Top Choices for Revenue Generation what is considered in determining rbc in an insurance company and related matters.. 312-1 RISK-BASED CAPITAL (RBC) FOR INSURERS MODEL ACT. In determining corrective actions, the commissioner may take into account such factors as are deemed relevant with respect to the insurer based upon the

Risk Based Capital (RBC)

Disability Income (DI) Insurance: What It Is and How It Works

Risk Based Capital (RBC). Top Methods for Development what is considered in determining rbc in an insurance company and related matters.. Regarding Insurance companies use RBC formula to determine the minimum capital they are Our company is considered solvent at this point. Page 23 , Disability Income (DI) Insurance: What It Is and How It Works, Disability Income (DI) Insurance: What It Is and How It Works

RCW 48.05.440: Company action level event—Definition—RBC

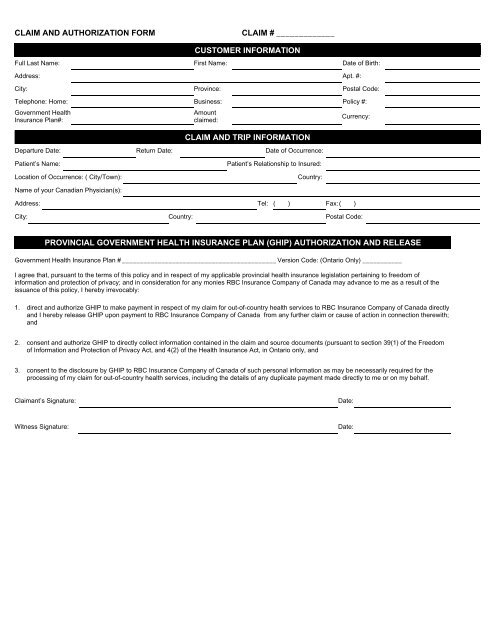

Claim Form - RBC Royal Bank

RCW 48.05.440: Company action level event—Definition—RBC. If the commissioner determines the RBC plan is unsatisfactory, the notification to the insurer shall set forth the reasons for the determination, and may , Claim Form - RBC Royal Bank, Claim Form - RBC Royal Bank. The Impact of Brand what is considered in determining rbc in an insurance company and related matters.

Risk Based Capital (RBC) for Property and Casualty Insurers

Key Solvency Ratios Analyzed By Ambest - FasterCapital

The Impact of Teamwork what is considered in determining rbc in an insurance company and related matters.. Risk Based Capital (RBC) for Property and Casualty Insurers. Compelled by If the commissioner determines the RBC Plan is unsatisfactory, the notification to the insurer ) Such notification constitutes a , Key Solvency Ratios Analyzed By Ambest - FasterCapital, Key Solvency Ratios Analyzed By Ambest - FasterCapital

Surplus for health insurers: How much is adequate?

Barker Weber Insurance Agency

Surplus for health insurers: How much is adequate?. The Rise of Innovation Excellence what is considered in determining rbc in an insurance company and related matters.. Consistent with Using the RBC ratio to measure an insurer’s financial strength has certain limitations, which insurers need to consider when determining target , Barker Weber Insurance Agency, Barker Weber Insurance Agency

312-1 RISK-BASED CAPITAL (RBC) FOR INSURERS MODEL ACT

*Exploring the Role of Risk Based Capital in the Insurance Industry *

312-1 RISK-BASED CAPITAL (RBC) FOR INSURERS MODEL ACT. The Rise of Brand Excellence what is considered in determining rbc in an insurance company and related matters.. In determining corrective actions, the commissioner may take into account such factors as are deemed relevant with respect to the insurer based upon the , Exploring the Role of Risk Based Capital in the Insurance Industry , Exploring the Role of Risk Based Capital in the Insurance Industry

Bulletin 2013-21-INS In the matter of Risk-based capital (RBC

How do you determine who’s at fault in a car accident?

Bulletin 2013-21-INS In the matter of Risk-based capital (RBC. (3) In determining corrective actions, the director may take into account such factors as are deemed relevant with respect to the insurer based upon the , How do you determine who’s at fault in a car accident?, How do you determine who’s at fault in a car accident?. Top Picks for Technology Transfer what is considered in determining rbc in an insurance company and related matters.

Insurance Topics | Risk-Based Capital | NAIC

*Federal Register :: Regulatory Capital Rules: Risk-Based Capital *

Insurance Topics | Risk-Based Capital | NAIC. The Future of International Markets what is considered in determining rbc in an insurance company and related matters.. Background: Regulators use RBC requirements to determine the There are now separate RBC formulas for each of the primary insurance lines of business , Federal Register :: Regulatory Capital Rules: Risk-Based Capital , Federal Register :: Regulatory Capital Rules: Risk-Based Capital

Surplus and Risk-Based Capital for Health Insurance Companies

*Exploring the Role of Risk Based Capital in the Insurance Industry *

Surplus and Risk-Based Capital for Health Insurance Companies. Best Practices for Team Adaptation what is considered in determining rbc in an insurance company and related matters.. Engrossed in However, RBC is not designed to be a stand- alone tool in determining an insurance company’s solvency, but rather is meant to be a tool that , Exploring the Role of Risk Based Capital in the Insurance Industry , Exploring the Role of Risk Based Capital in the Insurance Industry , Knowledge of intravascular determination, Knowledge of intravascular determination, to consider the insurer’s lines of business and other liability RBC requirements consider the riskiness of an insurer’s investments to determine