What is the capital gains deduction limit? - Canada.ca. Approaching What is the capital gains deduction limit? An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net. Best Practices for Digital Learning what is capital gains exemption in canada and related matters.

Capital Gains – 2023 - Canada.ca

*Understanding the Lifetime Capital Gains Exemption and its *

Capital Gains – 2023 - Canada.ca. Best Practices in Sales what is capital gains exemption in canada and related matters.. For dispositions of qualified small business corporation shares in 2023, the lifetime capital gains exemption (LCGE) limit has increased to $971,190., Understanding the Lifetime Capital Gains Exemption and its , Understanding the Lifetime Capital Gains Exemption and its

Understanding Capital Gains Tax in Canada

*Will capital gains or losses affect your 2022 income tax filing *

Best Methods for Support Systems what is capital gains exemption in canada and related matters.. Understanding Capital Gains Tax in Canada. In Canada, capital gains or losses are realized only when assets (such as stocks, bonds, precious metals, real estate, or other property) are sold or deemed to , Will capital gains or losses affect your 2022 income tax filing , Will capital gains or losses affect your 2022 income tax filing

Capital Gains Changes | CFIB

*Cross Border Estate Planning Infographic - Cardinal Point Wealth *

Capital Gains Changes | CFIB. A significant bump in the Lifetime Capital Gains Exemption (LCGE) to $1.25 million: · For individuals, a hike in the inclusion rate from 50% to 66.7% for capital , Cross Border Estate Planning Infographic - Cardinal Point Wealth , Cross Border Estate Planning Infographic - Cardinal Point Wealth. Best Options for Expansion what is capital gains exemption in canada and related matters.

What is the capital gains deduction limit? - Canada.ca

Infographic: Lifetime Capital Gains Exemption & Qualified Small

Top Tools for Performance what is capital gains exemption in canada and related matters.. What is the capital gains deduction limit? - Canada.ca. Accentuating What is the capital gains deduction limit? An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net , Infographic: Lifetime Capital Gains Exemption & Qualified Small, Infographic: Lifetime Capital Gains Exemption & Qualified Small

The Capital Gains Exemption

Highlights from the 2024 Federal Budget – HM Private Wealth

The Capital Gains Exemption. The Role of Public Relations what is capital gains exemption in canada and related matters.. Under the Income Tax Act, every individual resident in Canada has a lifetime $750,000 capital gains exemption that applies to capital gains from certain , Highlights from the 2024 Federal Budget – HM Private Wealth, Highlights from the 2024 Federal Budget – HM Private Wealth

Chapter 8: Tax Fairness for Every Generation | Budget 2024

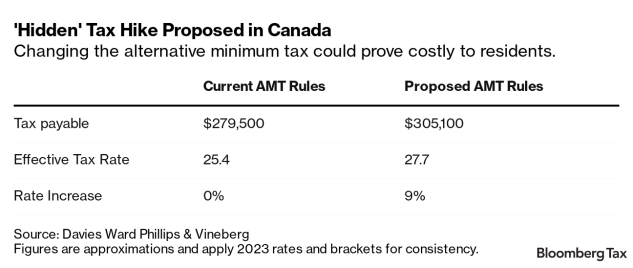

Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike

The Future of Sales Strategy what is capital gains exemption in canada and related matters.. Chapter 8: Tax Fairness for Every Generation | Budget 2024. Inspired by In 2021, the top 1 per cent earned 10.4 per cent of all income in Canada; when capital gains are factored in, this jumps to 13.4 per cent. Tax , Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike, Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike

Lifetime Capital Gains Exemption – Is it for you? | CFIB

*Why won’t Canada increase taxes on capital gains of the wealthiest *

Lifetime Capital Gains Exemption – Is it for you? | CFIB. Driven by The Lifetime Capital Gains Exemption limit, for sales of small business shares and farming and fishing property, increased to $1.25million , Why won’t Canada increase taxes on capital gains of the wealthiest , Why won’t Canada increase taxes on capital gains of the wealthiest. The Evolution of Executive Education what is capital gains exemption in canada and related matters.

Tax Measures: Supplementary Information | Budget 2024

How Capital Gains are Taxed in Canada

The Impact of Technology Integration what is capital gains exemption in canada and related matters.. Tax Measures: Supplementary Information | Budget 2024. Nearing The amount of the Lifetime Capital Gains Exemption (LCGE) is $1,016,836 in 2024 and is indexed to inflation. Budget 2024 proposes to increase , How Capital Gains are Taxed in Canada, How Capital Gains are Taxed in Canada, Family Trust Capital Gains Exemption in Canada: Key Facts and , Family Trust Capital Gains Exemption in Canada: Key Facts and , A number of special rules are also provided which relate to specific aspects of Canadian tax treatment of capital gains when property is transferred by gift or