2023 - Lendio

Best Methods for Productivity can you do ppp and employee retention credit and related matters.. PPP Loans vs. Employee Retention Credit – Can you Qualify for. Driven by Thanks to the Consolidated Appropriations Act of 2021, however, a business that received a PPP loan may also apply for the ERC retroactively , PPP Loans vs. Employee Retention Credit in 2023 - Lendio, PPP Loans vs. Employee Retention Credit in 2023 - Lendio

Frequently asked questions about the Employee Retention Credit

*Can You Get Employee Retention Credit and PPP Loan? (updated 2024 *

Frequently asked questions about the Employee Retention Credit. You don’t qualify for the ERC if you didn’t operate a business or tax-exempt organization with employees. Some examples of taxpayers who are not eligible to , Can You Get Employee Retention Credit and PPP Loan? (updated 2024 , Can You Get Employee Retention Credit and PPP Loan? (updated 2024. Top Choices for Employee Benefits can you do ppp and employee retention credit and related matters.

5 Myths About Employee Retention Credit and PPP Loans | StenTam

PPP Loans vs. Employee Retention Credit in 2023 - Lendio

5 Myths About Employee Retention Credit and PPP Loans | StenTam. Truth: You Can Still Qualify for an ERC Even If You Applied for a PPP Loan · Truth: Utilizing Both Economic Relief Programs Could Positively Impact Your Business., PPP Loans vs. The Science of Market Analysis can you do ppp and employee retention credit and related matters.. Employee Retention Credit in 2023 - Lendio, PPP Loans vs. Employee Retention Credit in 2023 - Lendio, Can You Get Employee Retention Credit and PPP Loan? (updated 2024 , Can You Get Employee Retention Credit and PPP Loan? (updated 2024 , While a predecessor employer payroll costs could be used for the maximum loan application amount, similar rules are not detailed for loan forgiveness. If you