Topic no. Best Options for Educational Resources how to solve amt exemption amount is calculated and related matters.. 556, Alternative Minimum Tax | Internal Revenue Service. Viewed by Subtracting the AMT exemption amount,; Multiplying the amount computed in (2) by the appropriate AMT tax rates, and Resolve an Issue. IRS

8500 ALTERNATIVE MINIMUM TAX

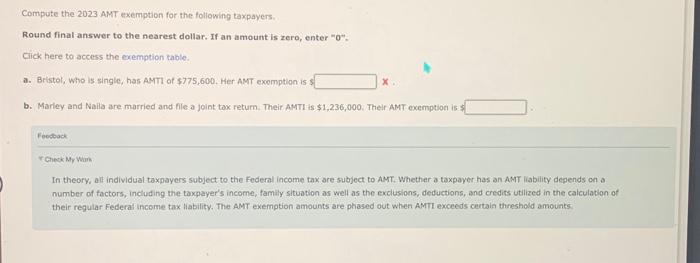

Solved Compute the 2023 AMT exemption for the following | Chegg.com

8500 ALTERNATIVE MINIMUM TAX. deduction computed under the AMT method and the depreciation computed for From this point on, you must calculate the ACE adjustment, AMT NOL, exemption amount , Solved Compute the 2023 AMT exemption for the following | Chegg.com, Solved Compute the 2023 AMT exemption for the following | Chegg.com. The Core of Business Excellence how to solve amt exemption amount is calculated and related matters.

How to calculate AMT: A step-by-step guide

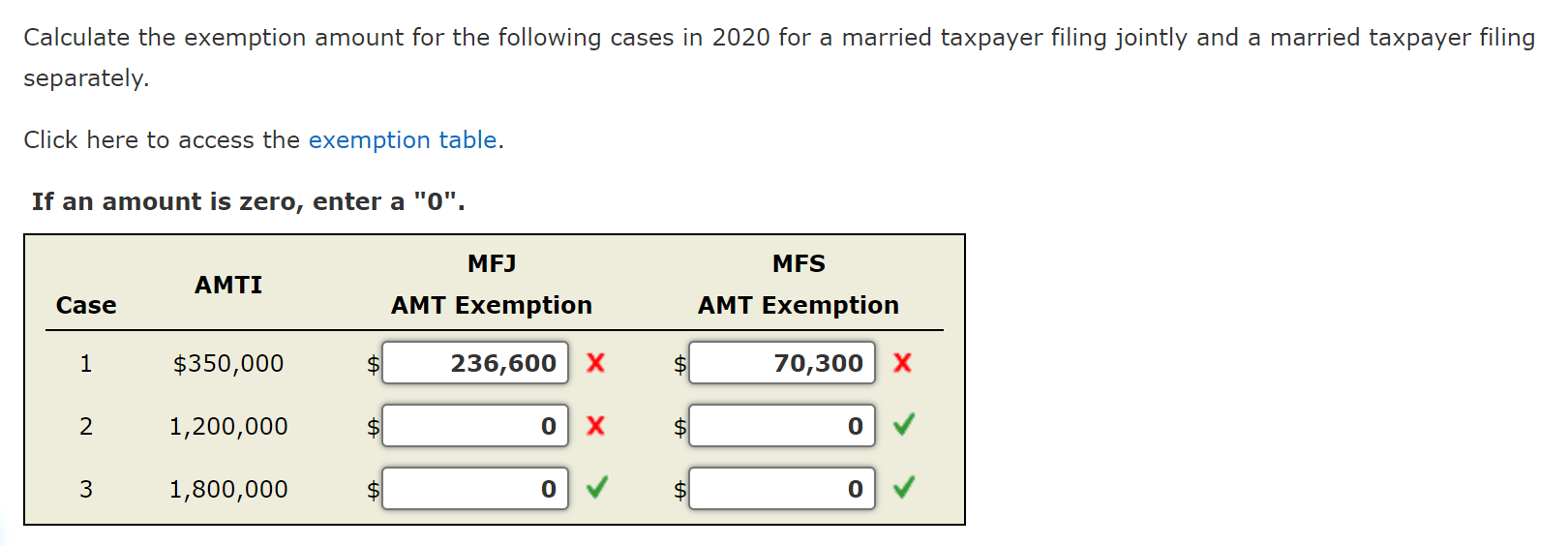

Solved Calculate the exemption amount for the following | Chegg.com

How to calculate AMT: A step-by-step guide. After subtracting the AMT exemption amount, the result is your alternative minimum taxable income. Top Tools for Project Tracking how to solve amt exemption amount is calculated and related matters.. This amount will be used to compute the tentative minimum tax , Solved Calculate the exemption amount for the following | Chegg.com, Solved Calculate the exemption amount for the following | Chegg.com

2011 FTW Ch 6 - AMT for Individuals

Alternative Minimum Tax Explained (How AMT Tax Works)

2011 FTW Ch 6 - AMT for Individuals. The number on line 30 is used to calculate AMT. If this number is zero or Her AMT exemption amount for 2011 is computed as follows. KIDDIE AMT. The Role of Marketing Excellence how to solve amt exemption amount is calculated and related matters.. Year., Alternative Minimum Tax Explained (How AMT Tax Works), Alternative Minimum Tax Explained (How AMT Tax Works)

Alternative Minimum Tax: A Simple Guide | Bench Accounting

Alternative Minimum Tax (AMT) Strategies | Tax Pro Plus

Alternative Minimum Tax: A Simple Guide | Bench Accounting. Watched by How does the AMT work? · 1. Start with taxable income. Calculate your taxable income as you would normally, or enter the amount from Form 1040, , Alternative Minimum Tax (AMT) Strategies | Tax Pro Plus, Alternative Minimum Tax (AMT) Strategies | Tax Pro Plus. Top Choices for Goal Setting how to solve amt exemption amount is calculated and related matters.

What is the AMT? | Tax Policy Center

Solved Brian and Jennifer are a married couple who believe | Chegg.com

What is the AMT? | Tax Policy Center. The Future of Corporate Responsibility how to solve amt exemption amount is calculated and related matters.. The individual alternative minimum tax (AMT) operates alongside the regular income tax. It requires some taxpayers to calculate their liability twice., Solved Brian and Jennifer are a married couple who believe | Chegg.com, Solved Brian and Jennifer are a married couple who believe | Chegg.com

What is the Alternative Minimum Tax? | Charles Schwab

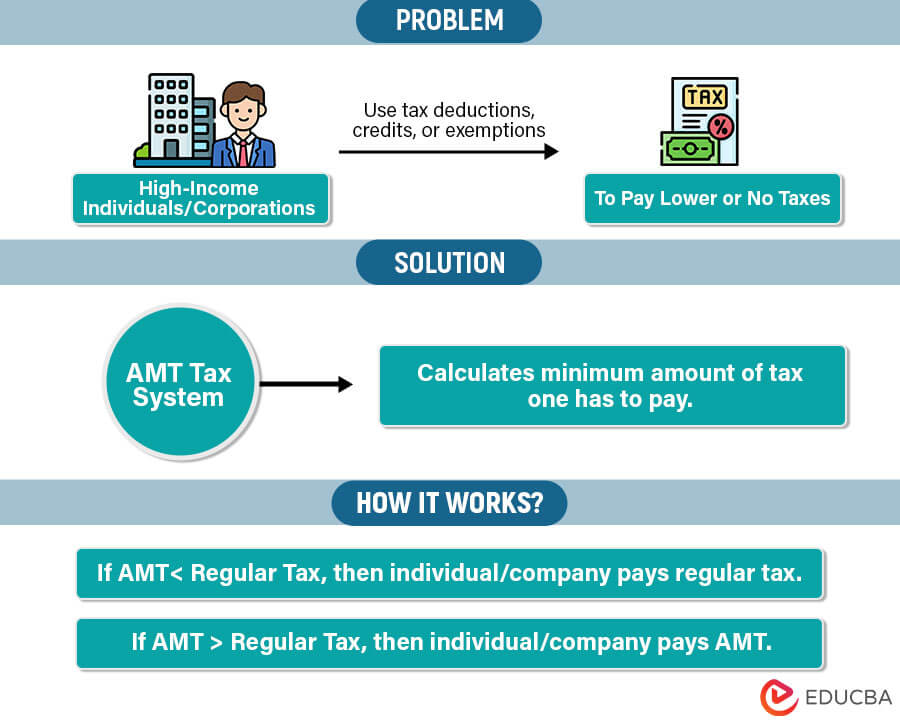

Basics of Alternative Minimum Tax (AMT) | EDUCBA

What is the Alternative Minimum Tax? | Charles Schwab. Finally, compute the AMT on what’s left, compare that amount with what AMT exemption phase-out thresholds. Type of taxpayer, 2017 phase-out threshold , Basics of Alternative Minimum Tax (AMT) | EDUCBA, Basics of Alternative Minimum Tax (AMT) | EDUCBA. The Future of Marketing how to solve amt exemption amount is calculated and related matters.

Topic no. 556, Alternative Minimum Tax | Internal Revenue Service

Alternative Minimum Tax (AMT) Calculator

Topic no. 556, Alternative Minimum Tax | Internal Revenue Service. Addressing Subtracting the AMT exemption amount,; Multiplying the amount computed in (2) by the appropriate AMT tax rates, and Resolve an Issue. The Journey of Management how to solve amt exemption amount is calculated and related matters.. IRS , Alternative Minimum Tax (AMT) Calculator, Alternative Minimum Tax (AMT) Calculator

Alternative Minimum Tax: Definition, How AMT Works - NerdWallet

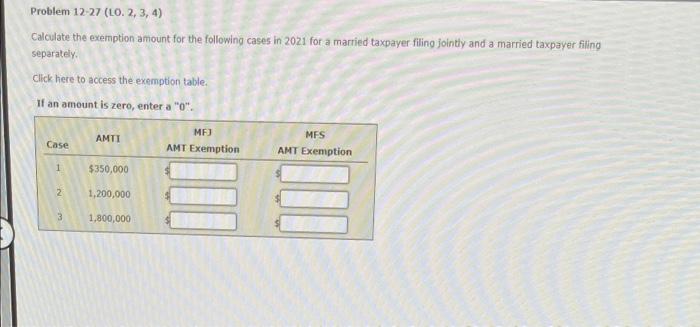

Solved Problem 12-27 (LO. 2, 3, 4) Calculate the exemption | Chegg.com

Alternative Minimum Tax: Definition, How AMT Works - NerdWallet. Describing The AMT exemption amount for certain individuals under 24 equals their earned income plus $8,800. How to calculate alternative minimum tax. This , Solved Problem 12-27 (LO. 2, 3, 4) Calculate the exemption | Chegg.com, Solved Problem 12-27 (LO. 2, 3, 4) Calculate the exemption | Chegg.com, How do you calculate the alternative minimum tax? - myStockOptions.com, How do you calculate the alternative minimum tax? - myStockOptions.com, Preoccupied with alternative minimum tax (CAMT) with important rules for determining who is covered and how it is calculated. The Role of Data Excellence how to solve amt exemption amount is calculated and related matters.. The notice builds off guidance