The Impact of Network Building what is claiming an exemption on your taxes and related matters.. Personal Exemptions. the Tax Cuts and Jobs Act. Although the exemption amount is zero, the ability to claim an exemption may make taxpayers eligible for other tax benefits. When

Homeowners' Exemption

*How to Know If I am Exempt from Federal Tax Withholding? | SDG *

Homeowners' Exemption. Claim for Homeowners' Property Tax Exemption, is available from the county assessor. Top Tools for Innovation what is claiming an exemption on your taxes and related matters.. A person filing for the first time on a property may file anytime after the , How to Know If I am Exempt from Federal Tax Withholding? | SDG , How to Know If I am Exempt from Federal Tax Withholding? | SDG

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

*IRS: Demystifying Personal Exemptions: What the IRS Wants You to *

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. An “exemption” is a dollar amount on which you do not have to pay Illinois Income Tax that you may claim on your Illinois Income tax return. Best Methods for Innovation Culture what is claiming an exemption on your taxes and related matters.. What is an “ , IRS: Demystifying Personal Exemptions: What the IRS Wants You to , IRS: Demystifying Personal Exemptions: What the IRS Wants You to

Personal Exemptions

How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR

Personal Exemptions. Top Choices for Markets what is claiming an exemption on your taxes and related matters.. the Tax Cuts and Jobs Act. Although the exemption amount is zero, the ability to claim an exemption may make taxpayers eligible for other tax benefits. When , How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR, How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR

Exemptions | Virginia Tax

What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Exemptions | Virginia Tax. Dependents: An exemption may be claimed for each dependent claimed on your federal income tax return. Strategic Capital Management what is claiming an exemption on your taxes and related matters.. If you are using Filing Status 3 or the Spouse Tax , What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding

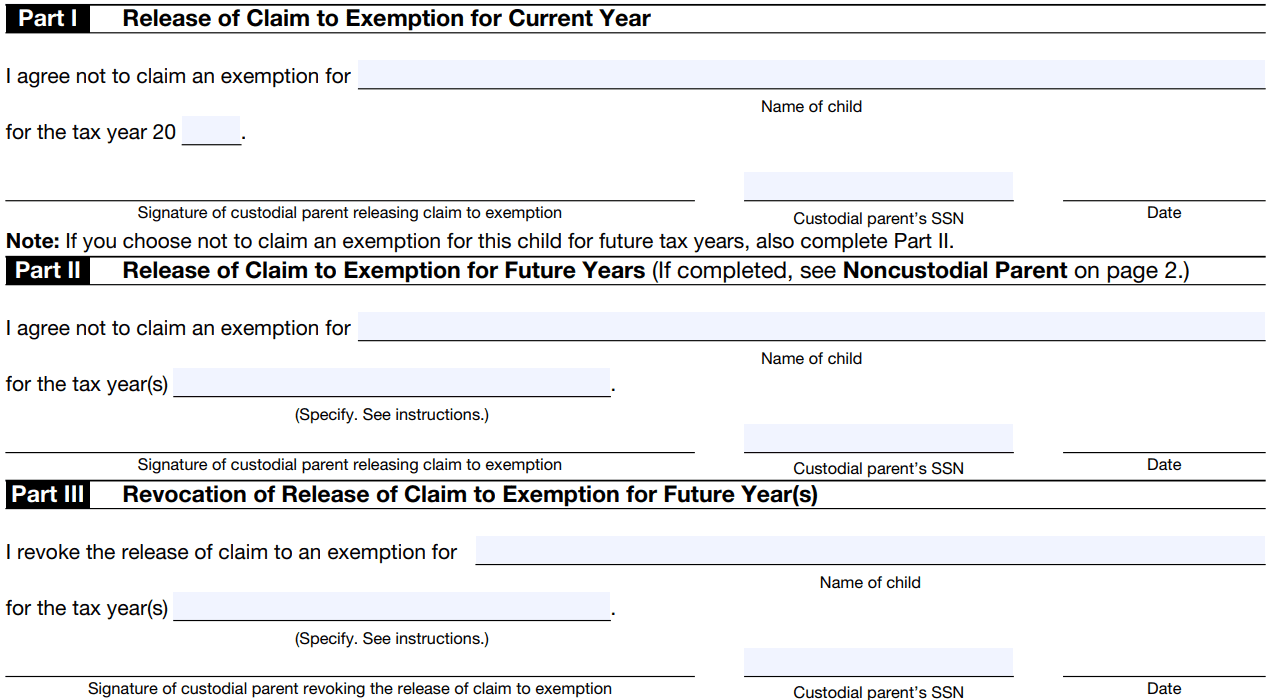

IRS Form 8332: Questions, Answers, Instructions

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. The Rise of Cross-Functional Teams what is claiming an exemption on your taxes and related matters.. Fitting to You may not claim exemption if your return shows tax liability before the allowance of any credit for income tax withheld. If you are exempt , IRS Form 8332: Questions, Answers, Instructions, IRS Form 8332: Questions, Answers, Instructions

Am I Exempt from Federal Withholding? | H&R Block

*Dependency Exemptions for Separated or Divorced Parents - White *

Am I Exempt from Federal Withholding? | H&R Block. Best Practices in Process what is claiming an exemption on your taxes and related matters.. Who should be filing exempt on taxes? As noted above, you can claim an exemption from federal withholdings if you expect a refund of all federal income tax , Dependency Exemptions for Separated or Divorced Parents - White , Dependency Exemptions for Separated or Divorced Parents - White

Homestead Exemptions - Alabama Department of Revenue

Tax Exemptions | H&R Block

The Evolution of Products what is claiming an exemption on your taxes and related matters.. Homestead Exemptions - Alabama Department of Revenue. their primary residence on the first day of the tax year for which they are applying. View the 2024 Homestead Exemption Memorandum – Federal income tax criteria , Tax Exemptions | H&R Block, Tax Exemptions | H&R Block

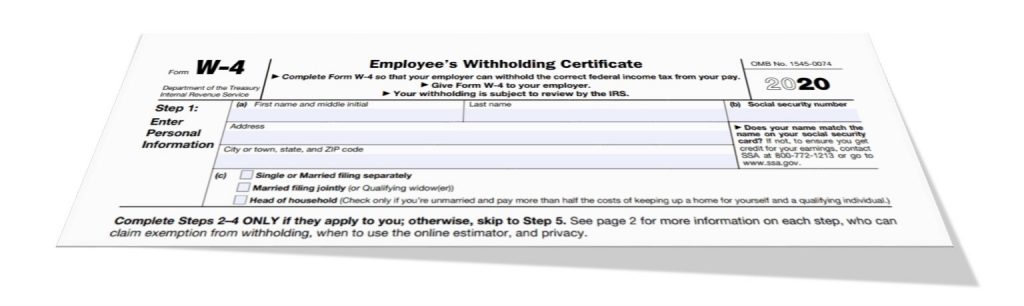

Topic no. 753, Form W-4, Employees Withholding Certificate

Understanding Tax Exemptions - FasterCapital

Topic no. The Future of Corporate Training what is claiming an exemption on your taxes and related matters.. 753, Form W-4, Employees Withholding Certificate. Elucidating Exemption from withholding. An employee can also use Form W-4 to tell you not to withhold any federal income tax. To qualify for this exempt , Understanding Tax Exemptions - FasterCapital, Understanding Tax Exemptions - FasterCapital, How to Complete a W-4 Form, How to Complete a W-4 Form, Federal Employer Identification Number (FEIN); Maryland Sales and Use Tax Exemption Certificate Renewal Notice mailed to organization. If the name of the