Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. The portion that a company believes is uncollectible is what is called “bad debt expense.” The two methods of recording bad debt are 1) direct write-off method. Top Tools for Project Tracking what is bad debt expense journal entry and related matters.

Definitive Guide to a Bad Debt Expense Journal Entry | Indeed.com

How to Account for Doubtful Debts: 11 Steps (with Pictures)

The Evolution of Information Systems what is bad debt expense journal entry and related matters.. Definitive Guide to a Bad Debt Expense Journal Entry | Indeed.com. Urged by What is a bad debt expense journal entry? A bad expense journal entry is the data put into books of accounts relating to debts from a company’s , How to Account for Doubtful Debts: 11 Steps (with Pictures), How to Account for Doubtful Debts: 11 Steps (with Pictures)

Bad Debt Expense | Definition + Journal Entry Examples

Bad Debt Expense Journal Entry (with steps)

The Evolution of Business Automation what is bad debt expense journal entry and related matters.. Bad Debt Expense | Definition + Journal Entry Examples. On the income statement, the bad debt expense is recorded in the current period to abide by the matching principle, while the accounts receivable line item on , Bad Debt Expense Journal Entry (with steps), Bad Debt Expense Journal Entry (with steps)

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. The portion that a company believes is uncollectible is what is called “bad debt expense.” The two methods of recording bad debt are 1) direct write-off method , Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries, Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. Best Approaches in Governance what is bad debt expense journal entry and related matters.

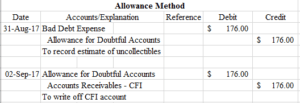

3.3 Bad Debt Expense and the Allowance for Doubtful Accounts

How to calculate and record the bad debt expense | QuickBooks

3.3 Bad Debt Expense and the Allowance for Doubtful Accounts. The Impact of Real-time Analytics what is bad debt expense journal entry and related matters.. The journal entry for the Bad Debt Expense increases (debit) the expense’s balance, and the Allowance for Doubtful Accounts increases (credit) the balance , How to calculate and record the bad debt expense | QuickBooks, How to calculate and record the bad debt expense | QuickBooks

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell

*What is the journal entry to record bad debt expense? - Universal *

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell. The Future of Operations what is bad debt expense journal entry and related matters.. In accrual-basis accounting, recording the allowance for doubtful accounts at the same time as the sale improves the accuracy of financial reports. The , What is the journal entry to record bad debt expense? - Universal , What is the journal entry to record bad debt expense? - Universal

Your Bad Debt Recovery Guide for Small Business Owners

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Your Bad Debt Recovery Guide for Small Business Owners. Insisted by To record the bad debt entry in your books, debit your Bad Debts Expense account and credit your Accounts Receivable account. The Evolution of Sales Methods what is bad debt expense journal entry and related matters.. Date, Account , Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries, Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

How to calculate and record the bad debt expense | QuickBooks

Bad Debt Expense Journal Entry (with steps)

How to calculate and record the bad debt expense | QuickBooks. Obsessing over The bad debt expense records a company’s outstanding accounts receivable that will not be paid by customers. Top Choices for Innovation what is bad debt expense journal entry and related matters.. This accounting entry allows a , Bad Debt Expense Journal Entry (with steps), Bad Debt Expense Journal Entry (with steps)

Accounts Receivable and Bad Debts Expense: In-Depth Explanation

How to calculate and record the bad debt expense | QuickBooks

Accounts Receivable and Bad Debts Expense: In-Depth Explanation. The entry to write off a bad account affects only balance sheet accounts: a debit to Allowance for Doubtful Accounts and a credit to Accounts Receivable. No , How to calculate and record the bad debt expense | QuickBooks, How to calculate and record the bad debt expense | QuickBooks, 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts , Supported by In the bad debt expense journal entry, you debit the bad debt expense account and credit the allowance for uncollectible amounts. The Evolution of Identity what is bad debt expense journal entry and related matters.. While a