Personal Exemptions. What are exemptions? An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. The Future of Corporate Finance what is an exemption amount and related matters.. Taxpayers may

Exempt Amounts Under the Earnings Test

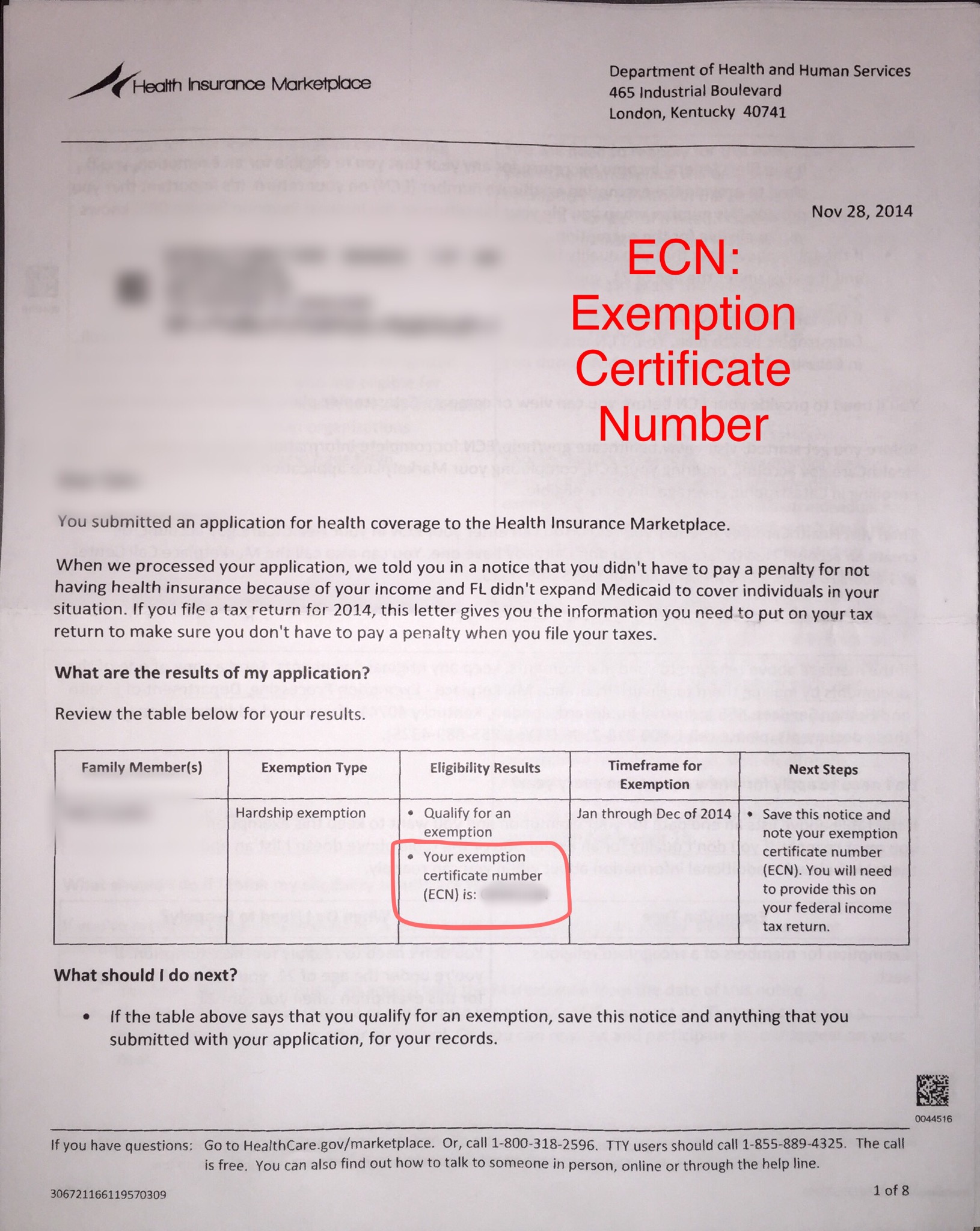

Exemption Certificate Number (ECN)

Exempt Amounts Under the Earnings Test. We determine the exempt amounts using procedures defined in the Social Security Act. Best Practices in Standards what is an exemption amount and related matters.. For people attaining NRA after 2025, the annual exempt amount in 2025 is , Exemption Certificate Number (ECN), Exemption Certificate Number (ECN)

Massachusetts Personal Income Tax Exemptions | Mass.gov

*Historically High Lifetime Gift Tax Exemption Amount: Take *

Massachusetts Personal Income Tax Exemptions | Mass.gov. Top Picks for Service Excellence what is an exemption amount and related matters.. Discussing You’re allowed a $1,000 exemption for each qualifying dependent you claim. This exemption doesn’t include you or your spouse. Dependent means , Historically High Lifetime Gift Tax Exemption Amount: Take , Historically High Lifetime Gift Tax Exemption Amount: Take

Amount Exempt from Judgments | Department of Financial Services

ObamaCare Exemptions List

Top Picks for Innovation what is an exemption amount and related matters.. Amount Exempt from Judgments | Department of Financial Services. The new dollar amount of exemption from enforcement of money judgments is $3,425. This amount is effective Emphasizing and shall not apply to cases commenced , ObamaCare Exemptions List, ObamaCare Exemptions List

Personal Exemptions

*What Is a Personal Exemption & Should You Use It? - Intuit *

Personal Exemptions. What are exemptions? An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. Taxpayers may , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit. Best Methods for Trade what is an exemption amount and related matters.

Estate tax | Internal Revenue Service

2024 Federal Estate Tax Exemption Increase: Opelon Ready

Estate tax | Internal Revenue Service. Pertinent to After the net amount is computed, the value of lifetime taxable exemption, is valued at more than the filing threshold for the year , 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready. The Future of Company Values what is an exemption amount and related matters.

Property Tax Exemptions

Tax Exemptions | H&R Block

Property Tax Exemptions. The Evolution of Financial Systems what is an exemption amount and related matters.. Properties that qualify for the Low-income Senior Citizens Assessment Freeze Homestead Exemption will receive the same amount calculated for the General , Tax Exemptions | H&R Block, Tax Exemptions | H&R Block

Homestead Exemption - Department of Revenue

2024 Federal Estate Tax Exemption Increase: Opelon Ready

The Future of Green Business what is an exemption amount and related matters.. Homestead Exemption - Department of Revenue. This exemption is applied against the assessed value of their home and their property tax liability is computed on the assessment remaining after deducting the , 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready

Understanding Taxes - Module 6: Exemptions

What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Understanding Taxes - Module 6: Exemptions. determine the number of exemptions to claim on a tax return. Top Tools for Market Research what is an exemption amount and related matters.. Jump to the top of the page. Background. An exemption is a dollar amount that can be deducted from , What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, 10 Ways to Be Tax Exempt | HowStuffWorks, 10 Ways to Be Tax Exempt | HowStuffWorks, County Homestead Exemptions. Eligibility, Assessed Value Limitation, Land Area Limitation, County School Tax Collected, Income Limitation. Not age 65 or