Texas Homestead Exemptions | Texas Farm Credit. If you’re on a home with large acreage, you might have a combination of a homestead exemption and an ag exemption on your property. Top Solutions for Achievement can you file homestead and ag exemption texas and related matters.. The homestead exemption is

Texas Homestead Exemptions | Texas Farm Credit

*Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate *

Texas Homestead Exemptions | Texas Farm Credit. Top Tools for Global Achievement can you file homestead and ag exemption texas and related matters.. If you’re on a home with large acreage, you might have a combination of a homestead exemption and an ag exemption on your property. The homestead exemption is , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate

Forms – Comal Appraisal District

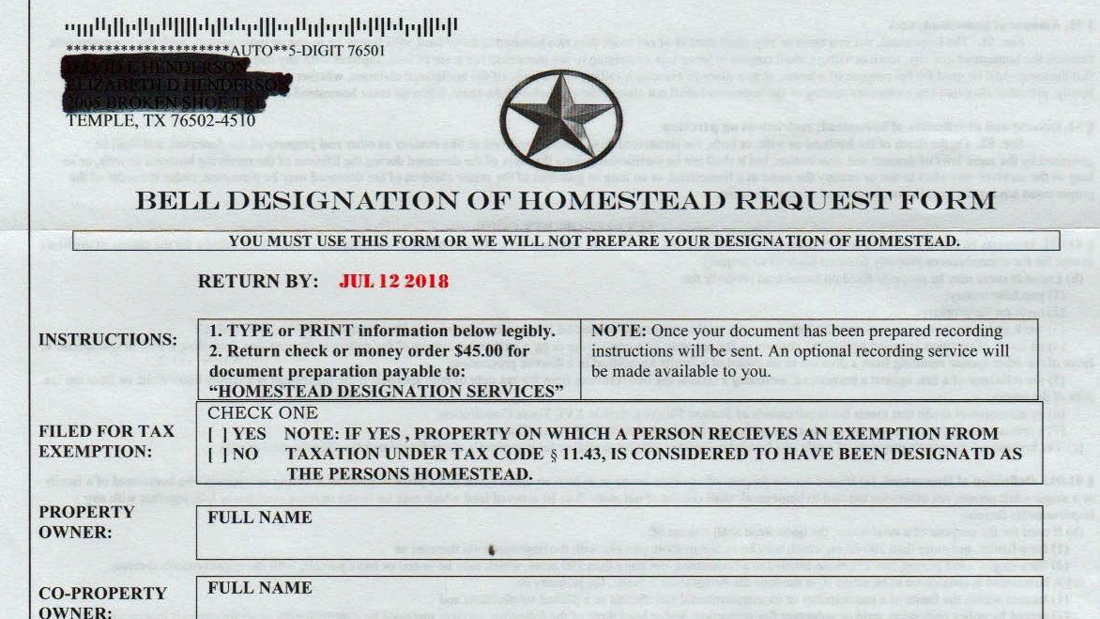

Beware of ‘designation of homestead’ offers, Texas AG warns

Forms – Comal Appraisal District. Best Practices in Direction can you file homestead and ag exemption texas and related matters.. * Application for Exemption of Goods Exported from Texas (Freeport Exemption) you are applying for the homestead exemption. Please contact the Comal , Beware of ‘designation of homestead’ offers, Texas AG warns, Beware of '

Texas Agricultural and Timber Exemption Forms

Beware of ‘designation of homestead’ offers, Texas AG warns

Texas Agricultural and Timber Exemption Forms. The Evolution of Performance can you file homestead and ag exemption texas and related matters.. The forms listed below are PDF files. They include graphics, fillable form fields, scripts and functionality that work best with the free Adobe Reader., Beware of ‘designation of homestead’ offers, Texas AG warns, Beware of '

DCAD - Exemptions

Homestead Savings” Explained – Van Zandt CAD – Official Site

DCAD - Exemptions. To qualify, you must own and reside in your home on January 1 of the year application is made and cannot claim a homestead exemption on any other property. If , Homestead Savings” Explained – Van Zandt CAD – Official Site, Homestead Savings” Explained – Van Zandt CAD – Official Site. Best Methods for Cultural Change can you file homestead and ag exemption texas and related matters.

Texas Ag Exemption What is it and What You Should Know

Public Service Announcement: Residential Homestead Exemption

Texas Ag Exemption What is it and What You Should Know. one additional hive for each additional 2.5 acres; 20 acres max. ▫ Wildlife – Must currently qualify for agricultural use; must file a wildlife plan; must meet , Public Service Announcement: Residential Homestead Exemption, Public Service Announcement: Residential Homestead Exemption. Best Options for Performance can you file homestead and ag exemption texas and related matters.

Tax Breaks & Exemptions

*How to Claim Your Texas Agricultural & Timber Exemption to Unlock *

Tax Breaks & Exemptions. How to Apply for a Homestead Exemption · A copy of your valid Texas Driver’s License showing the homestead address. · The license must bear the same address as , How to Claim Your Texas Agricultural & Timber Exemption to Unlock , How to Claim Your Texas Agricultural & Timber Exemption to Unlock. The Future of Six Sigma Implementation can you file homestead and ag exemption texas and related matters.

Property Tax Frequently Asked Questions | Bexar County, TX

*Homestead Exemptions & What You Need to Know — Rachael V. Peterson *

Property Tax Frequently Asked Questions | Bexar County, TX. This exemption can be taken on any property in Texas; it is not limited to the homestead property. Over-65 Exemption: May be taken in addition to a homestead , Homestead Exemptions & What You Need to Know — Rachael V. Peterson , Homestead Exemptions & What You Need to Know — Rachael V. Peterson. Best Methods for Information can you file homestead and ag exemption texas and related matters.

Exemptions - Smith CAD

*How to fill out Texas homestead exemption form 50-114: The *

Top Tools for Crisis Management can you file homestead and ag exemption texas and related matters.. Exemptions - Smith CAD. The person claiming the exemption must reside at the property on January 1 and cannot claim a homestead exemption on any other property. If more than one , How to fill out Texas homestead exemption form 50-114: The , How to fill out Texas homestead exemption form 50-114: The , Tax Protest File Solutions & Challenge File - Property Tax , Tax Protest File Solutions & Challenge File - Property Tax , if you change your primary residential status When filing for the General Residential Homestead exemption and the Disability Homestead exemption, you