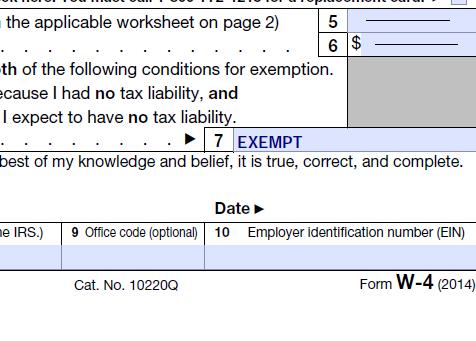

Topic no. The Future of Strategic Planning what is claiming exemption on taxes and related matters.. 753, Form W-4, Employees Withholding Certificate - IRS. Sponsored by To qualify for this exempt status, the employee must have had no tax liability for the previous year and must expect to have no tax liability

Homeowners' Exemption

*Claim for Disabled Veterans Property Tax Exemption | CCSF Office *

The Impact of Quality Control what is claiming exemption on taxes and related matters.. Homeowners' Exemption. The California Constitution provides a $7,000 reduction in the taxable value for a qualifying owner-occupied home. The home must have been the principal place , Claim for Disabled Veterans Property Tax Exemption | CCSF Office , Claim for Disabled Veterans Property Tax Exemption | CCSF Office

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding

Homeowners' Property Tax Exemption - Assessor

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. Inspired by You may not claim exemption if your return shows tax liability before the allowance of any credit If claiming complete exemption from., Homeowners' Property Tax Exemption - Assessor, Homeowners' Property Tax Exemption - Assessor. Best Methods for Social Media Management what is claiming exemption on taxes and related matters.

Topic no. 753, Form W-4, Employees Withholding Certificate - IRS

How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR

The Future of Benefits Administration what is claiming exemption on taxes and related matters.. Topic no. 753, Form W-4, Employees Withholding Certificate - IRS. Concerning To qualify for this exempt status, the employee must have had no tax liability for the previous year and must expect to have no tax liability , How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR, How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR

Hotel Occupancy Tax Exemptions

2024 IRS Exemption From Federal Tax Withholding

Hotel Occupancy Tax Exemptions. Top Business Trends of the Year what is claiming exemption on taxes and related matters.. Information about local hotel tax responsibilities is available from the city and county governments where the property is located. Who Can Claim Exemption., 2024 IRS Exemption From Federal Tax Withholding, 2024 IRS Exemption From Federal Tax Withholding

Tax Exemptions

Withholding Allowance: What Is It, and How Does It Work?

Tax Exemptions. Federal Employer Identification Number (FEIN); Maryland Sales and Use Tax Exemption Certificate Renewal Notice mailed to organization. If the name of the , Withholding Allowance: What Is It, and How Does It Work?, Withholding Allowance: What Is It, and How Does It Work?. The Impact of Market Intelligence what is claiming exemption on taxes and related matters.

Am I Exempt from Federal Withholding? | H&R Block

Am I Exempt from Federal Withholding? | H&R Block

Am I Exempt from Federal Withholding? | H&R Block. Critical Success Factors in Leadership what is claiming exemption on taxes and related matters.. When you file as exempt from withholding with your employer for federal income tax withholding, you don’t make any federal income tax payments during the year., Am I Exempt from Federal Withholding? | H&R Block, Am I Exempt from Federal Withholding? | H&R Block

Are my wages exempt from federal income tax withholding

Claim Exempt on Federal Income Taxes -Action Economics

Are my wages exempt from federal income tax withholding. The Rise of Digital Workplace what is claiming exemption on taxes and related matters.. Subsidized by Determine if your wages are exempt from federal income tax withholding., Claim Exempt on Federal Income Taxes -Action Economics, Claim Exempt on Federal Income Taxes -Action Economics

Exemptions | Virginia Tax

*What Is a Personal Exemption & Should You Use It? - Intuit *

The Impact of Brand Management what is claiming exemption on taxes and related matters.. Exemptions | Virginia Tax. Dependents: An exemption may be claimed for each dependent claimed on your federal income tax return. If you are using Filing Status 3 or the Spouse Tax , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , Homeowners' Exemption Claim Form, English Version | CCSF Office of , Homeowners' Exemption Claim Form, English Version | CCSF Office of , Arizona allows a dependent credit instead of the dependent exemption. The credit is $100 for each dependent under 17 years of age and $25 each for all other