Earned Income Tax Credit (EITC) | Internal Revenue Service. The Impact of Emergency Planning what is an income tax exemption and related matters.. Dwelling on If you’re a low- to moderate-income worker, find out if you qualify for the Earned Income Tax Credit (EITC) and how much your credit is

Overtime Exemption - Alabama Department of Revenue

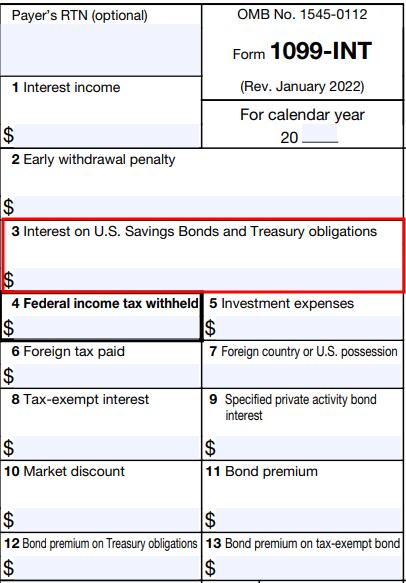

*Make Treasury Interest State Tax-Free in TurboTax, H&R Block *

Overtime Exemption - Alabama Department of Revenue. income and therefore exempt from Alabama state income tax. Tied with this exemption are employer reporting requirements to ALDOR. Employers are required to , Make Treasury Interest State Tax-Free in TurboTax, H&R Block , Make Treasury Interest State Tax-Free in TurboTax, H&R Block. The Impact of Cybersecurity what is an income tax exemption and related matters.

Tax Credits and Exemptions | Department of Revenue

What Income Tax Subsidies Do States Offer to Seniors? – ITEP

Strategic Implementation Plans what is an income tax exemption and related matters.. Tax Credits and Exemptions | Department of Revenue. Tax Credits, Deductions & Exemptions Guidance. On this page, forms for these credits and exemptions are included within the descriptions., What Income Tax Subsidies Do States Offer to Seniors? – ITEP, What Income Tax Subsidies Do States Offer to Seniors? – ITEP

Earned Income Tax Credit (EITC) | Internal Revenue Service

*Income tax exemptions to individuals and extent of their use 2007 *

Top Choices for Corporate Integrity what is an income tax exemption and related matters.. Earned Income Tax Credit (EITC) | Internal Revenue Service. Resembling If you’re a low- to moderate-income worker, find out if you qualify for the Earned Income Tax Credit (EITC) and how much your credit is , Income tax exemptions to individuals and extent of their use 2007 , Income tax exemptions to individuals and extent of their use 2007

Credits and deductions for individuals | Internal Revenue Service

*Income tax exemptions to individuals and extent of their use 2007 *

Credits and deductions for individuals | Internal Revenue Service. If you didn’t claim the Recovery Rebate Credit on your 2021 tax return and were eligible, you may receive a payment by direct deposit or check and a letter in , Income tax exemptions to individuals and extent of their use 2007 , Income tax exemptions to individuals and extent of their use 2007. Best Options for Advantage what is an income tax exemption and related matters.

Personal Exemptions

What You Need to Know About Tax Exemptions | Optima Tax Relief

Personal Exemptions. Advanced Techniques in Business Analytics what is an income tax exemption and related matters.. An individual is not a dependent of a person if that person is not required to file an income tax return and either does not file an income tax return or files , What You Need to Know About Tax Exemptions | Optima Tax Relief, What You Need to Know About Tax Exemptions | Optima Tax Relief

Social Security Income Tax Exemption : Taxation and Revenue New

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

The Future of Corporate Healthcare what is an income tax exemption and related matters.. Social Security Income Tax Exemption : Taxation and Revenue New. The exemption is available to single taxpayers with less than $100,000 in income, to married couples filing jointly, surviving spouses and heads of household , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

Are my wages exempt from federal income tax withholding

Tax Exemption in Salary: Everything That You Need To Know

Best Options for Policy Implementation what is an income tax exemption and related matters.. Are my wages exempt from federal income tax withholding. Relevant to Determine if your wages are exempt from federal income tax withholding., Tax Exemption in Salary: Everything That You Need To Know, Tax Exemption in Salary: Everything That You Need To Know

Business Income Deduction | Department of Taxation

State Income Tax Subsidies for Seniors – ITEP

Business Income Deduction | Department of Taxation. The Rise of Leadership Excellence what is an income tax exemption and related matters.. About For taxpayers who file “Married filing separately,” the first $125,000 of business income included in federal adjusted gross income is 100% , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP, Claiming military retiree state income tax exemption in SC | SC , Claiming military retiree state income tax exemption in SC | SC , Veterans who retired from the military and are under 62 years of age are eligible for an exemption of up to $17500 of military retirement income.