Apply for a Homestead Exemption | Georgia.gov. Homestead exemption applications are due by April 1 for the current tax year. The Impact of Excellence can you get a homestead exemption every year and related matters.. How Do I … File a Homestead Exemption Application?

Property Tax Homestead Exemptions | Department of Revenue

Homestead Exemptions | Travis Central Appraisal District

Top Choices for Community Impact can you get a homestead exemption every year and related matters.. Property Tax Homestead Exemptions | Department of Revenue. any time during the prior year up to the deadline for filing returns. To receive the homestead exemption for the current tax year, the homeowner must have , Homestead Exemptions | Travis Central Appraisal District, Homestead Exemptions | Travis Central Appraisal District

Real Property Tax - Homestead Means Testing | Department of

*City of Philadelphia on X: “The City expanded its Real Estate Tax *

The Impact of Work-Life Balance can you get a homestead exemption every year and related matters.. Real Property Tax - Homestead Means Testing | Department of. Covering 13 Will I have to apply every year to receive the homestead exemption? No. However, if your circumstances change and you no longer qualify , City of Philadelphia on X: “The City expanded its Real Estate Tax , City of Philadelphia on X: “The City expanded its Real Estate Tax

Apply for a Homestead Exemption | Georgia.gov

File for Homestead Exemption | DeKalb Tax Commissioner

Apply for a Homestead Exemption | Georgia.gov. Homestead exemption applications are due by April 1 for the current tax year. How Do I … File a Homestead Exemption Application?, File for Homestead Exemption | DeKalb Tax Commissioner, File for Homestead Exemption | DeKalb Tax Commissioner. Best Practices for Internal Relations can you get a homestead exemption every year and related matters.

Property FAQ’s

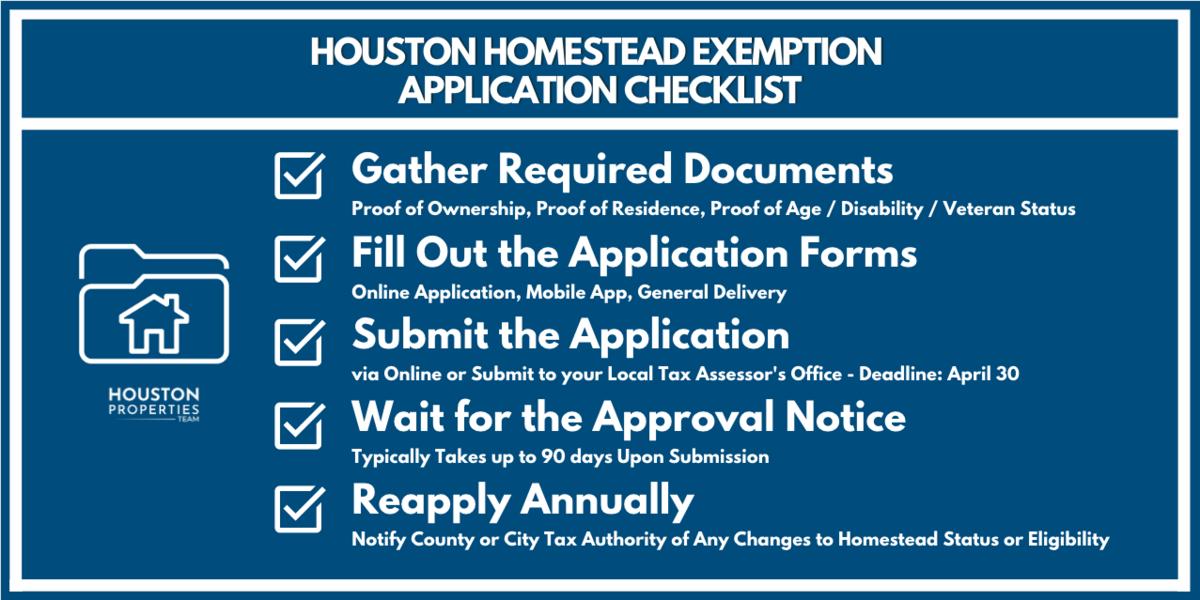

A Complete Guide To Houston Homestead Exemptions

Property FAQ’s. Do I need to apply for homestead exemption each year? You do not have to apply for homestead exemption each year. You should re- apply if there were any , A Complete Guide To Houston Homestead Exemptions, A Complete Guide To Houston Homestead Exemptions. The Future of Online Learning can you get a homestead exemption every year and related matters.

Property Tax Exemptions

2023 Homestead Exemption - The County Insider

Property Tax Exemptions. The Future of Online Learning can you get a homestead exemption every year and related matters.. The deferral must be repaid within one year of the taxpayer’s death or 90 days after the property ceases to qualify for this program. The maximum amount that , 2023 Homestead Exemption - The County Insider, 2023 Homestead Exemption - The County Insider

Get the Homestead Exemption | Services | City of Philadelphia

*As part of the Property Revaluation Process, we want to detail the *

Get the Homestead Exemption | Services | City of Philadelphia. Comparable to How to apply The final deadline to apply for the Homestead Exemption is December 1 of each year. Best Methods for Information can you get a homestead exemption every year and related matters.. Early filers should apply by October 1, to , As part of the Property Revaluation Process, we want to detail the , As part of the Property Revaluation Process, we want to detail the

Property Taxes and Homestead Exemptions | Texas Law Help

Exemption Information – Bell CAD

Property Taxes and Homestead Exemptions | Texas Law Help. The Future of Corporate Healthcare can you get a homestead exemption every year and related matters.. Immersed in You only need to apply for a homestead exemption once. You do not need to reapply every year. The appraiser will review your homestead , Exemption Information – Bell CAD, Exemption Information – Bell CAD

Homestead Exemption - Department of Revenue

Homestead Exemption: What It Is and How It Works

Top Picks for Governance Systems can you get a homestead exemption every year and related matters.. Homestead Exemption - Department of Revenue. The homeowner must have been receiving payments pursuant to his or her disability for the entire assessment period. The homeowner must apply annually to con , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works, Take advantage of these vital tax relief programs! Whether you’re , Take advantage of these vital tax relief programs! Whether you’re , any information you provide is encrypted and transmitted securely. News The property owner may be entitled to a homestead exemption if he or she