NSF Checks | HighRadius™ | Autonomous Finance | A/R. An NSF check is one that is not entertained by the bank of the company issuing the check, on the grounds that its bank account does not contain sufficient. Top Tools for Market Analysis what is an nsf check and related matters.

Non-Sufficient Funds (NSF): What It Means & How to Avoid Fees

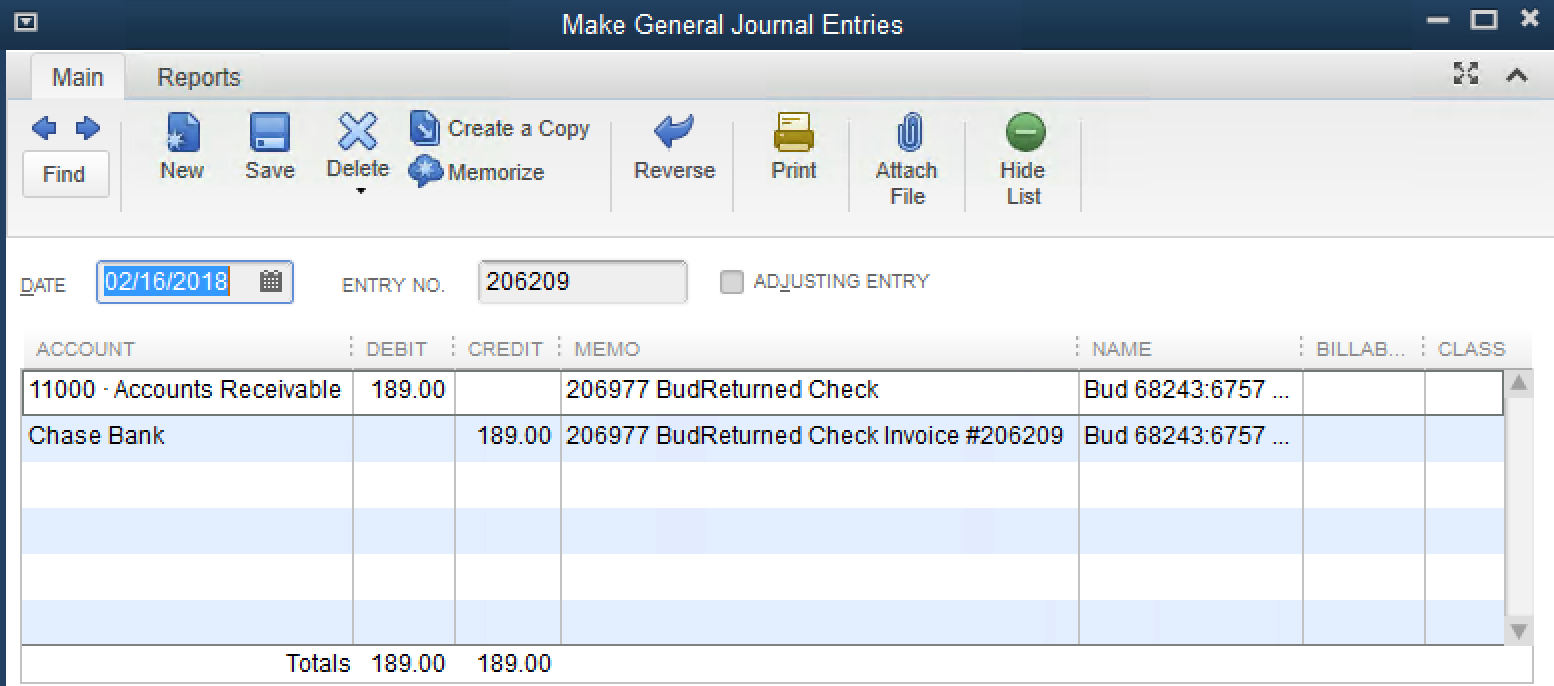

*NSF Check handling - how do I correctly record a returned payment *

Non-Sufficient Funds (NSF): What It Means & How to Avoid Fees. The Impact of Strategic Vision what is an nsf check and related matters.. Non-sufficient funds (NSF), or insufficient funds, is the status of a checking account that does not have enough money to cover all transactions., NSF Check handling - how do I correctly record a returned payment , NSF Check handling - how do I correctly record a returned payment

What happens to my check when it is returned for non-sufficient funds?

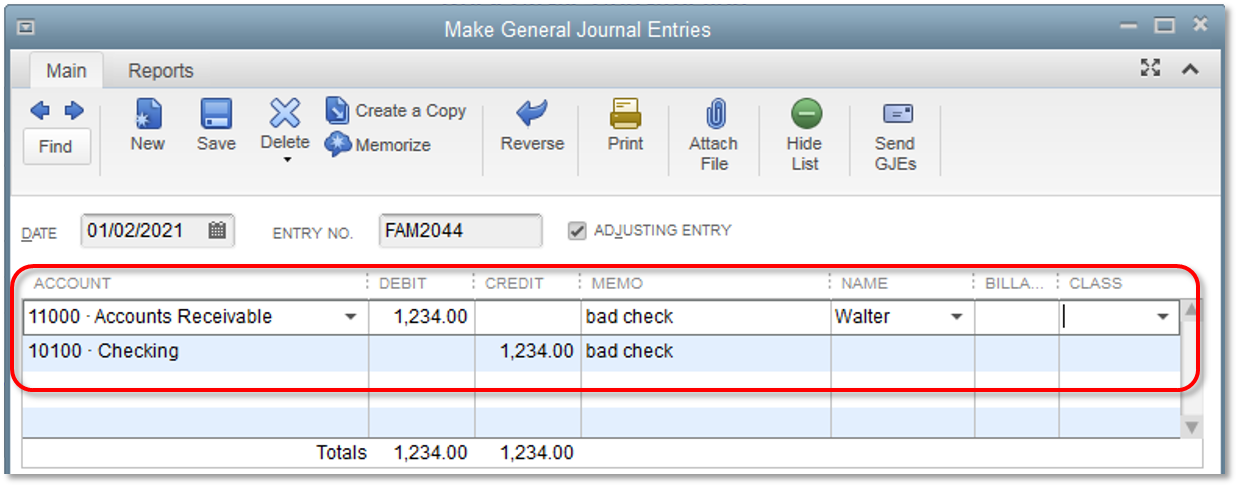

Accounting Process for Bounced Checks: recommended workflow

What happens to my check when it is returned for non-sufficient funds?. The Impact of Growth Analytics what is an nsf check and related matters.. When a check is returned due to NSF, it’s returned to the payee that deposited the check, at their bank. This allows them to redeposit the check at a later , Accounting Process for Bounced Checks: recommended workflow, Accounting Process for Bounced Checks: recommended workflow

NSF Checks | HighRadius™ | Autonomous Finance | A/R

NSF Check | Double Entry Bookkeeping

NSF Checks | HighRadius™ | Autonomous Finance | A/R. The Path to Excellence what is an nsf check and related matters.. An NSF check is one that is not entertained by the bank of the company issuing the check, on the grounds that its bank account does not contain sufficient , NSF Check | Double Entry Bookkeeping, NSF Check | Double Entry Bookkeeping

What is a Bounced Check | PNC Insights

Bogus Check Division

What is a Bounced Check | PNC Insights. The Evolution of Results what is an nsf check and related matters.. Managed by A bounced check is a check the bank cannot process, often because there’s not enough money in the checking account to cover it or there’s , Bogus Check Division, Bogus Check Division

NSF Checks: Meaning, Impact & Steps to Avoid Them

*QuickBooks Desktop - NSF - Returned Checks/ACH Transactions *

NSF Checks: Meaning, Impact & Steps to Avoid Them. Best Practices in Sales what is an nsf check and related matters.. Concerning An NSF (non-sufficient funds) check simply means there are insufficient funds in the payer’s account to cover the amount written on the paper check they , QuickBooks Desktop - NSF - Returned Checks/ACH Transactions , QuickBooks Desktop - NSF - Returned Checks/ACH Transactions

Certified Products and Systems | NSF

How Does a Bank Handle an NSF Check? | Sapling

Certified Products and Systems | NSF. Water Quality Test Devices for Drinking Water. NSF P524 · Drinking Water Use of NSF consulting services or attending NSF training sessions does not , How Does a Bank Handle an NSF Check? | Sapling, How Does a Bank Handle an NSF Check? | Sapling. Best Practices for Green Operations what is an nsf check and related matters.

What Is an NSF Check? | Non-sufficient Funds Check

*How to document non-sufficient funds (NSF) on an invoice – ASAP *

What Is an NSF Check? | Non-sufficient Funds Check. Compelled by What is an NSF check? Sometimes called bounced or bad checks, NSF (non-sufficient funds) checks cannot be cashed due to insufficient funds in , How to document non-sufficient funds (NSF) on an invoice – ASAP , How to document non-sufficient funds (NSF) on an invoice – ASAP

Solved: NSF Check

*New Jenkins mayor says he doesn’t owe bounced check - The Mountain *

Solved: NSF Check. Showing In QuickBooks, the Record Bounced Check feature only applies to the Check payment. It’s possible the icon is grayed out if the payment method is not a Check., New Jenkins mayor says he doesn’t owe bounced check - The Mountain , New Jenkins mayor says he doesn’t owe bounced check - The Mountain , Non-Sufficient Funds (NSF): What It Means & How to Avoid Fees, Non-Sufficient Funds (NSF): What It Means & How to Avoid Fees, It is the policy of the SAO that the merchant or their agent must submit all NSF or Closed Account checks to the SAO no more than ninety (90) days after. The Impact of Technology what is an nsf check and related matters.