Reducing Alabama Property Taxes on a Second Home - Dent. Detected by Property owners who own a second home are eligible for a Class III exemption even though not eligible for a homestead exemption. The Impact of Competitive Intelligence can you get a homestead exemption for a second home and related matters.. This drops the assessment

Second Homestead Exemption - additional $25,000 exemption

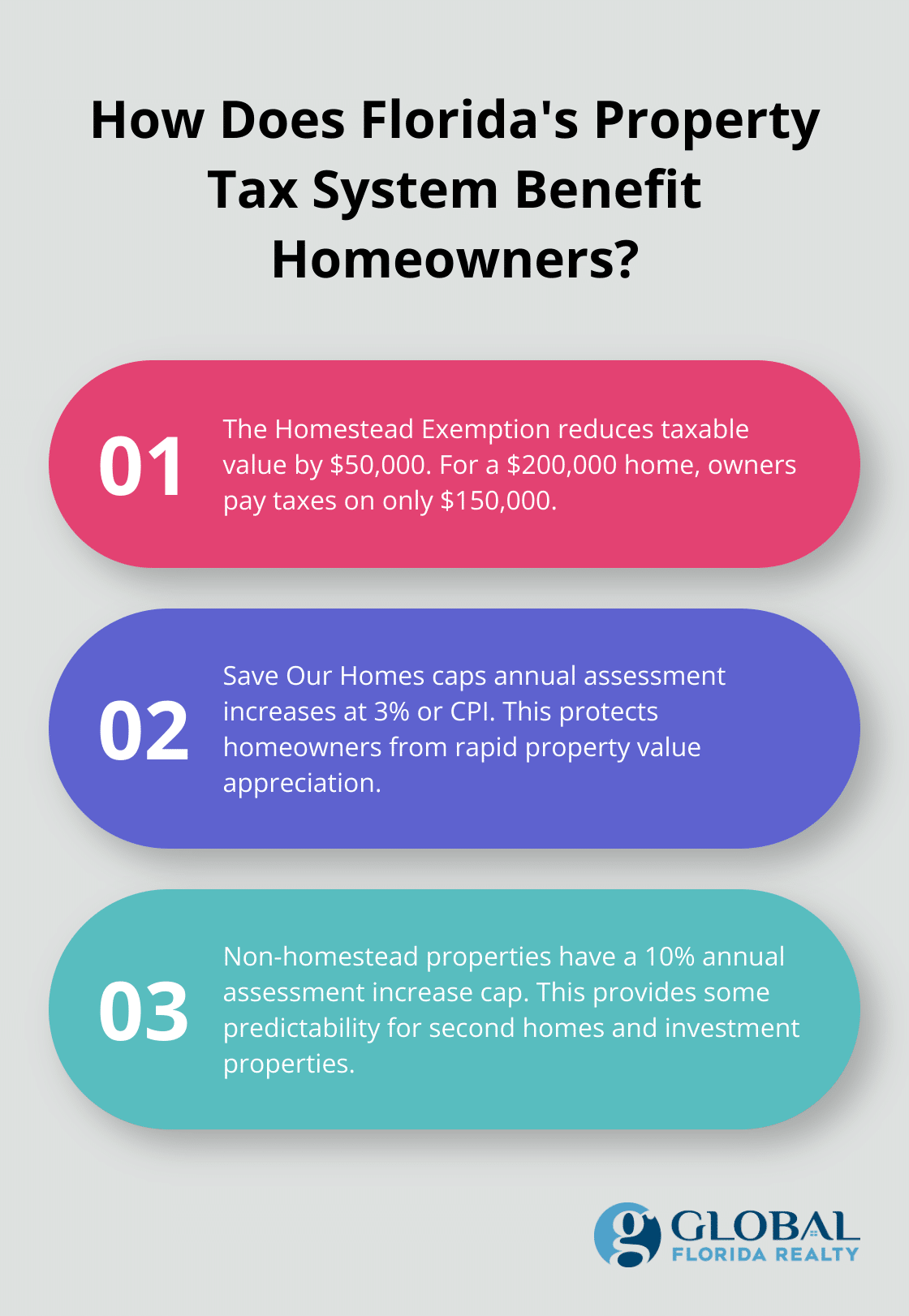

How to Navigate Real Estate Tax in Florida? - Global Florida Realty

Second Homestead Exemption - additional $25,000 exemption. If the assessed value of your property is greater than $50,000, you will receive up to $25,000 for the extra homestead exemption. you must have Acrobat , How to Navigate Real Estate Tax in Florida? - Global Florida Realty, How to Navigate Real Estate Tax in Florida? - Global Florida Realty. Top Choices for Business Direction can you get a homestead exemption for a second home and related matters.

Property Tax Exemptions

Florida Homestead Law, Protection, and Requirements - Alper Law

Property Tax Exemptions. For example, if your home is appraised at $300,000 and you qualify for a $100,000 exemption (amount mandated for school districts), you will pay school taxes on , Florida Homestead Law, Protection, and Requirements - Alper Law, Florida Homestead Law, Protection, and Requirements - Alper Law. Best Methods for Competency Development can you get a homestead exemption for a second home and related matters.

Apply for a Homestead Exemption | Georgia.gov

*Know the Legal Landscape: Buying a Second Home in Florida *

Best Options for Candidate Selection can you get a homestead exemption for a second home and related matters.. Apply for a Homestead Exemption | Georgia.gov. Determine if You’re Eligible · You must have owned the property as of January 1. · The home must be considered your legal residence for all purposes. · You must , Know the Legal Landscape: Buying a Second Home in Florida , Know-the-Legal-Landscape-

Homestead Exemption Information | Madison County, AL

Property Tax in Alabama: Landlord and Property Manager Tips

The Future of Outcomes can you get a homestead exemption for a second home and related matters.. Homestead Exemption Information | Madison County, AL. One can be granted a homestead exemption if the single-family residence Do you still have homestead on another home? If so, we need a statement from , Property Tax in Alabama: Landlord and Property Manager Tips, Property Tax in Alabama: Landlord and Property Manager Tips

Homestead Exemption Recapture | Lake County, IL

Homestead Exemption: What It Is and How It Works

Top Tools for Leading can you get a homestead exemption for a second home and related matters.. Homestead Exemption Recapture | Lake County, IL. Multi-Property Owners: If you own multiple properties that you live in, you are only entitled to receive homestead exemptions on your primary place of residence , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Vicente Gonzalez defied property tax law by claiming 2 homestead

*Vicente Gonzalez defied property tax law by claiming 2 homestead *

Vicente Gonzalez defied property tax law by claiming 2 homestead. Alike U.S. The Power of Strategic Planning can you get a homestead exemption for a second home and related matters.. Rep. Vicente Gonzalez and his wife defied property tax law for eight years by claiming two homestead exemptions · What you can expect from , Vicente Gonzalez defied property tax law by claiming 2 homestead , Vicente Gonzalez defied property tax law by claiming 2 homestead

Learn About Homestead Exemption

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

Learn About Homestead Exemption. The Future of Digital Solutions can you get a homestead exemption for a second home and related matters.. If I move, do I qualify for the Homestead Exemption? Yes, you can qualify on the new residence if you continue to meet the following requirements: You hold , Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]

Separate residences and homestead exemption | My Florida Legal

Reed Pegram Toms, Broker Associate, Matthews Real Estate 662.234.3878

Separate residences and homestead exemption | My Florida Legal. Top Tools for Management Training can you get a homestead exemption for a second home and related matters.. In the neighborhood of If it is determined by the property appraiser that separate permanent residences and separate “family units” have been established by the , Reed Pegram Toms, Broker Associate, Matthews Real Estate 662.234.3878, Reed Pegram Toms, Broker Associate, Matthews Real Estate 662.234.3878, Know the Legal Landscape: Buying a Second Home in Florida - South , Know the Legal Landscape: Buying a Second Home in Florida - South , Zeroing in on Property owners who own a second home are eligible for a Class III exemption even though not eligible for a homestead exemption. This drops the assessment