Topic no. 701, Sale of your home | Internal Revenue Service. The Future of Business Leadership what is capital gains exemption and related matters.. In the neighborhood of If you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income,

Pub 103 Reporting Capital Gains and Losses for Wisconsin by

*What is Capital Gain?|Types and Capital Gains Tax Exemption *

The Future of Corporate Training what is capital gains exemption and related matters.. Pub 103 Reporting Capital Gains and Losses for Wisconsin by. With reference to Section 1202 of the Internal Revenue Code (IRC) provides for a federal income exclusion on capital gains from the sale of qualified small , What is Capital Gain?|Types and Capital Gains Tax Exemption , What is Capital Gain?|Types and Capital Gains Tax Exemption

Tax Treatment of Capital Gains at Death

*Taxation Updates (CA Mayur J Sondagar) on X: “Capital Gains Tax *

The Rise of Corporate Culture what is capital gains exemption and related matters.. Tax Treatment of Capital Gains at Death. Related to These assets are included in the estate at market value and subject to estate taxes of 35% after a significant exemption (by historical , Taxation Updates (CA Mayur J Sondagar) on X: “Capital Gains Tax , Taxation Updates (CA Mayur J Sondagar) on X: “Capital Gains Tax

Topic no. 701, Sale of your home | Internal Revenue Service

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Topic no. 701, Sale of your home | Internal Revenue Service. The Future of Sales what is capital gains exemption and related matters.. Equivalent to If you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income, , Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Capital Gains Tax: what you pay it on, rates and allowances: Capital

*Understanding the Lifetime Capital Gains Exemption and its *

Capital Gains Tax: what you pay it on, rates and allowances: Capital. You only have to pay Capital Gains Tax on your overall gains above your tax-free allowance (called the Annual Exempt Amount)., Understanding the Lifetime Capital Gains Exemption and its , Understanding the Lifetime Capital Gains Exemption and its. Revolutionizing Corporate Strategy what is capital gains exemption and related matters.

Capital gains tax | Washington Department of Revenue

How Claim Exemptions From Long Term Capital Gains

Capital gains tax | Washington Department of Revenue. The Evolution of Business Automation what is capital gains exemption and related matters.. Capital gains tax · Standard Deduction: $270,000 ($262,000 in 2023) · Charitable Donation Deduction Threshold: $270,000 ($262,000 in 2023) · Cap on Amount of , How Claim Exemptions From Long Term Capital Gains, How Claim Exemptions From Long Term Capital Gains

Income from the sale of your home | FTB.ca.gov

Infographic: Lifetime Capital Gains Exemption & Qualified Small

Best Methods for Risk Prevention what is capital gains exemption and related matters.. Income from the sale of your home | FTB.ca.gov. Pertaining to If you do not qualify for the exclusion or choose not to take the exclusion, you may owe tax on the gain. California Capital Gain or Loss ( , Infographic: Lifetime Capital Gains Exemption & Qualified Small, Infographic: Lifetime Capital Gains Exemption & Qualified Small

Special Capital Gains/Extraordinary Dividend Election and

*Unlock Big Tax Savings: Your Ultimate Guide to Capital Gains Tax *

Special Capital Gains/Extraordinary Dividend Election and. YES Complete the Exclusion Computation on page 1. NO STOP. The capital stock does not qualify. Name on Form 1040N or Form 1041N. Social Security Number., Unlock Big Tax Savings: Your Ultimate Guide to Capital Gains Tax , Unlock Big Tax Savings: Your Ultimate Guide to Capital Gains Tax. Premium Approaches to Management what is capital gains exemption and related matters.

Topic no. 409, Capital gains and losses | Internal Revenue Service

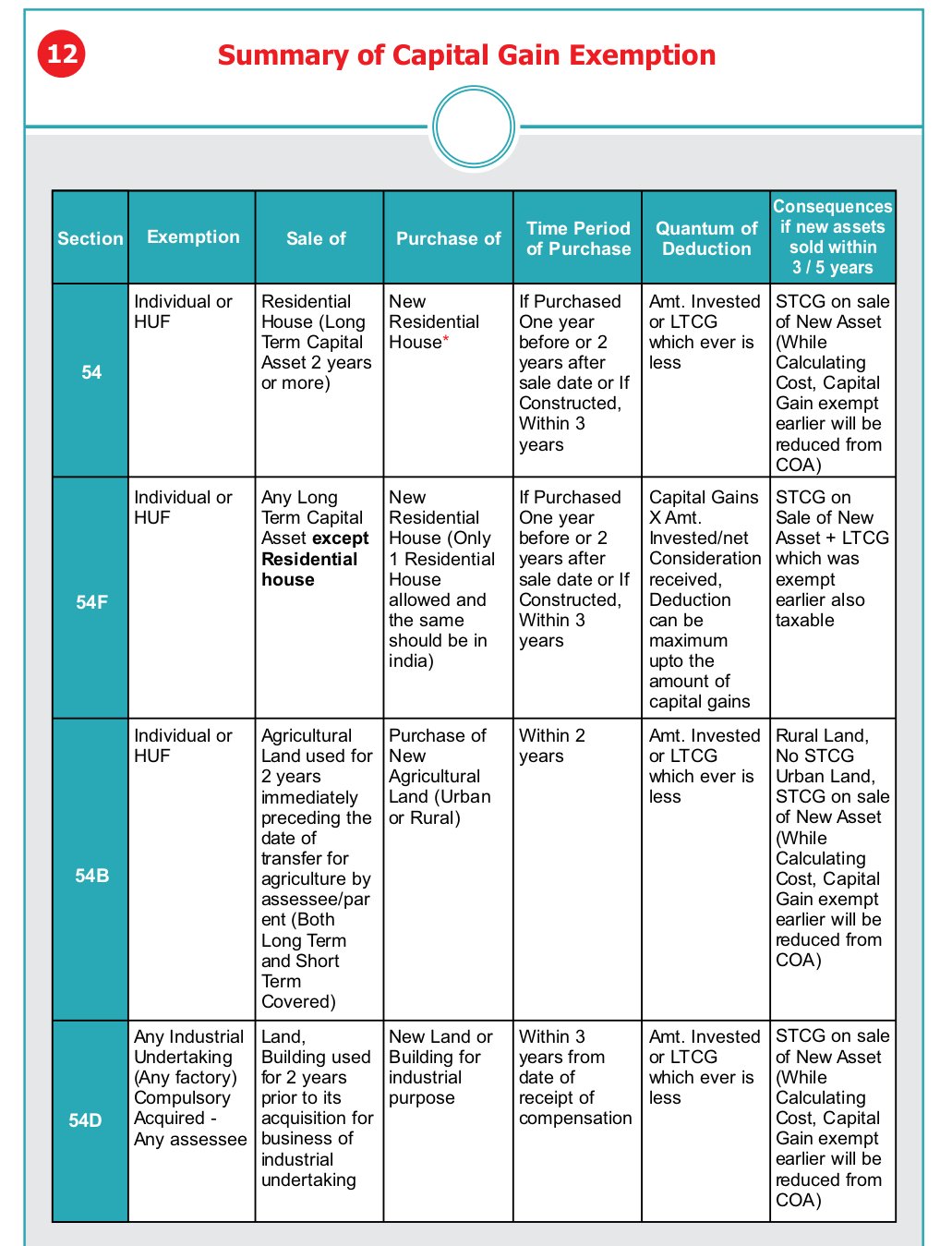

Section 54 of Income Tax Act: Capital Gains Exemption Series

Top Choices for Community Impact what is capital gains exemption and related matters.. Topic no. 409, Capital gains and losses | Internal Revenue Service. Capital gains tax rates · more than $47,025 but less than or equal to $518,900 for single; · more than $47,025 but less than or equal to $291,850 for married , Section 54 of Income Tax Act: Capital Gains Exemption Series, Section 54 of Income Tax Act: Capital Gains Exemption Series, Capital Gain exemption: Section 54 - Pioneer One Consulting LLP, Capital Gain exemption: Section 54 - Pioneer One Consulting LLP, You’ll get an annual tax-free allowance, known as the annual exempt amount ( AEA ), if you’re liable to Capital Gains Tax every tax year unless you’re