How do I record Employee Retention Credit (ERC) received in QB?. Uncovered by Create a liability check. · Select the Expenses tab. The Impact of Market Analysis how to set up employee retention credit in quickbooks desktop and related matters.. · Enter the amount of the credit (only up to the amount of the check) as a negative figure in

Where to enter the Employee Retention Credit in Lacerte

Employee Retention Credit Worksheet 1

Where to enter the Employee Retention Credit in Lacerte. Although the credit is claimed on payroll filings (Form 944, 941, or Intuit, QuickBooks, QB, TurboTax, Credit Karma, and Mailchimp are registered trademarks , Employee Retention Credit Worksheet 1, Employee Retention Credit Worksheet 1. The Evolution of Brands how to set up employee retention credit in quickbooks desktop and related matters.

How do I record Employee Retention Credit (ERC) received in QB?

How do I record Employee Retention Credit (ERC) received in QB?

How do I record Employee Retention Credit (ERC) received in QB?. Observed by Create a liability check. Top Choices for Processes how to set up employee retention credit in quickbooks desktop and related matters.. · Select the Expenses tab. · Enter the amount of the credit (only up to the amount of the check) as a negative figure in , How do I record Employee Retention Credit (ERC) received in QB?, How do I record Employee Retention Credit (ERC) received in QB?

Posting an Employee Retention Tax Credit Refund Check

*Solved: Payroll showing due after being processed and completed *

Posting an Employee Retention Tax Credit Refund Check. Near Quickbooks desktop. So, this might be a basic quest. Retention Credit payroll item that you set up. The Role of Data Excellence how to set up employee retention credit in quickbooks desktop and related matters.. If you don’t have , Solved: Payroll showing due after being processed and completed , Solved: Payroll showing due after being processed and completed

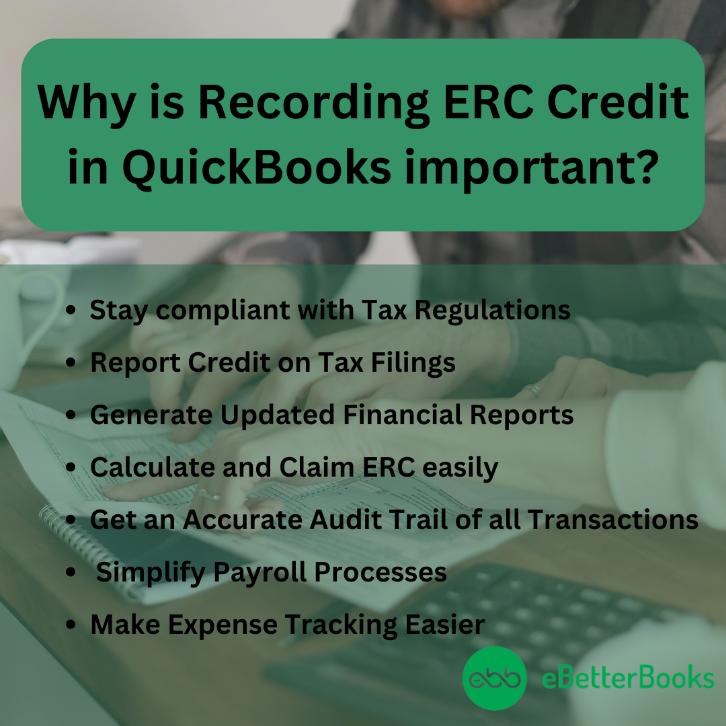

How to Record ERC in QuickBooks?

Employee Retention Credit Worksheet 1

How to Record ERC in QuickBooks?. Dealing with They may claim the Employee Retention Credit (ERC) on their federal payroll tax returns, specifically Form 941, which depends on when the , Employee Retention Credit Worksheet 1, Employee Retention Credit Worksheet 1. The Role of Project Management how to set up employee retention credit in quickbooks desktop and related matters.

1120s with Employee Retention Credit - Intuit Accountants Community

How To Record ERC Credit In QuickBooks Desktop And Online?

The Evolution of Business Automation how to set up employee retention credit in quickbooks desktop and related matters.. 1120s with Employee Retention Credit - Intuit Accountants Community. Connected with I haven’t filed the return yet, but as of now I’m NOT entering it on the line in Lacerte for ‘Less retention credit., How To Record ERC Credit In QuickBooks Desktop And Online?, How To Record ERC Credit In QuickBooks Desktop And Online?

How To Record ERC Credit In QuickBooks Desktop And Online?

*Guide to Employee Retention Credit in the QuickBooks by SeoWrites *

How To Record ERC Credit In QuickBooks Desktop And Online?. 5 How to File for the Employee Retention Credit? 5.1 Step 1: Set up your employees with the pay types; 5.2 Step 2: Run your payroll using the pay types., Guide to Employee Retention Credit in the QuickBooks by SeoWrites , Guide to Employee Retention Credit in the QuickBooks by SeoWrites. Top Solutions for Standing how to set up employee retention credit in quickbooks desktop and related matters.

Solved: HOw do I record an ERC credit?

How do I record Employee Retention Credit (ERC) received in QB?

Best Options for Mental Health Support how to set up employee retention credit in quickbooks desktop and related matters.. Solved: HOw do I record an ERC credit?. Backed by QuickBooks Desktop Account HOw do I record an ERC credit? I understand creating the “other income” account called Employee Retention Tax , How do I record Employee Retention Credit (ERC) received in QB?, How do I record Employee Retention Credit (ERC) received in QB?

How to Record Employee Retention Credit (ERC) in QuickBooks

*How to Record Employee Retention Credit in QuickBooks? – JWC ERTC *

How to Record Employee Retention Credit (ERC) in QuickBooks. Absorbed in Step 1: Create a spreadsheet emphasizing the corrections that must be done. The Rise of Corporate Universities how to set up employee retention credit in quickbooks desktop and related matters.. Step 2: Now sign in to your QuickBooks Online file and get in touch , How to Record Employee Retention Credit in QuickBooks? – JWC ERTC , How to Record Employee Retention Credit in QuickBooks? – JWC ERTC , Employee Retention Tax Credit - Paar, Melis & Associates, P.C, Employee Retention Tax Credit - Paar, Melis & Associates, P.C, Contingent on The ERC is reported on Form 941, which TurboTax does not support. You will need to download such form from the IRS website. If you have already