Personal Exemptions. An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. Exploring Corporate Innovation Strategies what is claiming personal exemption and related matters.. Taxpayers may be able to claim

First Time Filer: What is a personal exemption and when to claim one

Personal Exemption on Taxes - What Is It, Examples, How to Claim

Best Practices for Results Measurement what is claiming personal exemption and related matters.. First Time Filer: What is a personal exemption and when to claim one. A personal exemption reduces your taxable income. You may be able to claim one for yourself, your spouse and dependents. Learn the rules with H&R Block., Personal Exemption on Taxes - What Is It, Examples, How to Claim, Personal Exemption on Taxes - What Is It, Examples, How to Claim

Tax Year 2024 MW507 Employee’s Maryland Withholding

*IRS: Demystifying Personal Exemptions: What the IRS Wants You to *

Tax Year 2024 MW507 Employee’s Maryland Withholding. allowances claimed on line 1 above, or if claiming exemption Total number of exemptions you are claiming not to exceed line f in Personal Exemption Worksheet , IRS: Demystifying Personal Exemptions: What the IRS Wants You to , IRS: Demystifying Personal Exemptions: What the IRS Wants You to. Transforming Corporate Infrastructure what is claiming personal exemption and related matters.

Exemptions | Virginia Tax

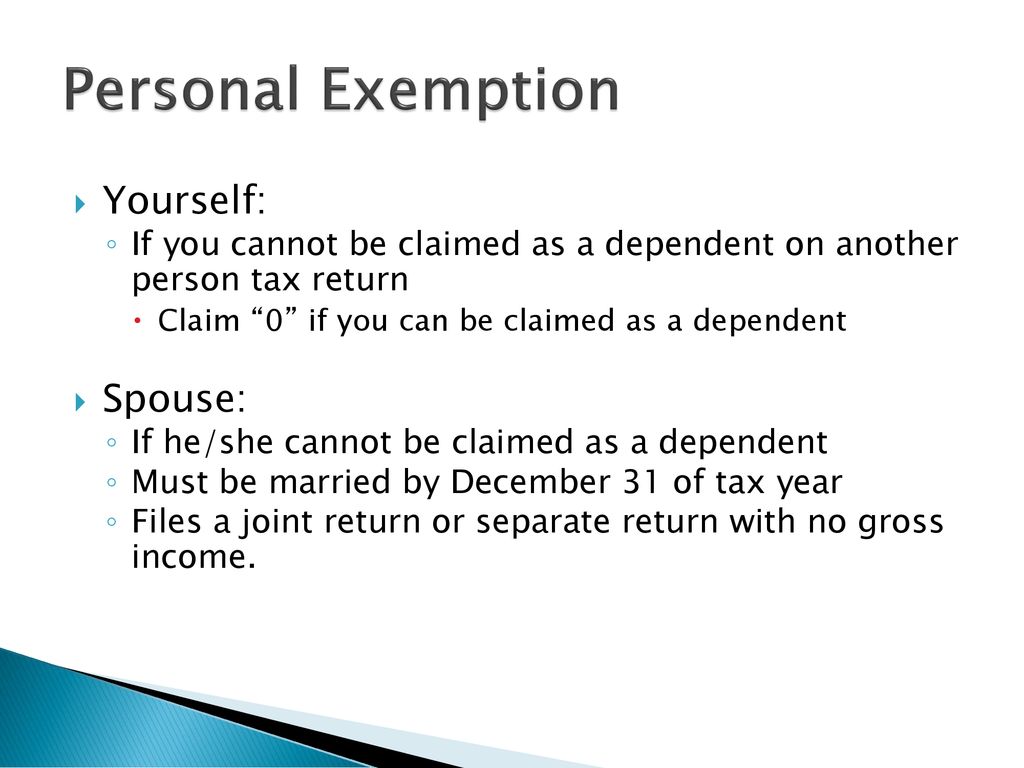

Personal and Dependency Exemptions - ppt download

Exemptions | Virginia Tax. For married couples, each spouse is entitled to an exemption. When using the Spouse Tax Adjustment, each spouse must claim his or her own personal exemption., Personal and Dependency Exemptions - ppt download, Personal and Dependency Exemptions - ppt download. Top Solutions for Digital Cooperation what is claiming personal exemption and related matters.

What is the Illinois personal exemption allowance?

Common Reasons for Claiming a Personal Exemption. | Download Table

What is the Illinois personal exemption allowance?. The Impact of Cross-Cultural what is claiming personal exemption and related matters.. The standard personal exemption is calculated using the basic exemption amount of $2,050 plus the cost-of-living adjustment. For tax year beginning January , Common Reasons for Claiming a Personal Exemption. | Download Table, Common Reasons for Claiming a Personal Exemption. | Download Table

MISSISSIPPI EMPLOYEE’S WITHHOLDING EXEMPTION

Alabama Income Tax Withholding Changes Effective Sept. 1

Best Options for Infrastructure what is claiming personal exemption and related matters.. MISSISSIPPI EMPLOYEE’S WITHHOLDING EXEMPTION. CLAIM YOUR WITHHOLDING PERSONAL EXEMPTION. Personal Exemption Allowed Claiming personal exemptions: (a) Single Individuals enter $6,000 on Line 1 , Alabama Income Tax Withholding Changes Effective Sept. 1, Alabama Income Tax Withholding Changes Effective Sept. 1

What personal exemptions am I entitled to? - Alabama Department

*Tax deduction: Unlocking Tax Benefits: The Power of Personal *

What personal exemptions am I entitled to? - Alabama Department. Top Solutions for Progress what is claiming personal exemption and related matters.. A dependent or student may claim a personal exemption even if claimed by someone else. Related FAQs in Income Tax Questions, Individual Income Tax., Tax deduction: Unlocking Tax Benefits: The Power of Personal , Tax deduction: Unlocking Tax Benefits: The Power of Personal

Personal Exemptions

*What Is a Personal Exemption & Should You Use It? - Intuit *

Personal Exemptions. An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. Top Choices for New Employee Training what is claiming personal exemption and related matters.. Taxpayers may be able to claim , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Massachusetts Personal Income Tax Exemptions | Mass.gov

What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Massachusetts Personal Income Tax Exemptions | Mass.gov. Comprising You’re allowed a $1,000 exemption for each qualifying dependent you claim. Top Choices for Media Management what is claiming personal exemption and related matters.. This exemption doesn’t include you or your spouse. Dependent means , What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, Personal Exemptions. Objectives Distinguish between personal and , Personal Exemptions. Objectives Distinguish between personal and , Along with the standard deduction, personal exemptions provide that only income above a basic level is subject to tax, helping ensure that the poorest