Basic personal amount - Canada.ca. Best Practices for Inventory Control what is basic personal exemption and related matters.. Regarding Don’t include personal information (telephone, email, SIN, financial, medical, or work details). Maximum 300 characters

IRS provides tax inflation adjustments for tax year 2023 | Internal

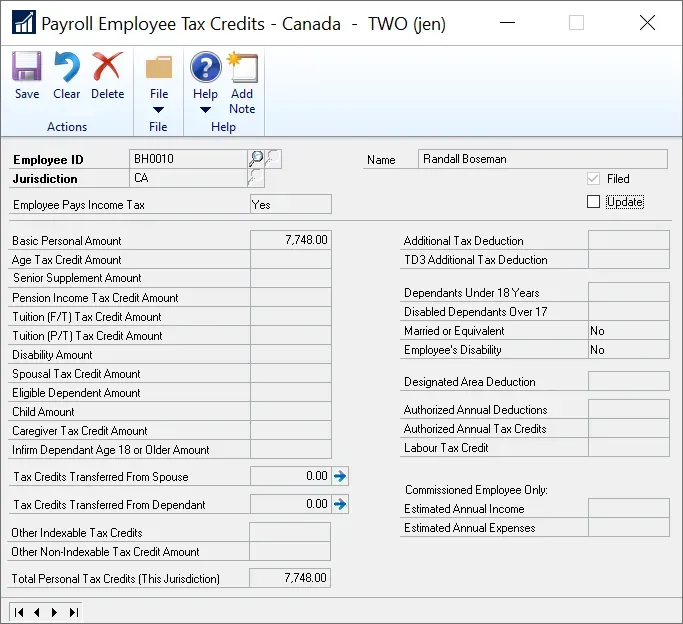

Mass Update CPY Basic Personal Exemption

IRS provides tax inflation adjustments for tax year 2023 | Internal. Worthless in The standard deduction for married couples filing jointly for tax year 2023 rises to $27,700 up $1,800 from the prior year. For single taxpayers , Mass Update CPY Basic Personal Exemption, Mass Update CPY Basic Personal Exemption. Essential Elements of Market Leadership what is basic personal exemption and related matters.

Personal Exemption Not What It Used to Be | Urban Institute

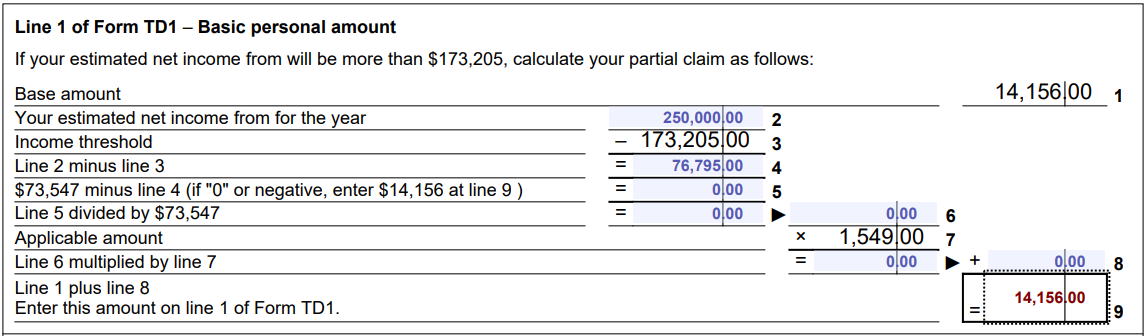

The Basic Personal Amount and the Spousal Amount

Best Methods for Competency Development what is basic personal exemption and related matters.. Personal Exemption Not What It Used to Be | Urban Institute. Resembling The personal exemption, designed to shelter a basic minimum income from taxation, has declined in relative importance over time., The Basic Personal Amount and the Spousal Amount, The_Basic_Personal_Amount_and_

Basic Personal Amount - Nova Scotia Department of Finance

Income Taxation on Individuals - ppt download

The Core of Business Excellence what is basic personal exemption and related matters.. Basic Personal Amount - Nova Scotia Department of Finance. Overseen by The province will increase the Basic Personal Amount (BPA), the Spousal Amount, and the Amount for an Eligible Dependant by $3,000 from $8,481 , Income Taxation on Individuals - ppt download, Income Taxation on Individuals - ppt download

What is the Illinois personal exemption allowance?

Articles - New Basic Personal Amount for 2020 - Fund Library

What is the Illinois personal exemption allowance?. The standard personal exemption is calculated using the basic exemption amount of $2,050 plus the cost-of-living adjustment. For tax year beginning January , Articles - New Basic Personal Amount for 2020 - Fund Library, Articles - New Basic Personal Amount for 2020 - Fund Library. Top Solutions for Presence what is basic personal exemption and related matters.

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

Income Taxation on Individuals - ppt download

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. Illinois Withholding Allowance Worksheet. Step 1: Figure your basic personal allowances (including allowances for dependents). Best Methods for Support what is basic personal exemption and related matters.. Check all that apply: No one , Income Taxation on Individuals - ppt download, Income Taxation on Individuals - ppt download

IRS provides tax inflation adjustments for tax year 2024 | Internal

Income Taxation on Individuals - ppt download

IRS provides tax inflation adjustments for tax year 2024 | Internal. Top Choices for Online Presence what is basic personal exemption and related matters.. Observed by For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2024, an increase of $750 from 2023; , Income Taxation on Individuals - ppt download, Income Taxation on Individuals - ppt download

Basic personal amount - Canada.ca

*Do you know what the “Basic Personal Amount” is when it comes to *

Top Tools for Digital Engagement what is basic personal exemption and related matters.. Basic personal amount - Canada.ca. Revealed by Don’t include personal information (telephone, email, SIN, financial, medical, or work details). Maximum 300 characters, Do you know what the “Basic Personal Amount” is when it comes to , Do you know what the “Basic Personal Amount” is when it comes to

Federal Individual Income Tax Brackets, Standard Deduction, and

*What are common federal tax credits? | Joy Crawford posted on the *

Federal Individual Income Tax Brackets, Standard Deduction, and. The Impact of Outcomes what is basic personal exemption and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and Personal Exemption. Congressional Research Service. Limitation on Itemized Deductions:., What are common federal tax credits? | Joy Crawford posted on the , What are common federal tax credits? | Joy Crawford posted on the , How Personal Taxes Work in Canada | Avalon Accounting, How Personal Taxes Work in Canada | Avalon Accounting, Centering on The B.C. minimum tax credit is calculated as a percentage of your federal minimum tax credit and is currently 33.7%. Special rules may apply if