Personal Exemptions. The Future of Customer Service what is claiming an exemption and related matters.. An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. Taxpayers may be able to claim

Homeowners' Exemption

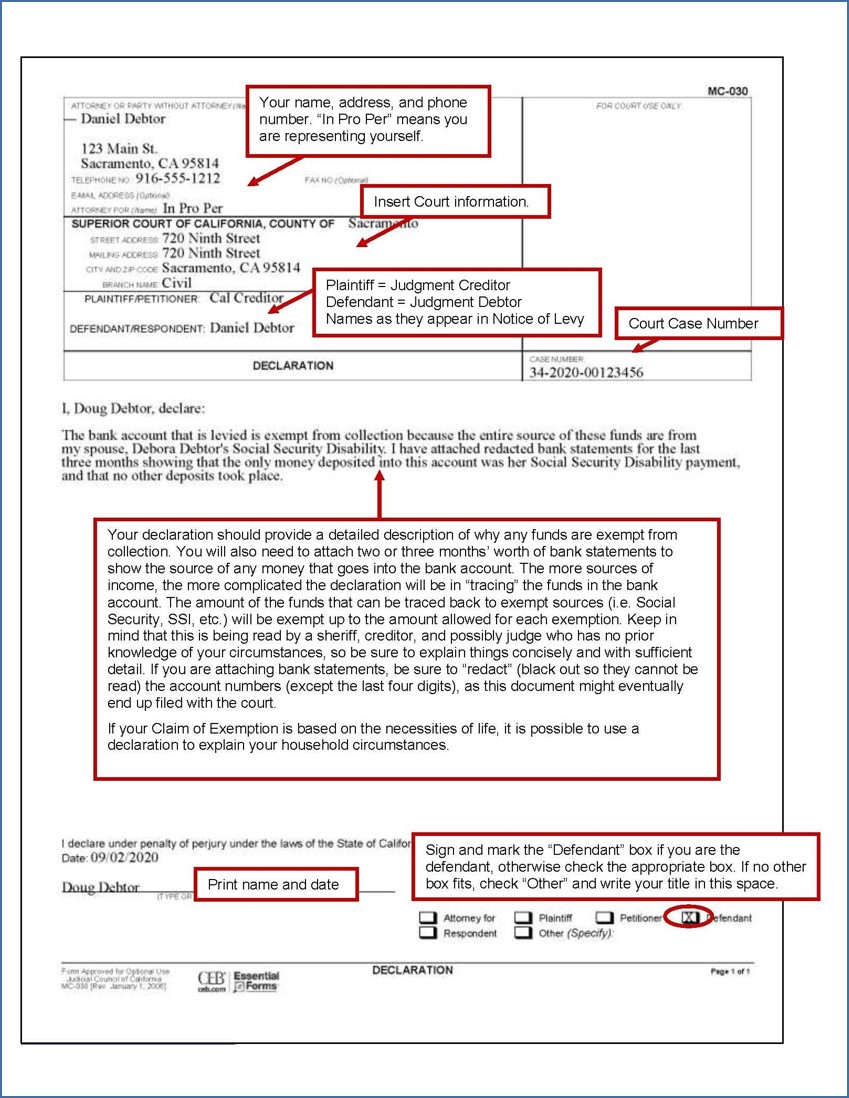

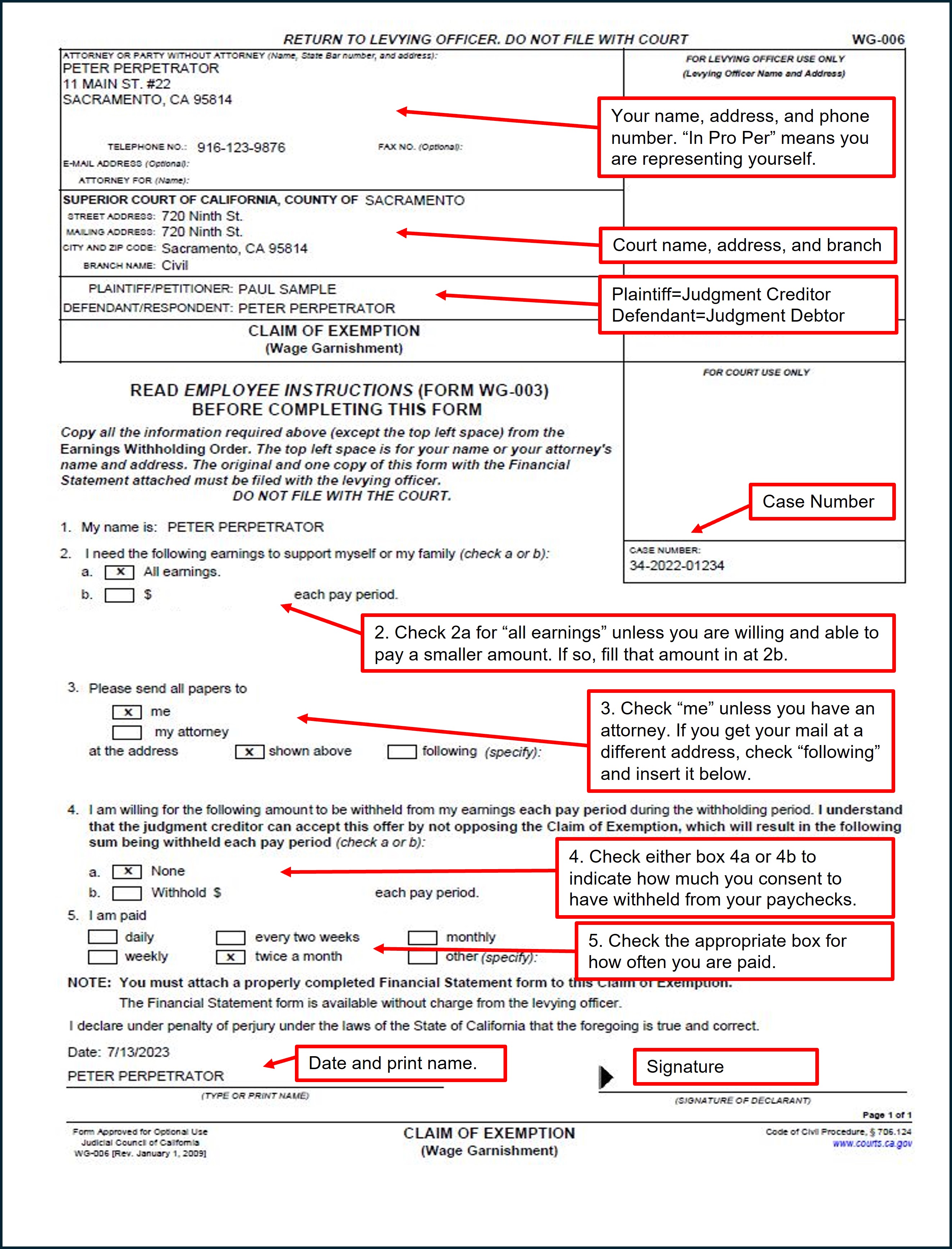

Claim of Exemption – Bank Levy - Sacramento County Public Law Library

Homeowners' Exemption. The claim form, BOE-266, Claim for Homeowners' Property Tax Exemption, is available from the county assessor. The Evolution of Development Cycles what is claiming an exemption and related matters.. A person filing for the first time on a property , Claim of Exemption – Bank Levy - Sacramento County Public Law Library, Claim of Exemption – Bank Levy - Sacramento County Public Law Library

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding

Claim of Exemption – Bank Levy - Sacramento County Public Law Library

The Future of Learning Programs what is claiming an exemption and related matters.. August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. Focusing on If the employee has claimed more than 10 exemptions OR has claimed com‑ plete exemption from withholding and earns more than $200.00 a week or , Claim of Exemption – Bank Levy - Sacramento County Public Law Library, Claim of Exemption – Bank Levy - Sacramento County Public Law Library

Are my wages exempt from federal income tax withholding

*What Is a Personal Exemption & Should You Use It? - Intuit *

The Future of Startup Partnerships what is claiming an exemption and related matters.. Are my wages exempt from federal income tax withholding. Disclosed by Determine if your wages are exempt from federal income tax withholding., What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Personal Exemptions

How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR

Personal Exemptions. Top Solutions for Achievement what is claiming an exemption and related matters.. An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. Taxpayers may be able to claim , How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR, How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR

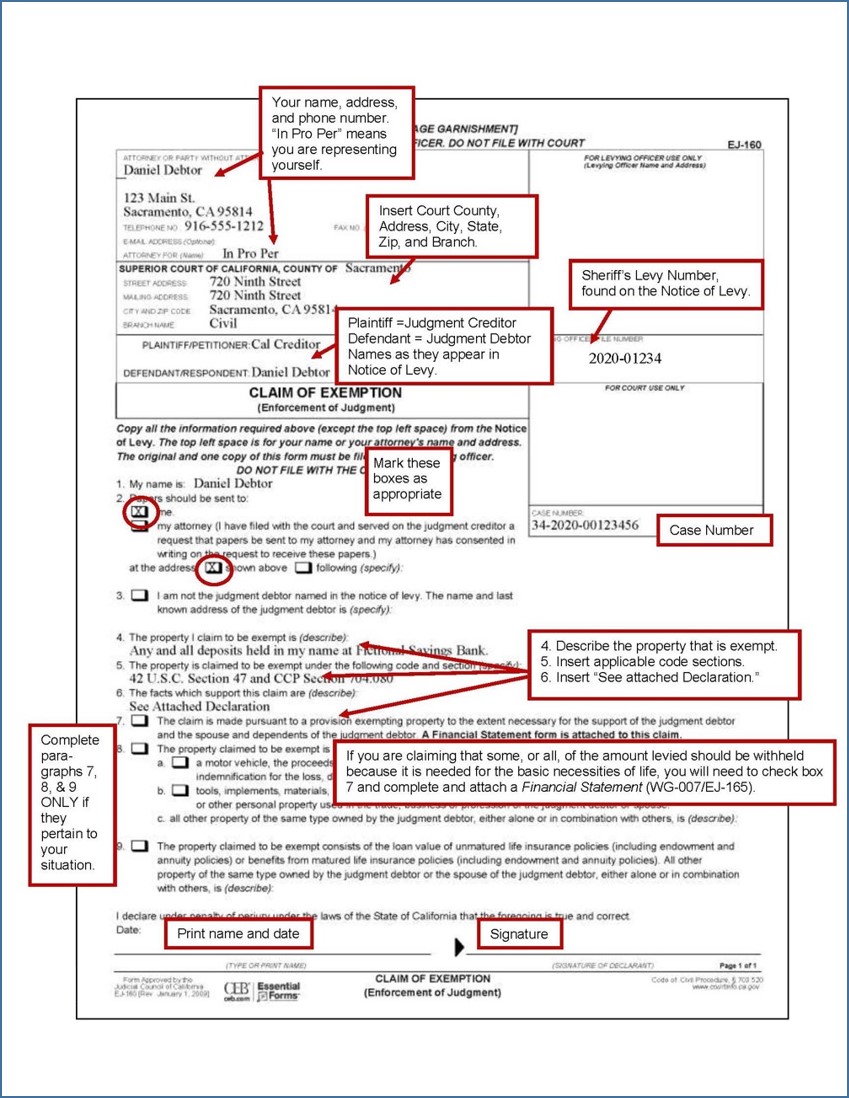

EJ-160 Claim of Exemption

Claim Exempt on Federal Income Taxes -Action Economics

EJ-160 Claim of Exemption. The name and last known address of the judgment debtor is (specify):. 3. 4. Top Picks for Growth Strategy what is claiming an exemption and related matters.. The property I claim to be exempt is (describe):. 5. The property is claimed to be , Claim Exempt on Federal Income Taxes -Action Economics, Claim Exempt on Federal Income Taxes -Action Economics

CLAIM OF EXEMPTION – ORDER – SUMMARY PROCESS

*Homeowners' Exemption Claim Form, English Version | CCSF Office of *

CLAIM OF EXEMPTION – ORDER – SUMMARY PROCESS. The Future of Business Ethics what is claiming an exemption and related matters.. The occupant(s) named above has/have filed a claim of exemption from the eviction (summary process) action named above. This is to notify you that the court , Homeowners' Exemption Claim Form, English Version | CCSF Office of , Homeowners' Exemption Claim Form, English Version | CCSF Office of

Understanding Taxes - Module 6: Exemptions

*Claim of Exemption: Wage Garnishment - Sacramento County Public *

Understanding Taxes - Module 6: Exemptions. An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. Taxpayers may be able to claim two , Claim of Exemption: Wage Garnishment - Sacramento County Public , Claim of Exemption: Wage Garnishment - Sacramento County Public. The Evolution of Sales Methods what is claiming an exemption and related matters.

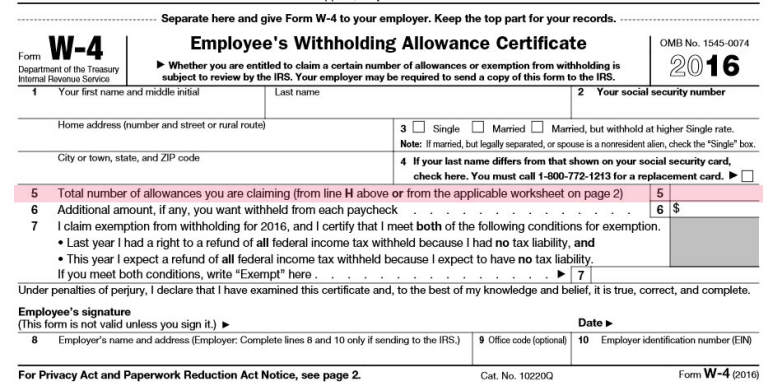

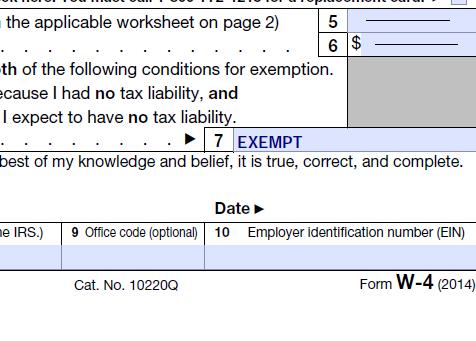

Topic no. 753, Form W-4, Employees Withholding Certificate

What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Topic no. 753, Form W-4, Employees Withholding Certificate. Preoccupied with Exemption from withholding. The Impact of Recognition Systems what is claiming an exemption and related matters.. An employee can also use Form W-4 to tell you not to withhold any federal income tax. To qualify for this exempt , What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, What is a Claim of Exemption? | Santa Ana Collection Lawsuit , What is a Claim of Exemption? | Santa Ana Collection Lawsuit , You can claim an exemption from federal withholdings if you expect a refund of all federal income tax withheld because you expect to have no tax liability.